- United States

- /

- Oil and Gas

- /

- NYSE:PSX

Phillips 66 (PSX): Evaluating Valuation After Record Refinery Utilization and Sharper Focus on Shareholder Returns

Reviewed by Simply Wall St

Phillips 66 (NYSE:PSX) just hit its highest refining utilization since 2018, thanks to streamlined operations and a fresh acquisition in its refinery portfolio. The company has also recently accelerated share repurchases, highlighting shareholder returns.

See our latest analysis for Phillips 66.

Despite some choppy quarters, Phillips 66 has seen momentum pick up, with its 90-day share price return climbing 13.3% and a year-to-date price gain of 18.7%. Recent events such as its sizable share buyback, board updates, and sector outperformance have only fueled interest. Its 15.6% total shareholder return over the past year shows that investors who stuck around have been rewarded for their patience.

If strong sector momentum has your attention, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

So with valuation multiples approaching historical averages and momentum on its side, should investors see Phillips 66 as undervalued at current levels, or is the market already factoring in the company’s future growth prospects?Most Popular Narrative: 49.5% Undervalued

With Phillips 66 trading at $135.75 and the most-followed narrative setting a fair value near double that level, a sharp disconnect appears. This valuation draws attention to projected improvements in profitability and operational leverage, which sets the stage for a bold outlook.

Analysts often look at the company's ability to capitalize on operational efficiencies, asset optimization, and its integrated business model to improve profitability. When these factors stabilize or trend favorably, PSX might stand to benefit, thus being perceived as undervalued in volatile times.

What numbers unlock this aggressive upside? The narrative hints at a transformation driven by operational changes, new investments, and margin expansion. These changes are often not expected from a classic refiner. Only by diving deeper can you discover which financial forecasts underpin this premium target.

Result: Fair Value of $268.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, volatile oil prices and shifting regulatory landscapes could quickly undermine margin expansion. It is essential for investors to monitor these risks closely.

Find out about the key risks to this Phillips 66 narrative.

Another View: High Price Tag on Key Ratio

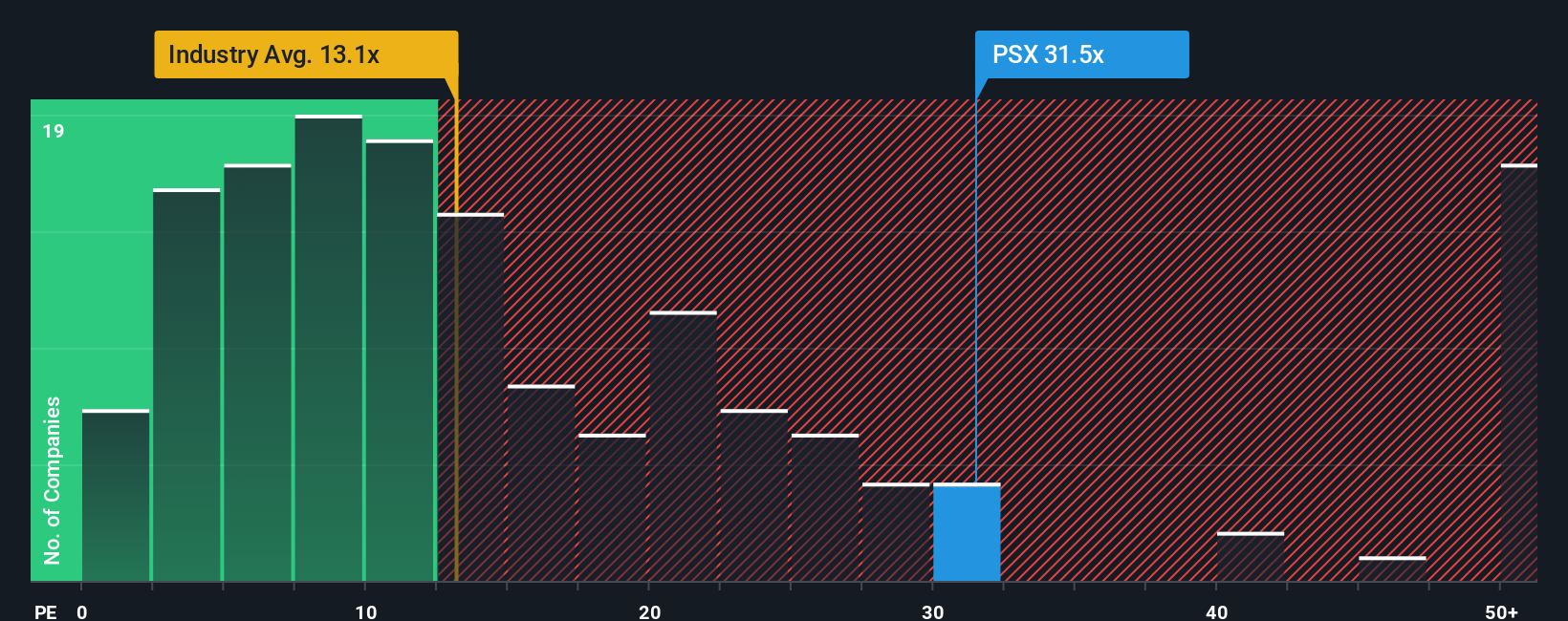

Looking through a different lens, Phillips 66 shares currently trade at a price-to-earnings ratio of 36.5 times. This is far above the US Oil and Gas industry average of 12.8 times, the peer average of 27.9 times, and an estimated fair ratio of 32.6 times. This hefty premium could signal that the market is pricing in much stronger growth or simply getting ahead of itself. Does this mean investors should tread carefully, or is the market on to something others have missed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Phillips 66 Narrative

If you have a different view or want to see what the data says for yourself, building your own perspective takes just a few minutes. Do it your way

A great starting point for your Phillips 66 research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Your next breakthrough investment could be just a click away. Do not let this opportunity pass you by. See which stocks excite the smartest investors right now.

- Compete with the pros by targeting high-potential opportunities featuring these 3604 penny stocks with strong financials that combine strong financials with breakout growth.

- Fuel your portfolio with powerful tailwinds from the latest trends, including these 27 AI penny stocks powering tomorrow’s innovations in artificial intelligence.

- Maximize value in your search by finding these 843 undervalued stocks based on cash flows that the market has overlooked, putting you ahead of the curve before others catch on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSX

Phillips 66

Operates as an energy manufacturing and logistics company in the United States, the United Kingdom, Germany, and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives