- United States

- /

- Oil and Gas

- /

- NYSE:STNG

Scorpio Tankers Inc. (NYSE:STNG) Looks Inexpensive But Perhaps Not Attractive Enough

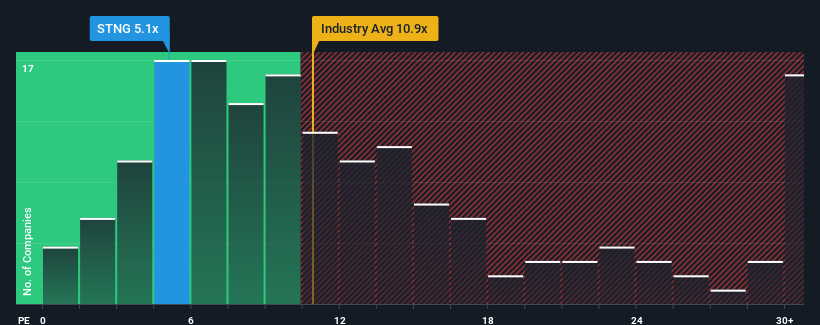

With a price-to-earnings (or "P/E") ratio of 5.1x Scorpio Tankers Inc. (NYSE:STNG) may be sending very bullish signals at the moment, given that almost half of all companies in the United States have P/E ratios greater than 19x and even P/E's higher than 35x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

With earnings that are retreating more than the market's of late, Scorpio Tankers has been very sluggish. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Check out our latest analysis for Scorpio Tankers

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Scorpio Tankers' to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 14%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings growth is heading into negative territory, declining 16% per year over the next three years. That's not great when the rest of the market is expected to grow by 10% per annum.

With this information, we are not surprised that Scorpio Tankers is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Scorpio Tankers' analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 2 warning signs for Scorpio Tankers you should be aware of, and 1 of them is concerning.

Of course, you might also be able to find a better stock than Scorpio Tankers. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:STNG

Scorpio Tankers

Engages in the seaborne transportation of crude oil and refined petroleum products worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives