- United States

- /

- Oil and Gas

- /

- NYSE:STNG

What Does Scorpio Tankers’ (STNG) Latest Ship Sale Reveal About Its Evolving Fleet Strategy?

Reviewed by Simply Wall St

- Scorpio Tankers Inc. announced it has entered into an agreement to sell its 2020-built scrubber-fitted MR product tanker, STI Maestro, for US$42.0 million, with the transaction expected to close in the fourth quarter of 2025.

- This deal, along with a newly secured long-term charter, highlights the company's ongoing efforts to optimize fleet management and support reliable revenue streams.

- We'll explore how the asset sale and charter agreement may influence Scorpio Tankers' investment narrative and future fleet strategy.

Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

Scorpio Tankers Investment Narrative Recap

To be a shareholder in Scorpio Tankers, you need to believe in the ongoing global demand for refined petroleum transport, supported by trade patterns favoring fuel-efficient modern fleets. The recent US$42.0 million vessel sale is consistent with Scorpio's fleet management approach and does not materially alter the current primary catalyst: higher product tanker rates driven by trade dislocations. The largest immediate risk, future overcapacity in the global tanker market, remains unchanged by this transaction.

One announcement closely tied to this context is the recent five-year charter secured at US$28,350 daily for the STI Orchard, starting in Q3 2025. This charter provides a predictable revenue stream amid spot market fluctuations and aligns with the catalysts supporting utilization and rate strength. Such moves indicate the company is prioritizing steady cash flows as industry supply and demand ebbs and flows.

However, these positive contract wins do not insulate investors from the possibility that if new ship deliveries lead to a pronounced rise in global product tanker capacity, ...

Read the full narrative on Scorpio Tankers (it's free!)

Scorpio Tankers' outlook estimates $972.2 million in revenue and $302.6 million in earnings by 2028. This projection assumes 2.0% annual revenue growth, but a decline in earnings of $56.4 million from the current $359.0 million.

Uncover how Scorpio Tankers' forecasts yield a $65.11 fair value, a 11% upside to its current price.

Exploring Other Perspectives

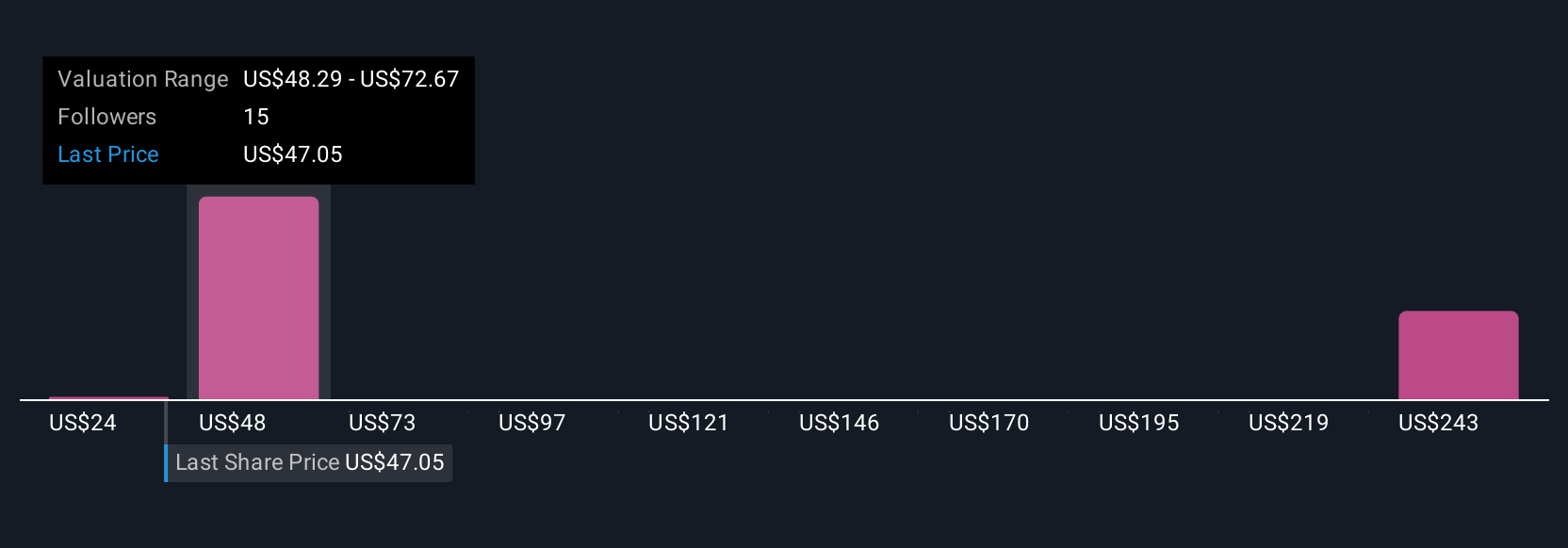

Five fair value opinions from the Simply Wall St Community span from US$23.90 to US$261.22 per share, with several clustered well above the current price. Many community members anticipate strength in ton-mile demand, yet new vessel deliveries could pressure rates and margins, shaping very different outlooks. Expand your view by considering these alternative analyses.

Explore 5 other fair value estimates on Scorpio Tankers - why the stock might be worth over 4x more than the current price!

Build Your Own Scorpio Tankers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Scorpio Tankers research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Scorpio Tankers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Scorpio Tankers' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STNG

Scorpio Tankers

Engages in the seaborne transportation of crude oil and refined petroleum products worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives