- United States

- /

- Oil and Gas

- /

- NYSE:REX

With EPS Growth And More, REX American Resources (NYSE:REX) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like REX American Resources (NYSE:REX), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for REX American Resources

How Fast Is REX American Resources Growing Its Earnings Per Share?

Over the last three years, REX American Resources has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. Thus, it makes sense to focus on more recent growth rates, instead. In impressive fashion, REX American Resources' EPS grew from US$1.58 to US$3.76, over the previous 12 months. Year on year growth of 138% is certainly a sight to behold.

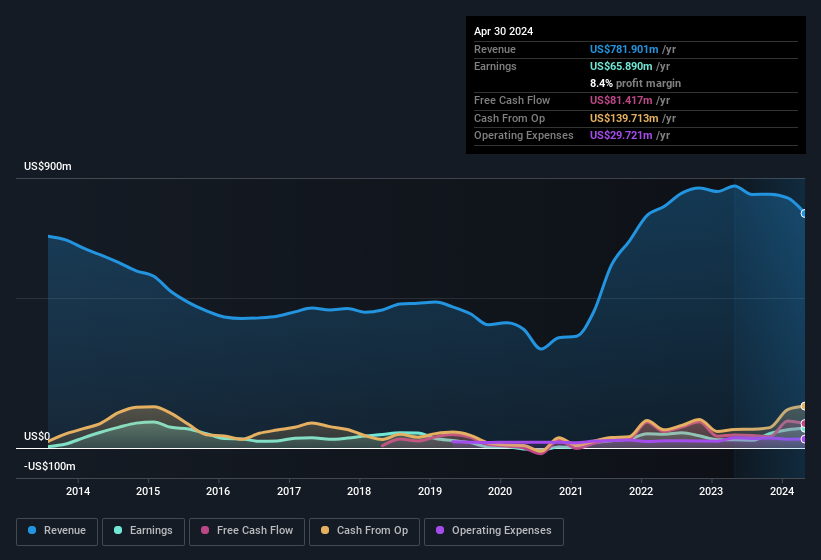

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Unfortunately, REX American Resources' revenue dropped 10% last year, but the silver lining is that EBIT margins improved from 2.7% to 9.3%. That's not a good look.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are REX American Resources Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. So it is good to see that REX American Resources insiders have a significant amount of capital invested in the stock. As a matter of fact, their holding is valued at US$45m. This considerable investment should help drive long-term value in the business. Despite being just 4.8% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Does REX American Resources Deserve A Spot On Your Watchlist?

REX American Resources' earnings per share have been soaring, with growth rates sky high. That EPS growth certainly is attention grabbing, and the large insider ownership only serves to further stoke our interest. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. Based on the sum of its parts, we definitely think its worth watching REX American Resources very closely. However, before you get too excited we've discovered 2 warning signs for REX American Resources that you should be aware of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in the US with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:REX

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.