- United States

- /

- Energy Services

- /

- NYSE:SLB

Could SLB's (SLB) Geothermal Partnership Reveal a New Path for Diversification Success?

Reviewed by Sasha Jovanovic

- Ormat Technologies and SLB recently announced an agreement to fast-track the development and commercialization of integrated geothermal assets, including enhanced geothermal systems (EGS), with a pilot project planned at an Ormat facility.

- This collaboration is designed to unlock new geothermal energy opportunities beyond traditional resources by streamlining project deployment and targeting widespread adoption among independent power producers, utilities, and large-scale energy users.

- We'll explore how this move into next-generation geothermal technology could strengthen SLB's diversification story and growth outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

SLB Investment Narrative Recap

To be a shareholder in SLB, you need to believe in the company’s ability to diversify beyond traditional oilfield services, unlocking new growth through digital transformation and expansion into low-carbon solutions. The recent announcement with Ormat Technologies to fast-track geothermal projects could modestly boost SLB’s energy transition narrative but is unlikely to materially change the near-term catalyst, which remains global upstream spending trends, nor does it immediately offset the cyclicality risk associated with oilfield service revenues.

Of the recent announcements, the October 10 partnership with Google Cloud and Project Innerspace directly supports SLB’s geothermal ambitions, complementing the new Ormat agreement by improving identification and development of geothermal resources. This initiative aligns with the growing operator demand for production optimization and digital efficiency, supporting SLB’s push toward a higher-margin recurring revenue mix.

Yet, in contrast to the promise of diversification, investors should be aware of heightened cyclicality risk if upstream spending declines in core markets...

Read the full narrative on SLB (it's free!)

SLB's outlook anticipates $38.7 billion in revenue and $4.9 billion in earnings by 2028. This is based on a 2.9% annual revenue growth rate and an $0.8 billion increase in earnings from the current $4.1 billion.

Uncover how SLB's forecasts yield a $45.16 fair value, a 23% upside to its current price.

Exploring Other Perspectives

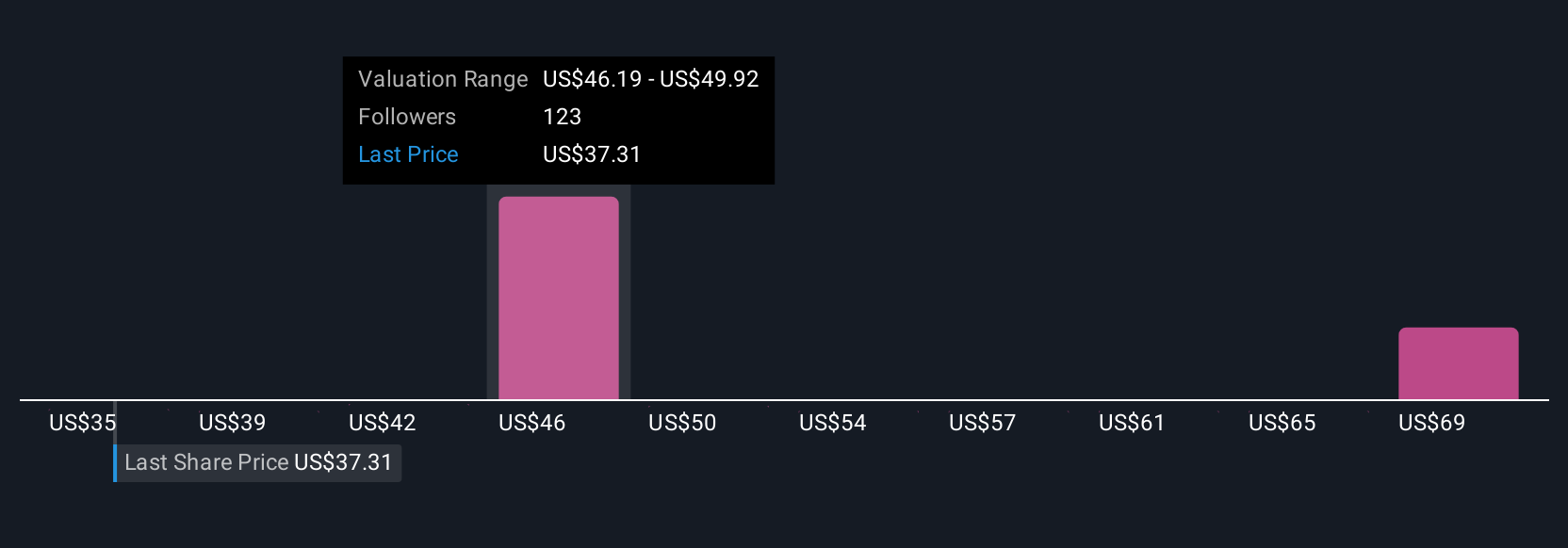

Simply Wall St Community members forecast SLB’s fair value between US$36 and US$81, based on 13 different perspectives. Given the wide range of opinions, remember that shifting global energy spending and adoption of low-carbon solutions remain key factors shaping SLB’s outlook.

Explore 13 other fair value estimates on SLB - why the stock might be worth just $36.00!

Build Your Own SLB Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SLB research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free SLB research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SLB's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SLB

SLB

Engages in the provision of technology for the energy industry worldwide.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives