- United States

- /

- Oil and Gas

- /

- NYSE:SBR

Taking Stock of Sabine Royalty Trust’s Valuation After Its Latest Monthly Distribution Declaration (SBR)

Reviewed by Simply Wall St

Sabine Royalty Trust (SBR) has declared a monthly cash distribution of $0.196670 per unit, payable on December 29 to holders of record as of December 15, putting fresh income front and center for yield focused investors.

See our latest analysis for Sabine Royalty Trust.

The latest cash distribution lands on a unit price that has already seen a solid year to date 21.13 percent share price return. At the same time, long term total shareholder returns of 298.74 percent over five years suggest momentum for income focused investors has been building rather than fading.

If Sabine’s steady checks have you thinking about what else is working in income and value, now is a good time to explore fast growing stocks with high insider ownership.

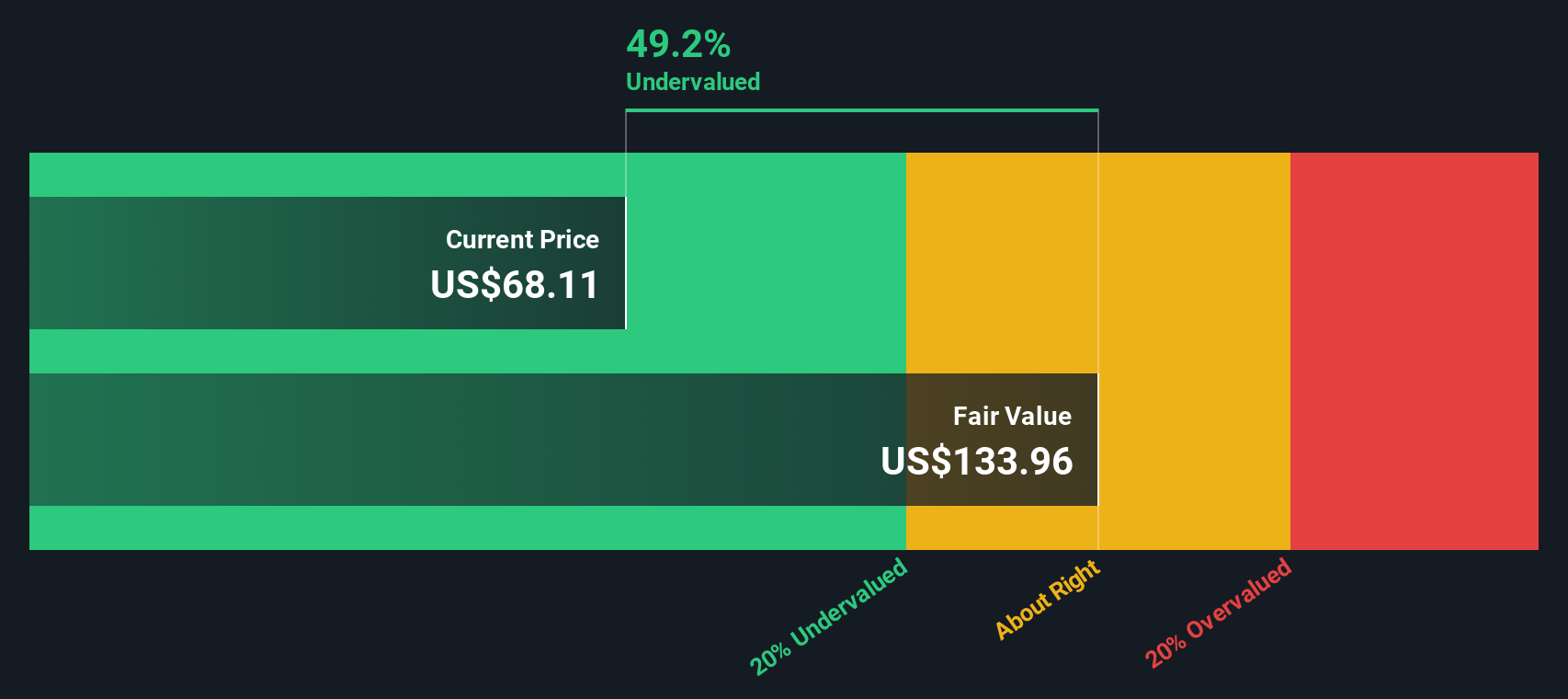

With units already up strongly and trading at what looks like a near 46 percent discount to intrinsic value, should investors view Sabine as a mispriced cash machine, or assume the market has already baked in years of future growth?

Price-to-Earnings of 14.5x: Is it justified?

Sabine Royalty Trust trades on a 14.5 times price to earnings multiple, modestly above the US oil and gas industry average of 13.8 times, even as our DCF work suggests the units change hands at a steep discount to intrinsic value.

The price to earnings ratio compares what investors pay for each dollar of current earnings, a particularly useful lens for a mature, highly profitable royalty trust with limited reinvestment needs. With return on equity running at an outstanding 1051.3 percent and earnings having compounded at roughly 13 percent annually over five years, the market seems willing to pay a slight premium to the sector for today’s profit stream, despite a softer earnings year and marginally lower profit margins than last year.

Against peers, Sabine screens as good value on this metric because its 14.5 times earnings multiple sits far below the broader peer group average of 33.9 times, suggesting investors may not be fully pricing in the trust’s combination of high quality earnings and long term compounding, even if it screens a touch expensive relative to the narrower oil and gas average.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 14.5x (UNDERVALUED)

However, investors still face risks from volatile commodity prices and potential production declines across Sabine’s legacy fields, which could pressure distributions and perceived undervaluation.

Find out about the key risks to this Sabine Royalty Trust narrative.

Another View: What Does Our DCF Say?

Our DCF model presents a much lower implied valuation for Sabine Royalty Trust, with an estimated fair value of $145.36 per unit compared with the current $78.93 price. This suggests it trades about 45.7 percent below the model’s estimate of intrinsic value. If that gap narrows, who captures the upside, and when?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sabine Royalty Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 910 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sabine Royalty Trust Narrative

If you see things differently or would rather dig into the numbers yourself, you can craft a personalized perspective in just a few minutes: Do it your way.

A great starting point for your Sabine Royalty Trust research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next opportunity by using the Simply Wall Street Screener to pinpoint stocks that match your strategy with precision.

- Turbo charge your hunt for undervalued opportunities by scanning these 910 undervalued stocks based on cash flows that could offer meaningful upside based on strong cash flow potential.

- Capitalize on the AI revolution by targeting these 26 AI penny stocks positioned to benefit from accelerating demand for intelligent automation and data driven services.

- Boost your income potential by reviewing these 15 dividend stocks with yields > 3% that combine attractive yields with the fundamentals to support those payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SBR

Sabine Royalty Trust

Sabine Royalty Trust holds royalty and mineral interests in various producing oil and gas properties in the United States.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026