- United States

- /

- Oil and Gas

- /

- NYSE:SOC

Sable Offshore (SOC): Evaluating Valuation After Lawsuits and Pipeline Restrictions Shake Investor Confidence

Reviewed by Kshitija Bhandaru

It has been a whirlwind few months for Sable Offshore (NYSE:SOC). Investors have watched the company come under a flurry of legal and regulatory scrutiny after multiple class action lawsuits alleged that it misled shareholders about restarting oil production off the coast of California. These lawsuits are closely tied to Sable Offshore's May secondary public offering and have been amplified by a court order temporarily stopping the company from transporting oil through its pipeline. Naturally, these developments have rattled the market, leaving many holders reevaluating their next move.

Peeling back to a broader picture, Sable Offshore's share price dropped sharply in the wake of these events. This comes after a year marked by swings in momentum. For example, while the company’s 12-month return has been positive at 6%, short-term performance has been more volatile. Shares climbed 11% over the past 3 months but slid 18% during the month amid recent legal twists. The three-year return still stands out, fueled by much earlier gains, but the current spotlight remains fixed on the company’s risks and future earning power.

The big question now is whether the recent pullback has exposed potential value in Sable Offshore, or if investors are simply bracing for tougher times that are already baked into the price.

Price-to-Book of 5.3x: Is it justified?

Sable Offshore is currently trading at a price-to-book ratio of 5.3 times, which is significantly higher than the US Oil and Gas industry average of 1.3 times. This suggests that investors are paying a substantial premium compared to what is typical for this sector.

The price-to-book ratio measures the market value of a company's equity relative to its book value. It is a widely used indicator in the energy sector because it helps compare the value investors assign to a company versus its actual net assets. For Sable Offshore, the elevated multiple raises questions about whether the company's future prospects justify such a high valuation.

Given this steep premium, it appears that the market is pricing in aggressive growth expectations or potential catalysts that could drive higher returns. However, current fundamentals show the company is unprofitable, with increasing losses, so the present multiple may not be justified unless those expectations are realized.

Result: Fair Value of $23.56 (OVERVALUED)

See our latest analysis for Sable Offshore.However, continued regulatory scrutiny and Sable Offshore's persistent net losses could pose real challenges to the optimistic outlook that is currently priced into shares.

Find out about the key risks to this Sable Offshore narrative.Another View: What Does the SWS DCF Model Say?

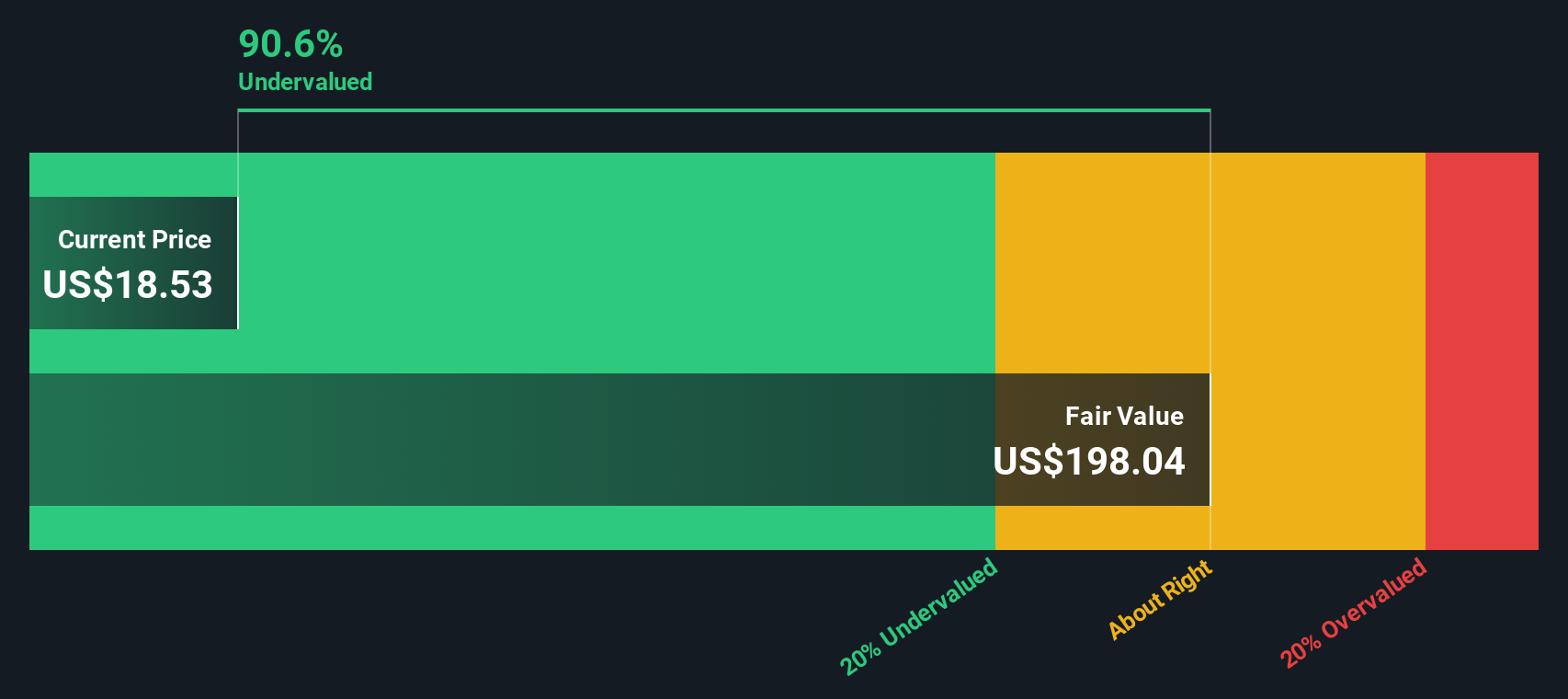

Taking a different approach, our DCF model presents a very different picture, suggesting Sable Offshore may actually be deeply undervalued at this time. Could the market's worries be clouding an overlooked opportunity?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Sable Offshore Narrative

If you see things differently or want a fresh perspective based on your own research, you can build your own story in just a few minutes. Do it your way.

A great starting point for your Sable Offshore research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that the best opportunities are often hiding where few are looking. Give yourself an edge by using these powerful tools to uncover stocks that match your strategy. Don’t let your next great investment pass you by.

- Tap into emerging industries and see which companies are shaping tomorrow’s breakthroughs in quantum computing by using our quantum computing stocks.

- Set your sights on reliable cash flow by finding companies with consistently high yields using our expertly curated dividend stocks with yields > 3%.

- Uncover hidden gems trading below their true value and capture market inefficiencies with the help of our undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SOC

Sable Offshore

Operates as an independent oil and gas company in the United States.

High growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives