- United States

- /

- Oil and Gas

- /

- NYSE:STNG

How an ESOP-Driven Share Offering at Scorpio Tankers (STNG) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- On September 26, 2025, Scorpio Tankers Inc. filed a shelf registration to offer 748,000 shares of common stock, raising up to US$43.15 million in an ESOP-related transaction.

- This move positions the company to increase employee ownership and potentially support future capital needs, reflecting ongoing shareholder and workforce alignment.

- We'll examine how renewed analyst optimism and the ESOP-related share offering could influence Scorpio Tankers' investment thesis and future prospects.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Scorpio Tankers Investment Narrative Recap

To be a shareholder in Scorpio Tankers, one needs to believe in the ongoing demand for global refined product shipping, as well as the company's ability to maintain high fleet utilization and manage industry cycles. The recent ESOP-related shelf registration does not materially change the key near-term catalyst, ton-mile demand supported by refinery dislocations, nor does it meaningfully alter Scorpio’s main risk, which remains sector overcapacity from new vessel deliveries in a cyclical industry.

Among the company's recent announcements, the sale of STI Maestro for US$42 million in September 2025 stands out. This asset sale follows Scorpio’s ongoing balance sheet optimization efforts, which could equip the company to deal with periods of market volatility and operational headwinds stemming from supply growth and regulatory pressures. In contrast, investors should be aware that overbuilding in the product tanker sector could ...

Read the full narrative on Scorpio Tankers (it's free!)

Scorpio Tankers' projections indicate revenues of $972.2 million and earnings of $302.6 million by 2028. This forecast assumes a 2.0% annual revenue growth rate and a decrease in earnings of $56.4 million from the current $359.0 million.

Uncover how Scorpio Tankers' forecasts yield a $66.78 fair value, a 17% upside to its current price.

Exploring Other Perspectives

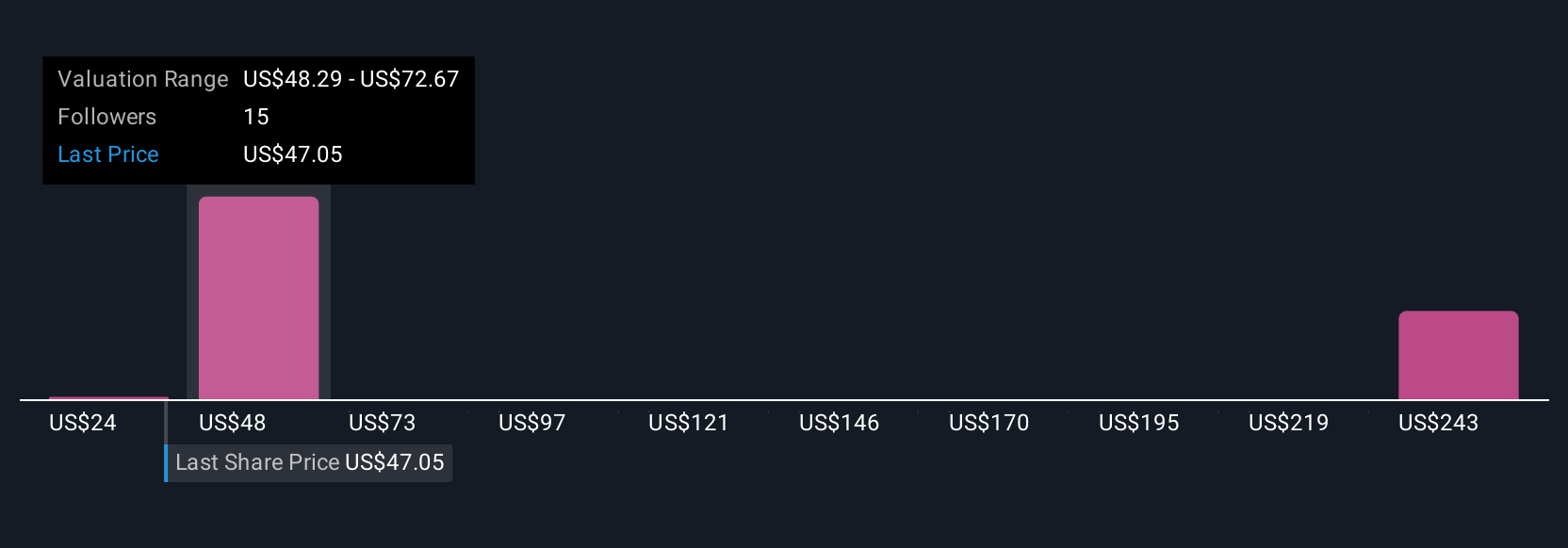

Five community contributors valued Scorpio Tankers between US$23.90 and US$277.22. Some expect overcapacity and industry cycles to weigh on performance, making it important to compare several viewpoints before deciding.

Explore 5 other fair value estimates on Scorpio Tankers - why the stock might be worth less than half the current price!

Build Your Own Scorpio Tankers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Scorpio Tankers research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Scorpio Tankers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Scorpio Tankers' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STNG

Scorpio Tankers

Engages in the seaborne transportation of crude oil and refined petroleum products worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives