- United States

- /

- Energy Services

- /

- NYSE:SLB

How the Tela AI Launch Could Shape SLB’s (SLB) Digital Transformation Strategy

Reviewed by Sasha Jovanovic

- SLB recently unveiled Tela™, an agentic AI assistant integrated into its platforms and applications to automate and transform upstream energy workflows, leveraging large language models and domain foundation models for the energy sector.

- This innovation positions SLB at the forefront of digitalization in the energy industry, enabling customers to achieve higher productivity and efficiency through AI-powered, adaptive workflow optimization tailored to operational priorities.

- We’ll examine how the launch of the Tela AI assistant signals a new chapter in SLB’s digital and automation-led investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

SLB Investment Narrative Recap

To be a shareholder in SLB, you need to believe in the company’s ability to harness digital innovation, like agentic AI, to drive recurring revenue in a sector where global energy consumption and digital transformation remain central catalysts. While the Tela™ AI assistant launch reinforces SLB’s push into higher-margin digital offerings, it doesn’t materially shift the most immediate catalyst: international upstream spending, or the core risk of upstream capital expenditure cuts amid macro uncertainty.

The company’s recent award of sizeable EPC contracts for deepwater projects in Malaysia is relevant here, as these long-cycle investments support SLB’s resilience against cyclicality and help anchor short-term revenue streams, though the impact of broader industry spending trends remains the main factor influencing near-term performance.

By contrast, investors should be aware that persistent macro volatility, including commodity price swings, could still pressure upstream budgets and compress margins if ...

Read the full narrative on SLB (it's free!)

SLB's narrative projects $38.7 billion in revenue and $4.9 billion in earnings by 2028. This requires 2.9% yearly revenue growth and an $0.8 billion earnings increase from the current $4.1 billion.

Uncover how SLB's forecasts yield a $45.30 fair value, a 26% upside to its current price.

Exploring Other Perspectives

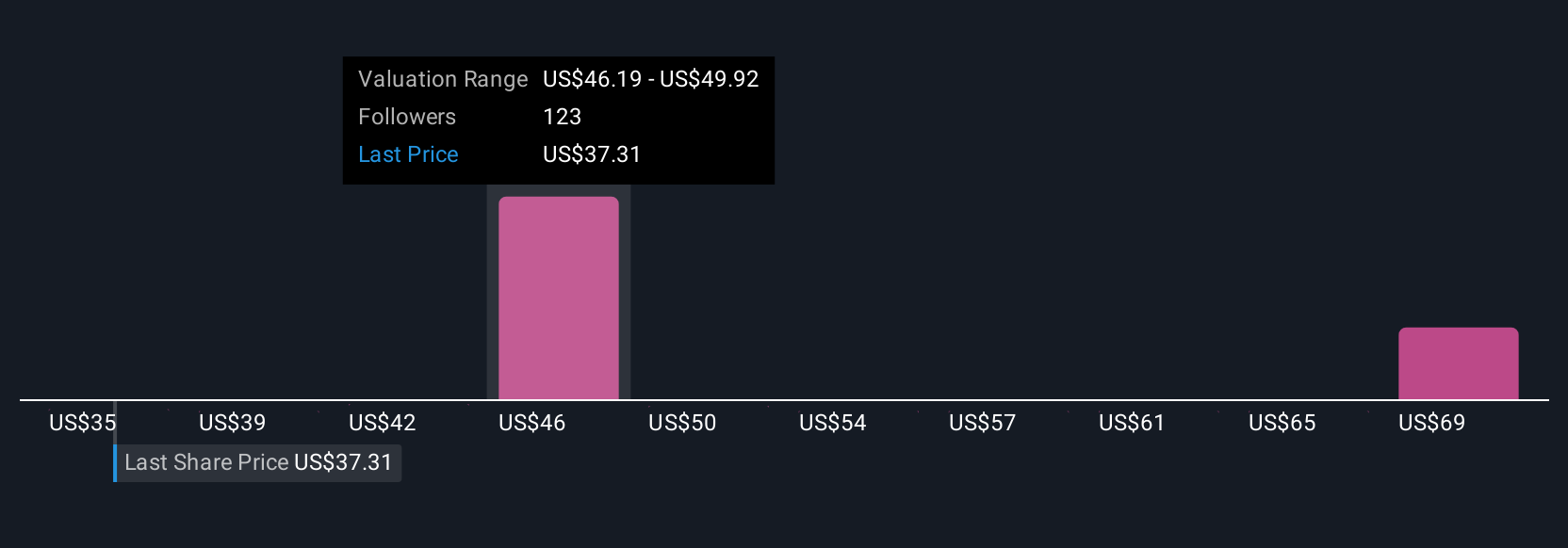

Fair value estimates from 13 Simply Wall St Community members range widely, from US$36 to over US$92 per share. As you compare these perspectives, keep in mind that sector demand for automation and digital solutions remains highly relevant to SLB’s evolving business model.

Explore 13 other fair value estimates on SLB - why the stock might be worth just $36.00!

Build Your Own SLB Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SLB research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free SLB research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SLB's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SLB

SLB

Engages in the provision of technology for the energy industry worldwide.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives