- United States

- /

- Oil and Gas

- /

- NYSE:SOC

How Sable Offshore's (SOC) Offshore Storage Pivot Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Earlier this week, Sable Offshore Corp. announced an alternative plan to transport crude oil using an offshore storage and treating vessel as regulatory delays continue to affect its onshore pipeline network.

- This pivot highlights the company’s willingness to adapt operations in response to persistent regulatory roadblocks, attracting renewed attention from market observers.

- We'll examine how the alternative crude oil transportation strategy shapes Sable Offshore's investment narrative amid ongoing regulatory challenges.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Sable Offshore's Investment Narrative?

Owning Sable Offshore shares right now means believing that the company can execute on its alternative crude oil transport plan in the face of ongoing regulatory and legal pressure, while turning the corner financially. The recent news of a shift back toward using offshore storage and treating vessels, rather than waiting for onshore pipeline approvals, marks a potentially material pivot for short-term catalysts. Immediately, this move has drawn market attention, reversing a lengthy price slump and injecting new optimism about production resumption. However, the risks remain considerable: court orders and lawsuits continue to cast doubt on operations, and regulatory setbacks have multiplied. This development may reduce the weight of regulatory timeline risk as a near-term issue, but legal and financial hurdles, including shareholder dilution and ongoing losses, are still front and center for investors watching future earnings and cash flow.

But, the shadow of ongoing class action lawsuits remains an important risk to consider.

Exploring Other Perspectives

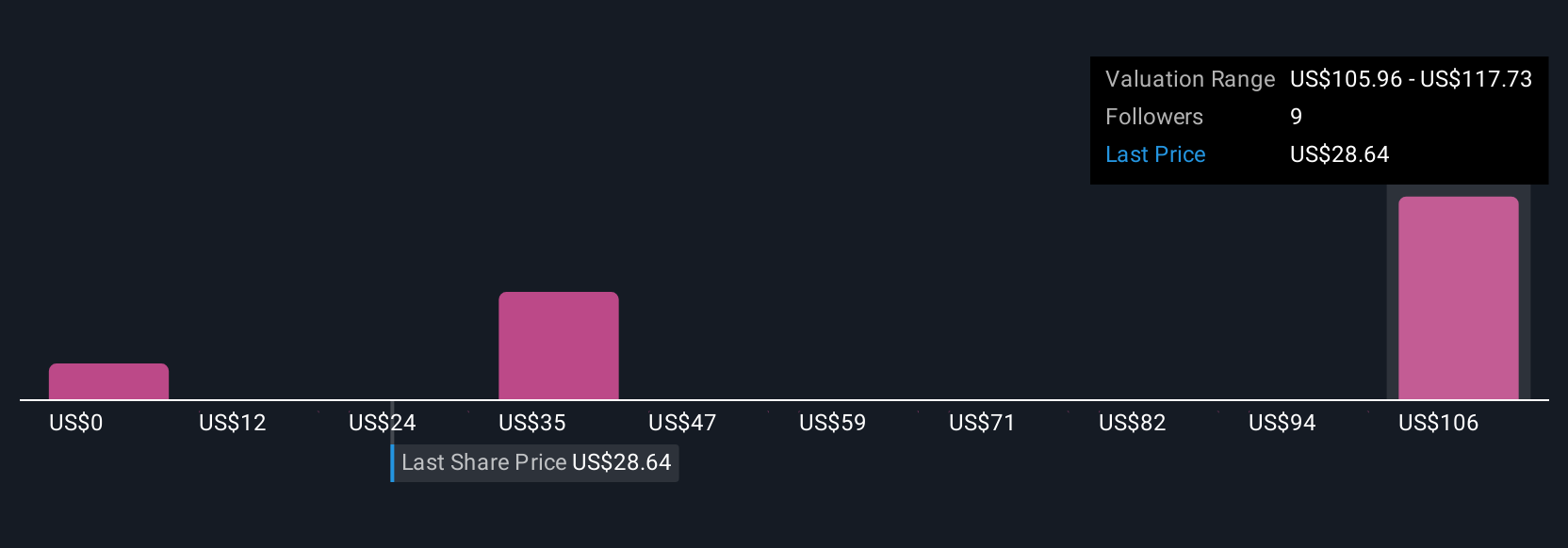

Explore 4 other fair value estimates on Sable Offshore - why the stock might be worth just $20.91!

Build Your Own Sable Offshore Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sable Offshore research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Sable Offshore research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sable Offshore's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SOC

Sable Offshore

Operates as an independent oil and gas company in the United States.

High growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives