- United States

- /

- Oil and Gas

- /

- NYSE:SUN

Is Sunoco's (SUN) Sharp Third-Quarter Profit Reversal Shaping a New Investment Narrative?

Reviewed by Sasha Jovanovic

- Sunoco LP reported its third quarter 2025 earnings in early November, revealing sales of US$6.03 billion and net income of US$137 million, both markedly higher than the same quarter last year.

- This turnaround saw the company swing to a profit per share versus a loss in the prior-year quarter, despite a weaker showing across the year-to-date period.

- We'll explore how Sunoco's sharp rebound in quarterly profitability could influence its longer-term investment narrative and outlook.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Sunoco Investment Narrative Recap

To invest in Sunoco, you must believe that demand for refined petroleum products will stay resilient enough for the company’s fuel distribution scale and acquisition strategy to continue supporting long-term earnings and market share growth. The recent third-quarter profit rebound is a positive signal, but does not materially shift the most important near-term catalyst, closing and integrating acquisitions, nor does it soften the key risk tied to secular volume headwinds from evolving fuel demand patterns.

Among Sunoco’s recent announcements, the ongoing series of dividend increases, including the latest 1.25% rise for Q3 2025, stands out as directly relevant to current profitability. This reflects management’s confidence in distributable cash flow and could bolster sentiment in the near term, especially as investors weigh how integration of new assets may impact coverage and leverage metrics going forward.

However, in contrast to the sharp quarterly profit, investors should be aware that …

Read the full narrative on Sunoco (it's free!)

Sunoco's outlook anticipates $26.7 billion in revenue and $1.6 billion in earnings by 2028. This implies a 7.4% annual revenue growth and an increase in earnings of $1.3 billion from the current $279.0 million.

Uncover how Sunoco's forecasts yield a $64.71 fair value, a 27% upside to its current price.

Exploring Other Perspectives

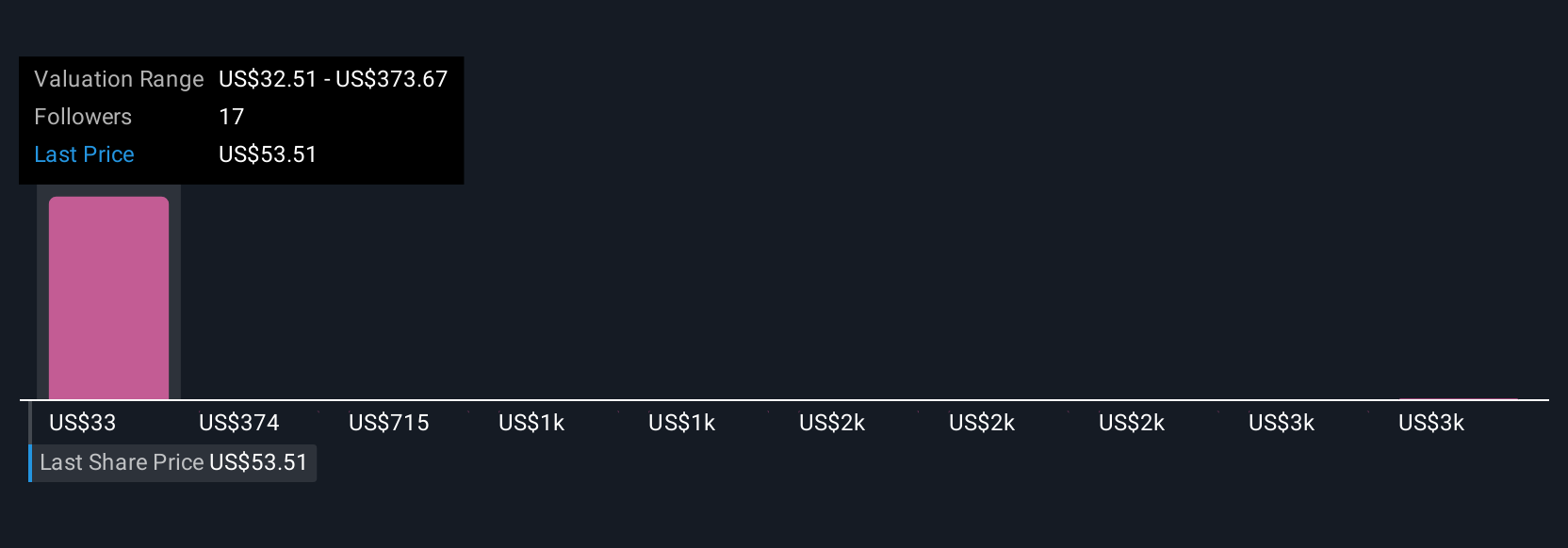

Fair value opinions among five Simply Wall St Community members span a wide range, from US$32.51 to US$3,444.12. While perspectives vary sharply, many are also watching whether Sunoco’s continued acquisition activity will effectively combat structural demand risks over the coming years.

Explore 5 other fair value estimates on Sunoco - why the stock might be worth 36% less than the current price!

Build Your Own Sunoco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sunoco research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sunoco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sunoco's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SUN

Sunoco

Engages in the energy infrastructure and distribution of motor fuels in the United States.

Undervalued with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives