- United States

- /

- Energy Services

- /

- NYSE:SEI

Solaris Energy Infrastructure (SEI): Exploring Valuation Ahead of Earnings and Analyst Upgrades

Reviewed by Simply Wall St

Solaris Energy Infrastructure (NYSE:SEI) is in the spotlight as the company prepares to announce its Q3 earnings on November 3. Recent upgrades to full-year earnings estimates have fueled conversation, coming just months after Solaris surpassed expectations last quarter.

See our latest analysis for Solaris Energy Infrastructure.

Momentum has really picked up for Solaris Energy Infrastructure, with the share price returning 25.8% over the past month and an impressive 80.8% year-to-date. This strong run reflects growing optimism after positive earnings news and earnings estimate upgrades. It is all capped off by a remarkable 319.5% total shareholder return over the past year.

If you want to see what other high flyers could be next, now is a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With such a rapid share price surge and analysts raising their forecasts, the key question now is whether Solaris Energy Infrastructure still offers room for upside or if the market has already priced in its future growth potential.

Most Popular Narrative: 4.8% Undervalued

The current narrative sees Solaris Energy Infrastructure trading just shy of its implied fair value, with the most recent close at $53.23 against a calculated fair value close to $55.89. This subtle gap powers a debate over how much upside might still be left on the table.

Analysts point to Solaris Energy Infrastructure's recent doubling of power capacity as a primary catalyst for raising price targets. They highlight the company’s ability to scale operations rapidly.

What’s driving this ambitious price target? Only a handful of major assumptions about future revenue growth, profit margins, and share count could tip the scales. The real intrigue is one aggressive projection about how much Solaris can widen its profits. Uncover the core thesis behind this bullish valuation and see what sets it apart from the crowd.

Result: Fair Value of $55.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Solaris's rapid recent growth could taper off if project delays or sector swings in oil and gas affect future revenue and margins.

Find out about the key risks to this Solaris Energy Infrastructure narrative.

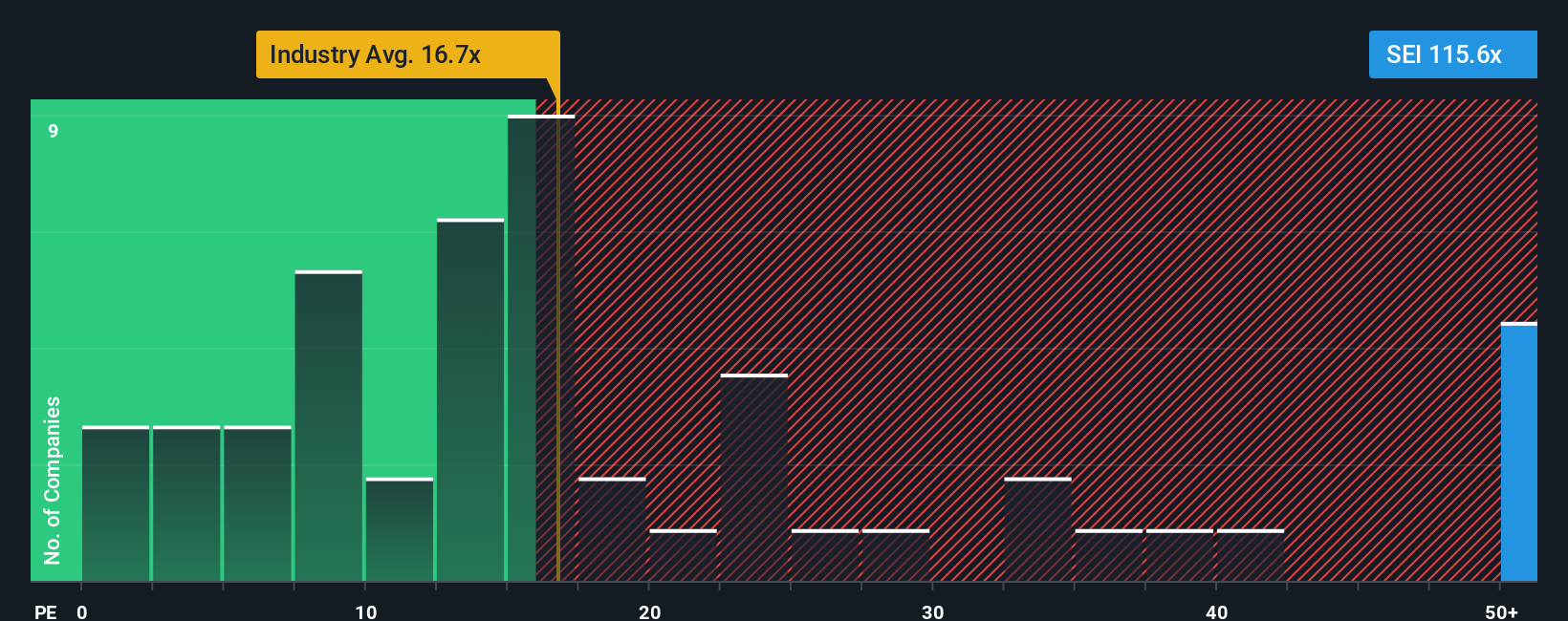

Another View: Price Ratios Signal Caution

Looking at current price ratios, Solaris Energy Infrastructure trades at a hefty 115.6 times earnings, which is far above both the US Energy Services industry average of 16.8 and its peers at 24. The fair ratio the market could move toward is 22.4. Such a wide premium increases the risk that expectations could get ahead of reality. Could these high hopes set up future disappointment, or is the market seeing something others miss?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Solaris Energy Infrastructure Narrative

If you see things differently or want to dig into the numbers yourself, you can analyze the data and build your own story in just a few minutes: Do it your way

A great starting point for your Solaris Energy Infrastructure research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

Ready for Your Next Smart Move?

Don't let another opportunity pass you by. The market is full of potential. Use the Simply Wall Street Screener to find your edge and stay ahead.

- Uncover high-yield opportunities and get consistent returns with these 22 dividend stocks with yields > 3%, packed with stocks yielding over 3%.

- Tap into the next wave of market disruptors by reviewing these 26 AI penny stocks, focused on artificial intelligence innovation.

- Secure powerful picks at undervalued prices with these 831 undervalued stocks based on cash flows, ensuring you never overpay for future growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SEI

Solaris Energy Infrastructure

Provides mobile and scalable equipment-based solutions for use in distributed power generation and management of raw materials used in the completion of oil and natural gas wells in the United States.

Exceptional growth potential with moderate risk.

Similar Companies

Market Insights

Community Narratives