The board of Scorpio Tankers Inc. (NYSE:STNG) has announced that it will pay a dividend of US$0.10 per share on the 15th of June. Including this payment, the dividend yield on the stock will be 1.4%, which is a modest boost for shareholders' returns.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Investors will be pleased to see that Scorpio Tankers' stock price has increased by 82% in the last 3 months, which is good for shareholders and can also explain a decrease in the dividend yield.

See our latest analysis for Scorpio Tankers

Scorpio Tankers Might Find It Hard To Continue The Dividend

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Even though Scorpio Tankers isn't generating a profit, it is generating healthy free cash flows that easily cover the dividend. This gives us some comfort about the level of the dividend payments.

Over the next year, EPS could expand by 28.8% if recent trends continue. While it is good to see income moving in the right direction, it still looks like the company won't achieve profitability. The healthy cash flows are definitely as good sign, though so we wouldn't panic just yet, especially with the earnings growing.

Scorpio Tankers' Dividend Has Lacked Consistency

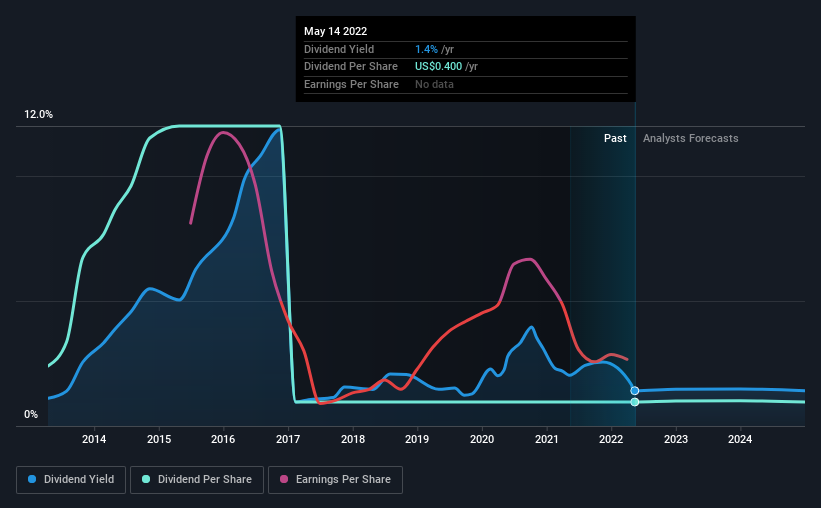

It's comforting to see that Scorpio Tankers has been paying a dividend for a number of years now, however it has been cut at least once in that time. If the company cuts once, it definitely isn't argument against the possibility of it cutting in the future. The first annual payment during the last 9 years was US$1.00 in 2013, and the most recent fiscal year payment was US$0.40. The dividend has shrunk at around 9.7% a year during that period. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

The Company Could Face Some Challenges Growing The Dividend

Given that the track record hasn't been stellar, we really want to see earnings per share growing over time. We are encouraged to see that Scorpio Tankers has grown earnings per share at 29% per year over the past five years. Even though the company is not profitable, it is growing at a solid clip. If profitability can be achieved soon and growth continues apace, this stock could certainly turn into a solid dividend payer.

Our Thoughts On Scorpio Tankers' Dividend

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Scorpio Tankers' payments, as there could be some issues with sustaining them into the future. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 2 warning signs for Scorpio Tankers that investors need to be conscious of moving forward. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:STNG

Scorpio Tankers

Engages in the seaborne transportation of crude oil and refined petroleum products worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives