- United States

- /

- Energy Services

- /

- NYSE:RIG

Assessing Transocean (RIG) Valuation After Recent Short-Term Share Price Weakness

Reviewed by Simply Wall St

Transocean (RIG) has quietly drifted lower over the past week, but the bigger story is how this offshore driller’s longer term recovery case stacks up against a still choppy earnings backdrop.

See our latest analysis for Transocean.

At around $3.97 a share, Transocean’s recent 7 day share price return of negative 3.87 percent contrasts with a stronger 90 day share price return of 19.58 percent and a 1 year total shareholder return of 12.46 percent. This suggests momentum has cooled, while the broader recovery story remains in place.

If this offshore name has you thinking about where else performance and insider conviction might be lining up, it is worth exploring fast growing stocks with high insider ownership for other potential ideas.

With shares still trading at a steep discount to some intrinsic value estimates despite recent gains, the key question is whether Transocean is genuinely undervalued or if the market is already pricing in its next leg of growth.

Most Popular Narrative Narrative: 4.7% Undervalued

With Transocean last closing at $3.97 versus a narrative fair value of about $4.17, the valuation gap is modest but still meaningful for patient investors.

Transocean's industry leading backlog (~$7 billion) with major E&P clients provides strong revenue visibility and cash flow stability, enabling efficient conversion of backlog into revenue and supporting rapid deleveraging, which will positively impact net debt levels and interest expense.

Curious how flat headline revenue can still justify a higher value? The real engine here is shifting margins, accelerating earnings and a surprisingly rich future multiple.

Result: Fair Value of $4.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, high leverage and persistent dayrate volatility mean weaker contract activity or softer oil prices could quickly puncture the recovery narrative.

Find out about the key risks to this Transocean narrative.

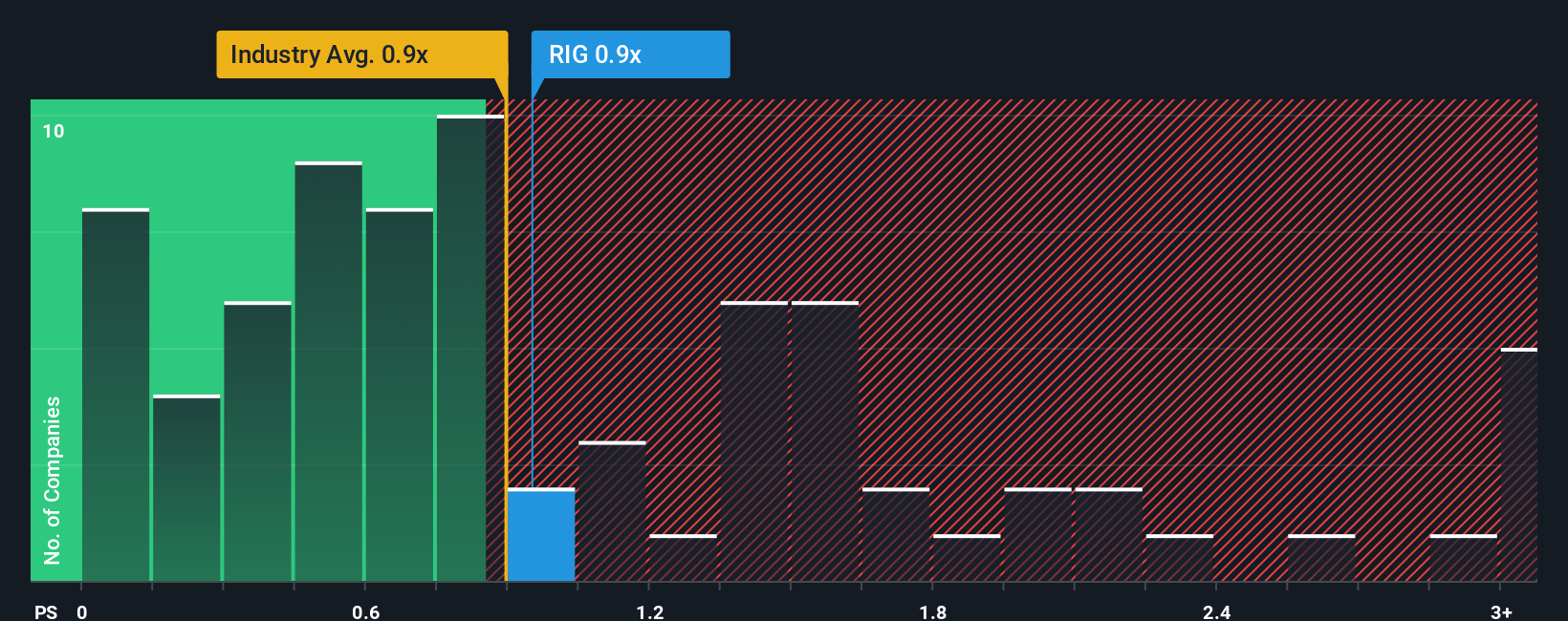

Another View: Market Ratios Flash Caution

While our fair value work suggests Transocean looks cheap overall, its price to sales ratio of 1.1 times is actually a bit rich compared with peers at about 1 times and a fair ratio of 1 times, hinting at less room for error if the recovery stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Transocean Narrative

If you see the story differently or simply prefer to dig into the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Transocean research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Ready to sharpen your edge beyond Transocean? Use the Simply Wall St Screener today so you are not the one hearing about the best ideas secondhand.

- Secure steadier portfolio income by targeting companies in these 13 dividend stocks with yields > 3% that offer attractive yields with the potential for sustainable payouts.

- Capture the next wave of market leaders by focusing on these 25 AI penny stocks positioned at the front line of artificial intelligence innovation.

- Turn market mispricing into opportunity by zeroing in on these 914 undervalued stocks based on cash flows that may trade below their cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Transocean might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RIG

Transocean

Provides offshore contract drilling services for oil and gas wells in Switzerland and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion