- United States

- /

- Oil and Gas

- /

- NYSE:PSX

Phillips 66 (PSX) Valuation in Focus After Trade Secret Judgment Finalized in Propel Fuels Case

Reviewed by Simply Wall St

A California court just shut down Phillips 66’s efforts to overturn a massive trade secret judgment tied to its abandoned acquisition of Propel Fuels. The legal saga centers on the company’s launch of a competing renewable fuels business, with ongoing appeal risks still looming.

See our latest analysis for Phillips 66.

It’s been a year of notable volatility for Phillips 66. After a strong start, sentiment recently cooled as the long-running Propel Fuels case resolved in court. The company’s share price return for 2024 remains up nearly 17% year-to-date, but with a muted 1-year total shareholder return of just over 4%, the short-term loss of momentum stands in sharp contrast to its impressive 149% five-year total return.

If legal drama has you thinking about what else is driving standout performance, now’s the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading at a discount to analyst price targets despite strong long-term returns, investors are left to consider whether Phillips 66’s current valuation offers an attractive entry point or if the market is already looking ahead to future growth.

Most Popular Narrative: 50.2% Undervalued

Phillips 66’s narrative fair value comes in at $268.71, more than double its current share price of $133.72. According to mschoen25, the company’s strong positioning and anticipated margin recovery are drawing attention for a reason.

Industry Position: Phillips 66 is a major player in the energy sector, particularly in refining, marketing, and transportation. Analysts often look at the company’s ability to capitalize on operational efficiencies, asset optimization, and its integrated business model to improve profitability.

Curious what assumptions could justify such a huge gap between market and fair value? The key drivers include bold profit margin targets, steady revenue growth, and a forward profit multiple that turns heads. What’s the rationale behind these figures? You’ll want to see the numbers and strategic moves that power this bullish outlook.

Result: Fair Value of $268.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting oil prices and unexpected operational setbacks could quickly challenge the bullish case that supports Phillips 66’s current valuation narrative.

Find out about the key risks to this Phillips 66 narrative.

Another View: Multiples Raise Eyebrows

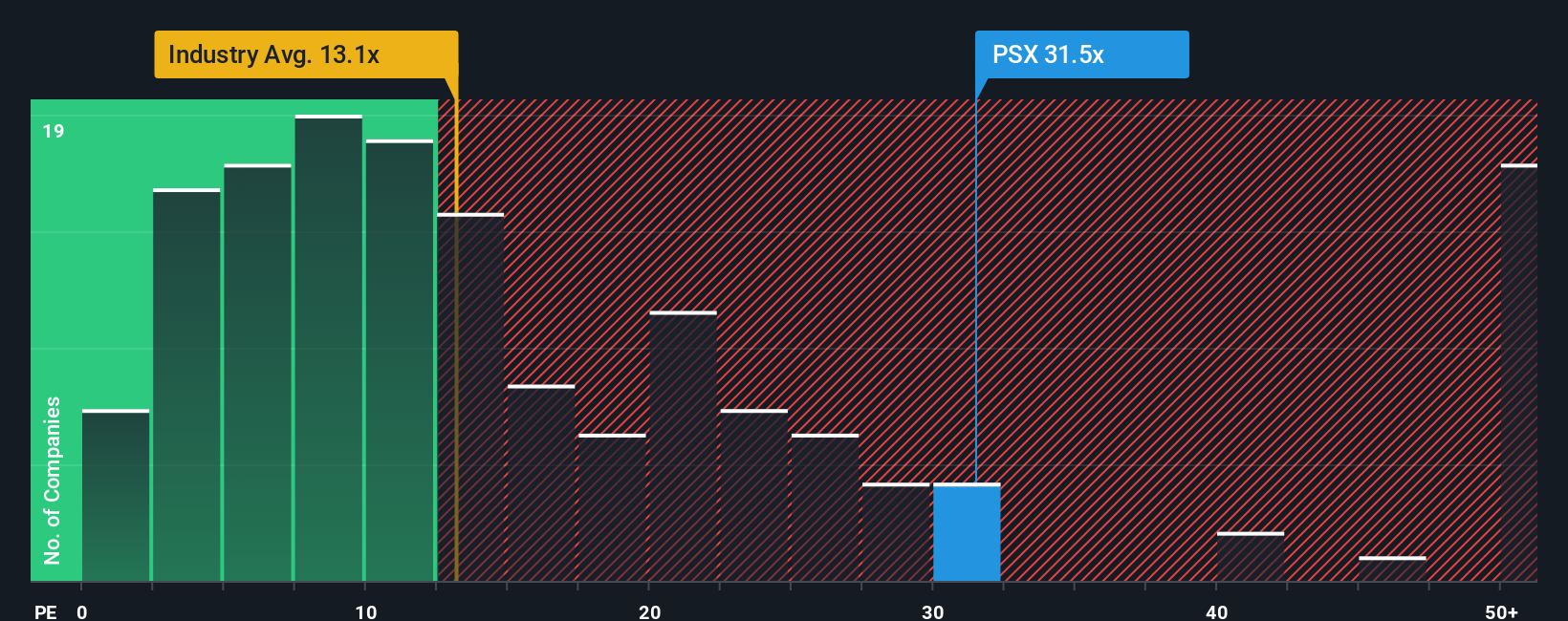

While the most popular narrative sees Phillips 66 as undervalued, a look at the price-to-earnings ratio tells a very different story. At 36 times earnings, the company appears expensive against both the industry average (13.1x) and its peers (24.8x), as well as the fair ratio of 24.6x. Such a wide gap highlights real valuation risk. Could the market reprice PSX closer to its sector?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Phillips 66 Narrative

If you want to dig deeper or have a different perspective, you can assemble your own view of Phillips 66's story in just a few minutes. Do it your way.

A great starting point for your Phillips 66 research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Great investments go beyond just one stock. Put yourself ahead of the crowd and check out these smart ideas to spot your next opportunity:

- Target strong, reliable streams by tapping into these 16 dividend stocks with yields > 3% which deliver yields above 3% and help build a solid foundation for your portfolio.

- Capitalize on next-generation innovation with these 26 AI penny stocks that are pushing the boundaries of artificial intelligence and transforming entire industries.

- Seize the potential for growth by browsing these 3598 penny stocks with strong financials featuring financially sound companies with room to grow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSX

Phillips 66

Operates as an energy manufacturing and logistics company in the United States, the United Kingdom, Germany, and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives