The board of SFL Corporation Ltd. (NYSE:SFL) has announced that it will be paying its dividend of $0.26 on the 28th of March, an increased payment from last year's comparable dividend. This takes the dividend yield to 7.8%, which shareholders will be pleased with.

Check out our latest analysis for SFL

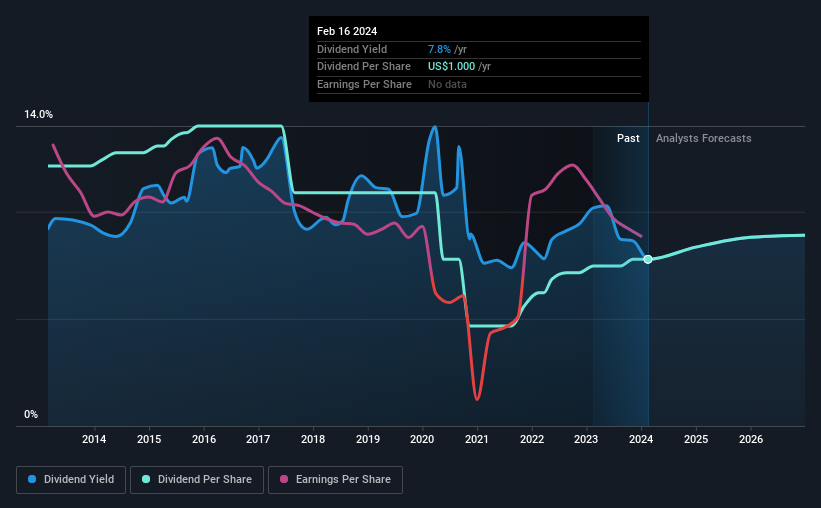

SFL's Dividend Is Well Covered By Earnings

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Prior to this announcement, the company was paying out 121% of what it was earning. It will be difficult to sustain this level of payout so we wouldn't be confident about this continuing.

Over the next year, EPS is forecast to expand by 74.5%. If recent patterns in the dividend continues, the payout ratio in 12 months could be 78% which is a bit high but can definitely be sustainable.

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. The dividend has gone from an annual total of $1.56 in 2014 to the most recent total annual payment of $1.00. This works out to be a decline of approximately 4.3% per year over that time. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

SFL May Find It Hard To Grow The Dividend

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. SFL hasn't seen much change in its earnings per share over the last five years.

We're Not Big Fans Of SFL's Dividend

In summary, investors will like to be receiving a higher dividend, but we have some questions about whether it can be sustained over the long term. The company seems to be stretching itself a bit to make such big payments, but it doesn't appear they can be consistent over time. Overall, the dividend is not reliable enough to make this a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. To that end, SFL has 3 warning signs (and 2 which are concerning) we think you should know about. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SFL

SFL

A maritime and offshore asset owning and chartering company, engages in the ownership, operation, and chartering out of vessels and offshore related assets on medium and long-term charters.

Moderate growth potential and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026