- United States

- /

- Energy Services

- /

- NYSE:SEI

Solaris Energy Infrastructure (SEI): Evaluating Valuation After Recent Share Price Surge

Reviewed by Simply Wall St

Solaris Energy Infrastructure (SEI) has been drawing increased attention following consistent share price appreciation, with gains of 22% over the past month and nearly 47% in the past 3 months. This performance stands out in an energy sector that is known for its volatility.

See our latest analysis for Solaris Energy Infrastructure.

The past year has been nothing short of remarkable for Solaris Energy Infrastructure. After a rocky start in 2024, momentum has gathered pace, with the company posting a 22% 1-month share price return and an impressive 266% total shareholder return over the last year. Recent surges suggest investor confidence is building, as market watchers grow more attuned to Solaris's ongoing growth and strategic moves.

If you’re curious about which other companies are catching investors’ interest right now, this is your opportunity to discover fast growing stocks with high insider ownership

Despite Solaris’s rapid ascent, the real question is whether these gains reflect a true undervaluation or if the stock’s outlook is already fully priced in. Is there still room for upside, or has the market anticipated future growth?

Most Popular Narrative: 14.7% Undervalued

Compared to the last close price of $47.70, the most widely followed narrative indicates Solaris Energy Infrastructure still trades well below its fair value. But what is actually driving that premium? Here is a direct look at one of the central drivers according to the expert consensus:

The accelerating demand for grid resiliency, electrification of industries, and AI-driven data center power needs is creating strong, ongoing demand for Solaris's modular, scalable power generation solutions. This is positioning the company for significant revenue growth as delivery of new capacity ramps through 2026 and beyond.

Think this price surge is already over? The narrative points to bold growth moves, ambitious margin projections, and profit multiples that could surprise even experienced investors. There is a fascinating story hidden beneath the headline valuation.

Result: Fair Value of $55.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Solaris’s projected growth faces risks from “one-off” project spikes and shifting oil demand, both of which could quickly alter expectations.

Find out about the key risks to this Solaris Energy Infrastructure narrative.

Another View: A Multiples-Based Reality Check

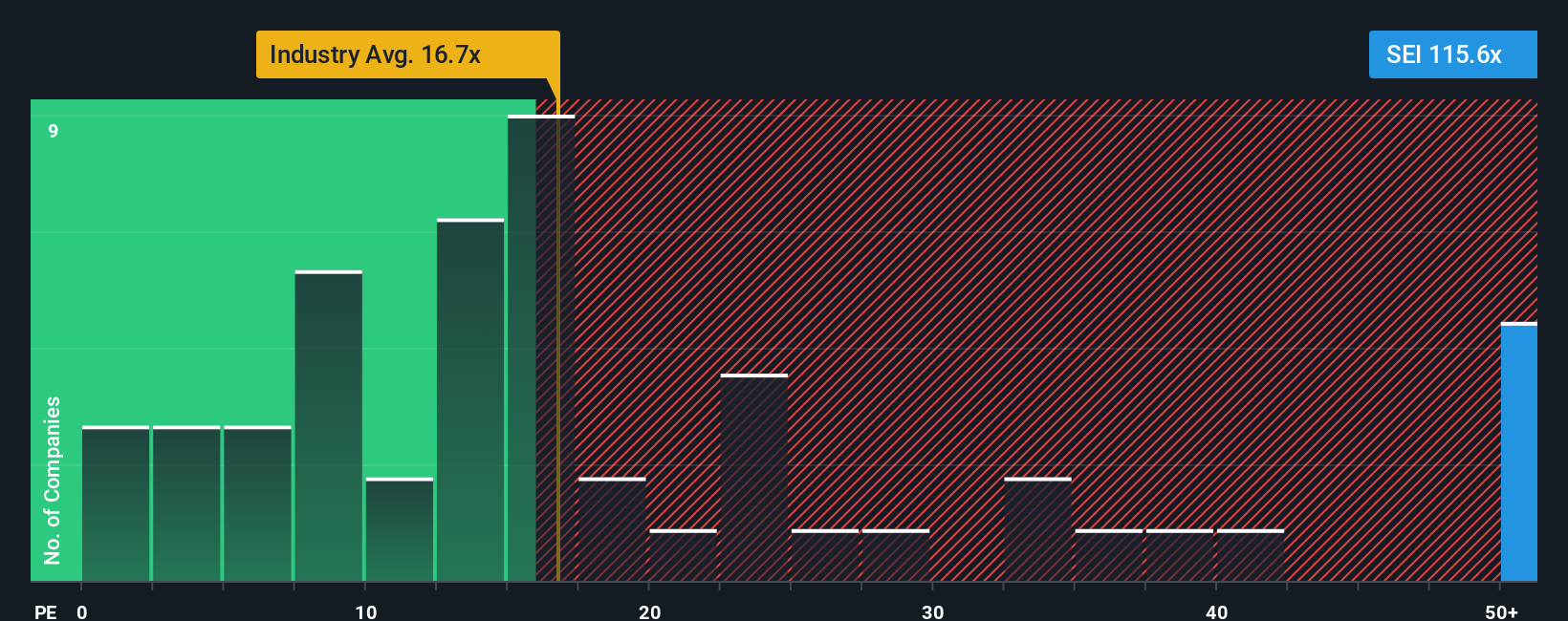

While the fair value estimate suggests Solaris Energy Infrastructure is significantly undervalued, market-based multiples tell a different story. The company’s current price-to-earnings ratio stands at 103.6x, which is much higher than its industry average of 15.3x, its peer group at 19.6x, and the calculated fair ratio of 22.5x. This wide gap implies the stock carries high expectations and may be more expensive than it first appears. Does this mean investors are taking on more valuation risk than they realize?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Solaris Energy Infrastructure Narrative

If these conclusions do not match your outlook or you want to dig deeper, you can explore the data and build your own perspective in just a few minutes with Do it your way.

A great starting point for your Solaris Energy Infrastructure research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always have an eye on fresh opportunities. If you want your portfolio to capture tomorrow’s winners, take a look at these uniquely positioned stocks and sectors on Simply Wall Street:

- Capture impressive yields and boost your passive income by reviewing these 17 dividend stocks with yields > 3% with robust financial health and attractive payout histories.

- Tap into the future of healthcare by investigating companies leveraging breakthroughs in artificial intelligence using these 33 healthcare AI stocks available right now.

- Capitalize on innovative technology shifts by seeking out these 27 AI penny stocks that are leading automation and machine learning revolutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SEI

Solaris Energy Infrastructure

Provides mobile and scalable equipment-based solutions for use in distributed power generation and management of raw materials used in the completion of oil and natural gas wells in the United States.

Exceptional growth potential with moderate risk.

Similar Companies

Market Insights

Community Narratives