- United States

- /

- Oil and Gas

- /

- NYSE:RRC

A Fresh Look at Range Resources (RRC) Valuation Following Upbeat Analyst Coverage and Natural Gas Demand Tailwinds

Reviewed by Simply Wall St

Range Resources (RRC) has caught investors’ attention following new coverage from several major banks and growing optimism for U.S. natural gas, driven by rising LNG exports and increasing energy needs from data centers.

See our latest analysis for Range Resources.

After upbeat analyst coverage and a flurry of industry optimism, Range Resources’ share price has climbed 7.6% over the past month. This move reflects surging investor interest in the energy sector and the company’s solid positioning. While year-to-date price gains remain modest, the real highlight is a robust 25% total shareholder return over the past year, which hints at building momentum on stronger fundamentals.

If the energy sector’s changing dynamics have you searching for compelling ideas, now is a great time to broaden your outlook and discover fast growing stocks with high insider ownership

With bullish analyst coverage and a favorable outlook for U.S. natural gas, the question now is whether Range Resources is still undervalued or if investors have already priced in the next leg of growth.

Most Popular Narrative: 11.5% Undervalued

With Range Resources closing at $37.12 and the most-followed narrative placing fair value around $41.96, this outlook underscores that many see additional upside for the shares if assumptions hold true. Investors are watching closely as industry dynamics and structural shifts could unlock further value. What is energizing such optimism?

Ongoing efficiency gains in drilling and completions and sustained reductions in per-unit well costs are enabling Range to increase production guidance and lower capital spending, directly expanding margins and delivering stronger free cash flow even in a flatter commodity environment.

Is there a playbook for outperformance hidden in these assumptions? This narrative hinges on relentless cost controls and a surprising margin boost. The full story contains the forecasted leaps in earnings and exactly how analysts expect the company to bend industry averages. Only by digging deeper can you see what financial milestones must be hit to justify this fair value.

Result: Fair Value of $41.96 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, tightening regulations or delayed demand from data centers could quickly reverse recent optimism and challenge the bullish case for continued upside.

Find out about the key risks to this Range Resources narrative.

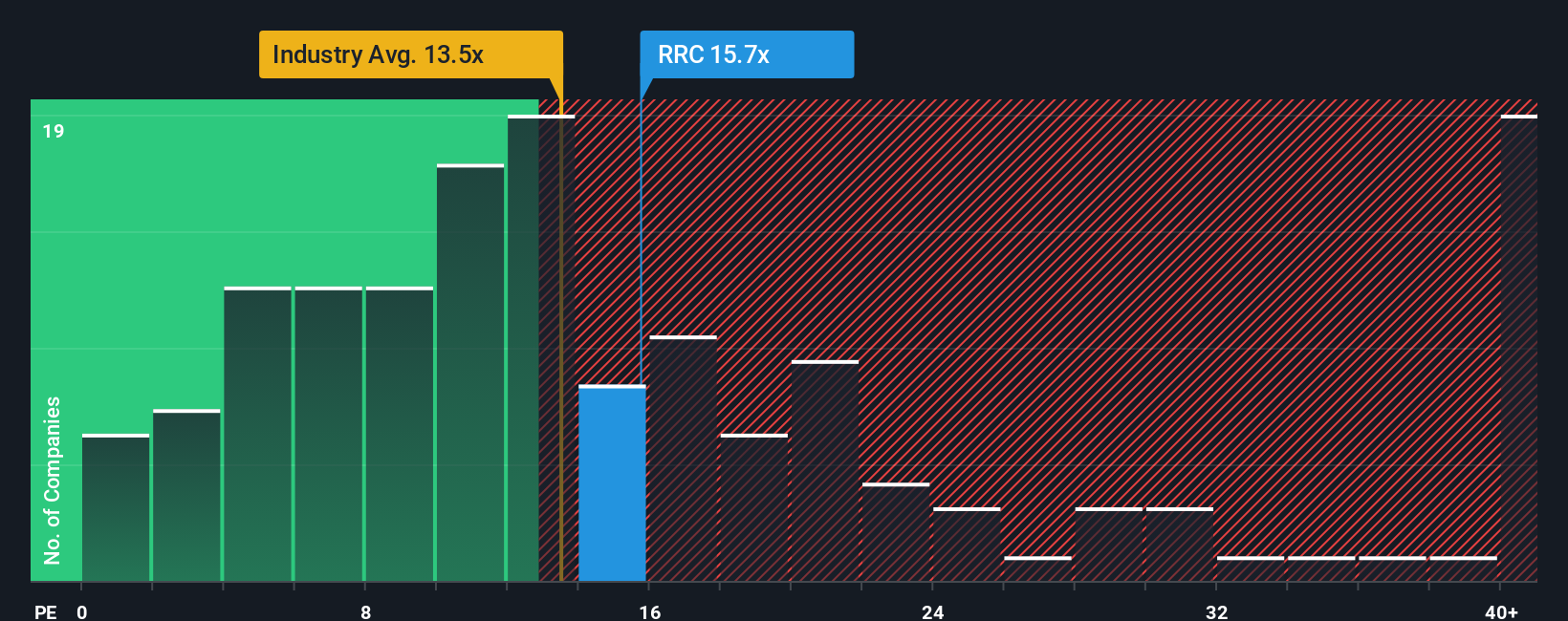

Another View: Valuation by Earnings Multiple

Looking from an earnings multiple perspective, Range Resources trades at 18.5 times earnings compared to a peer average of 18.2 times and an industry average of just 12.6 times. This suggests the market is pricing in a premium for Range, potentially exposing investors to more valuation risk if growth stalls. Could this premium hold up if market sentiment shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Range Resources Narrative

If you see the numbers differently or want to put your own perspective to the test, building your own take takes just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Range Resources.

Looking for more investment ideas?

Position yourself for what’s next by tapping into stock ideas that go beyond the obvious. The right picks can set you apart from the crowd.

- Unlock potential high-yield opportunities with these 17 dividend stocks with yields > 3%, delivering strong returns and stable income streams.

- Seize the frontier of innovation by targeting these 24 AI penny stocks, harnessing machine learning and automation for market disruption.

- Capitalize on bargain-priced businesses through these 875 undervalued stocks based on cash flows, which may be flying under the radar but have compelling fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RRC

Range Resources

Operates as an independent natural gas, natural gas liquids (NGLs), and oil company in the United States.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives