- United States

- /

- Oil and Gas

- /

- NYSE:SUN

How Sunoco’s Stock Looks After Recent Earnings and Oil Price Volatility in 2025

Reviewed by Bailey Pemberton

Thinking about what to do with Sunoco stock? You’re definitely not alone. Right now, the stock is trading at $49.43, and there’s been some movement that has investors checking their assumptions. While the last seven days have seen the stock slide by 2.5%, and Sunoco’s one-year return sits at -1.8%, it’s worth noting that over the past three years, the share price is up by a remarkable 52.7%. Looking further back, the five-year return is an impressive 191.8%, which suggests the company has seen significant growth during that period. These figures come against a backdrop of shifting market sentiment toward the entire energy sector, with ongoing conversations about infrastructure investment and fuel demand quietly affecting Sunoco’s outlook.

With a value score of 5, Sunoco checks the box for being undervalued in five out of six key measures. That’s a solid foundation for any valuation-focused conversation. However, as we review the numbers, there’s more to valuation than just a checklist. Let’s explore how those six methods stack up for Sunoco and why a deeper understanding can potentially provide an additional perspective.

Why Sunoco is lagging behind its peers

Approach 1: Sunoco Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them to their present value. This approach helps investors understand what the business is fundamentally worth today, based on its future ability to generate cash.

For Sunoco, the latest twelve months of Free Cash Flow stands at $433.8 million. Analyst estimates suggest that this figure will continue to grow, reaching a projected Free Cash Flow of $1.27 billion by 2029. While analyst coverage extends out five years, estimates for the following years are extrapolated to provide a longer-term perspective on growth.

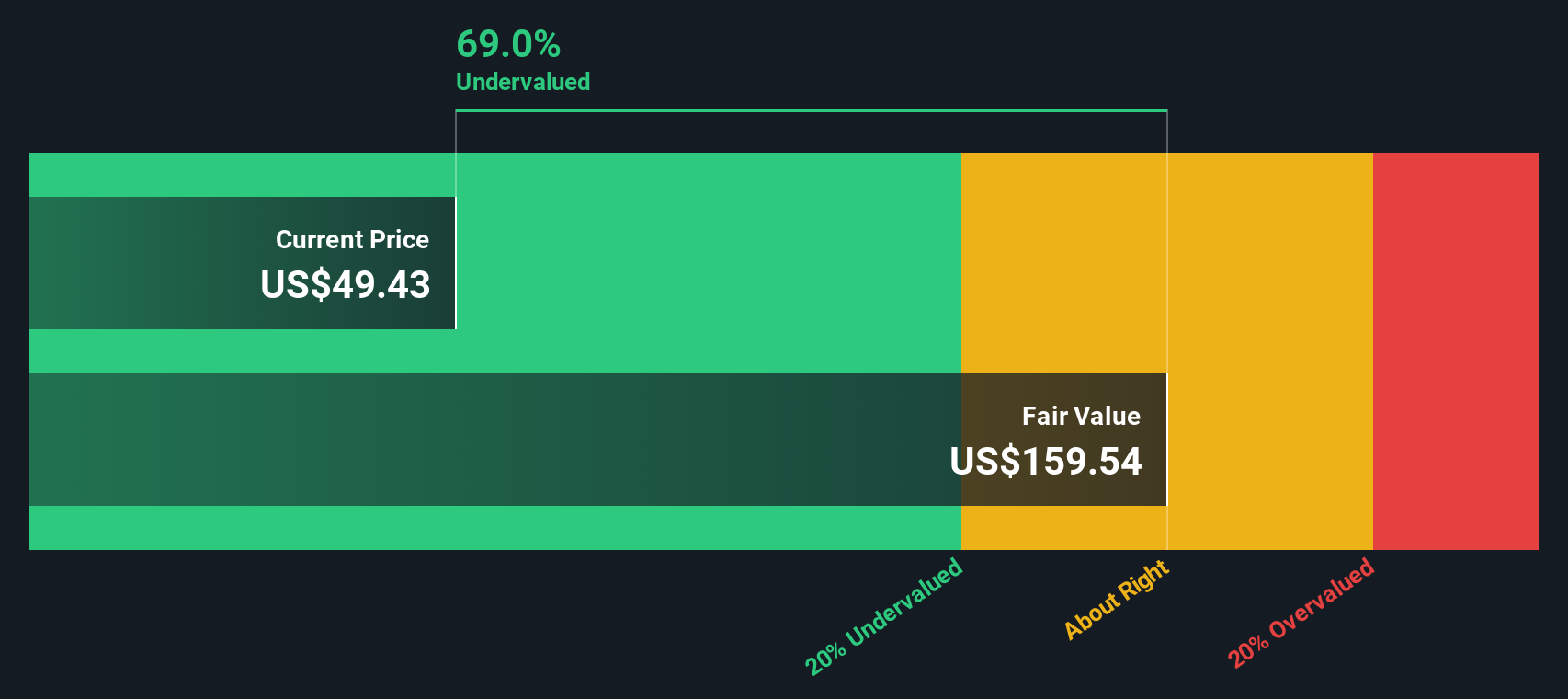

Based on these cash flow projections, the DCF model calculates Sunoco's fair value at $159.54 per share. Compared to the current share price of $49.43, this suggests the stock is trading at a 69.0% discount to its intrinsic value. This indicates a considerable margin of safety for value-focused investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sunoco is undervalued by 69.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Sunoco Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like Sunoco because it offers a straightforward view of how much investors are willing to pay for every dollar of current earnings. For companies generating consistent profits, the PE multiple captures both expectations for future growth and the level of risk investors associate with those earnings.

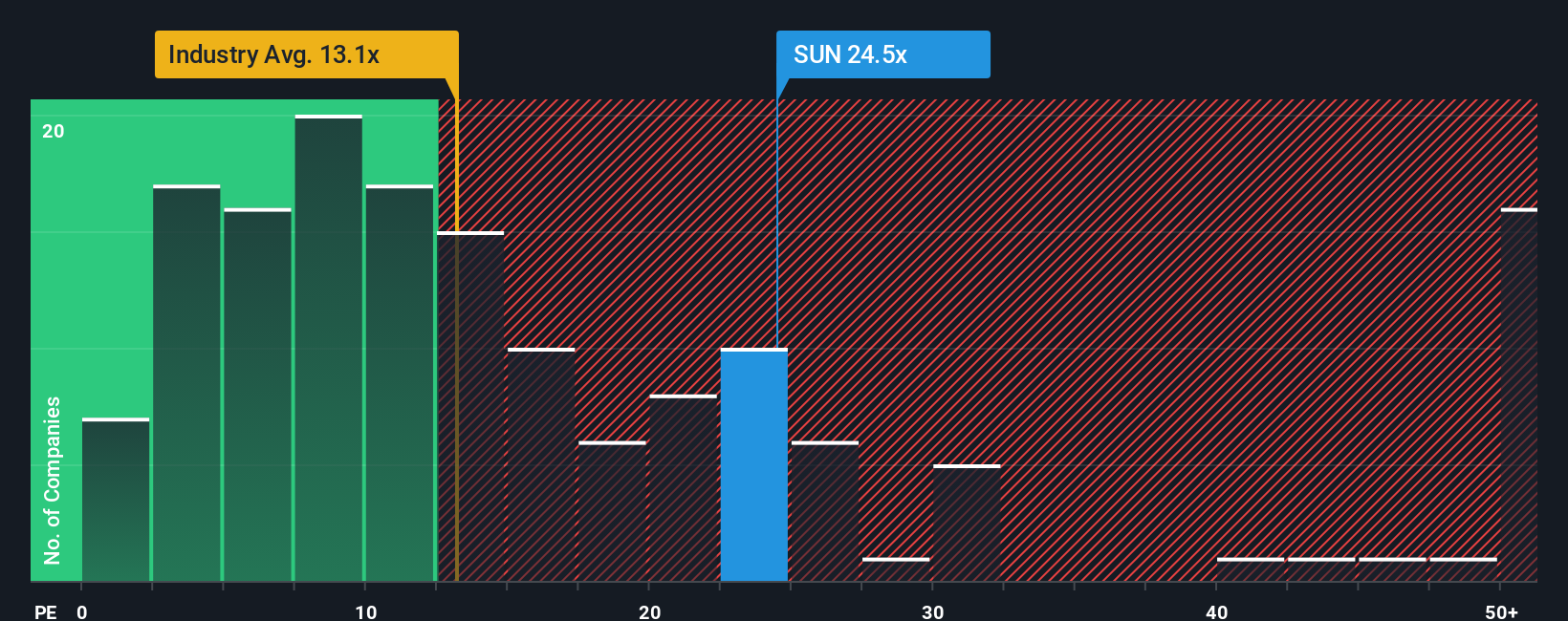

Market participants tend to assign higher PE ratios to businesses with robust growth prospects and lower risk, while slower-growing or riskier companies usually trade at a discount. In Sunoco’s case, the current PE ratio is 24.2x. This sits above the Oil and Gas industry average of 13.2x, but below the peer average of 35.0x. This reflects the company’s stronger growth profile relative to the broader sector, but a more moderate outlook compared to its most expensive peers.

To provide a more tailored analysis, Simply Wall St has developed the “Fair Ratio” in Sunoco's case, a proprietary value of 26.2x. Unlike industry averages or peer comparisons, the Fair Ratio accounts for factors specific to Sunoco, such as its future earnings growth, risk profile, profit margins, and market capitalization. This makes it a more comprehensive benchmark for evaluating whether the current valuation makes sense.

Comparing Sunoco’s actual PE (24.2x) to its Fair Ratio (26.2x), the slight difference suggests the stock's valuation is about right. This offers neither a significant discount nor an excessive premium relative to what would be expected for its growth and risk profile.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sunoco Narrative

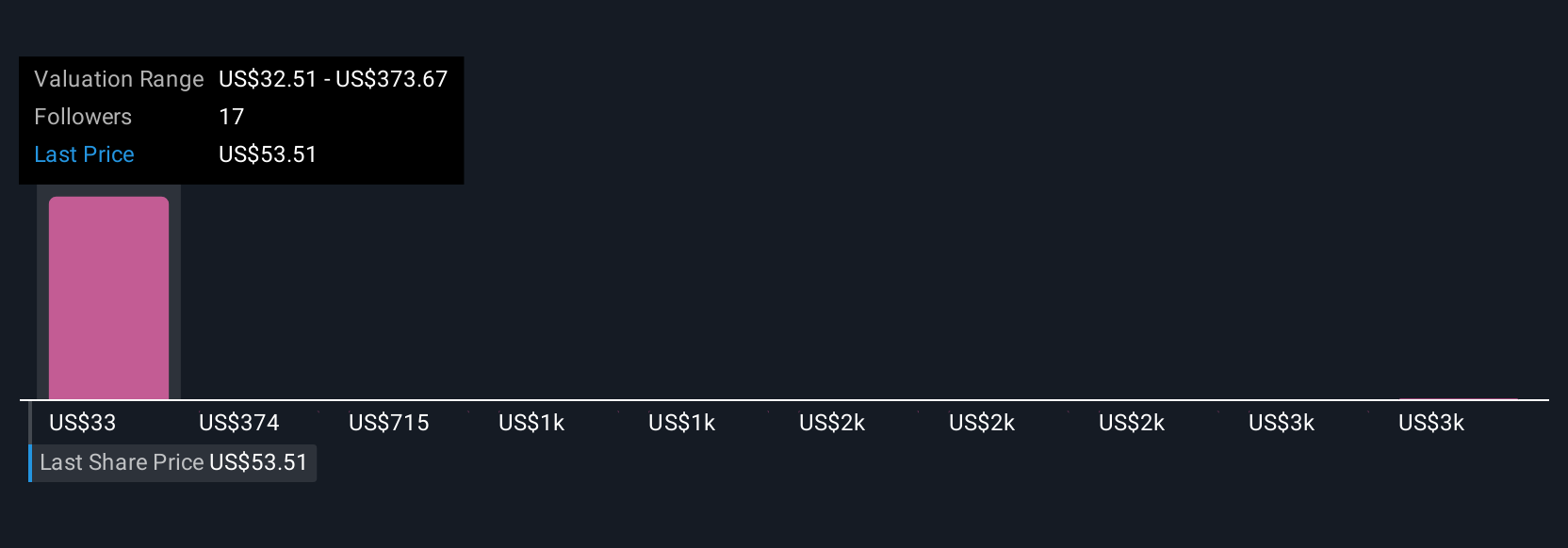

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your own story about Sunoco, where you combine what you believe about the company’s future, including its growth, earnings, and margins, into a single financial outlook and a fair value estimate.

Unlike traditional valuation methods that focus only on numbers, Narratives connect your perspective with a clear, quantifiable outcome by linking Sunoco’s story to a forecast and an up-to-date fair value. Narratives are easy to use and are available within the Community section on Simply Wall St’s platform, a resource trusted by millions of investors.

With Narratives, you can instantly compare your calculated fair value to the current share price, helping you decide if now is the right time to buy or sell. They update automatically as new information, such as earnings results or industry news, comes in, making sure your investment thesis always reflects the latest developments.

For example, you might believe Sunoco will deliver steady growth from ongoing acquisitions and resilient fuel demand, giving it a significantly higher fair value than today’s price. Alternatively, you may see greater risks from industry shifts and set a lower future earnings estimate, resulting in a more cautious outlook. This difference highlights how Narratives help turn your individual insights into informed decisions.

Do you think there's more to the story for Sunoco? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SUN

Sunoco

Engages in the energy infrastructure and distribution of motor fuels in the United States.

High growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026