- United States

- /

- Oil and Gas

- /

- NYSE:PSX

Is Phillips 66 a Bargain After 19% Price Gain and Renewable Fuel Investments?

Reviewed by Bailey Pemberton

- Wondering if Phillips 66 is trading for a bargain or a premium? You're not alone. It's a question every investor should be asking before taking the plunge.

- The stock has been on a steady climb, with a 19.0% gain so far this year and a total return of 257.0% over the past 5 years. This reflects both strong long-term growth and sustained market interest.

- Recent headlines have highlighted Phillips 66's strategic moves in the energy sector, such as investments in renewable fuels and infrastructure upgrades. These developments are keeping the company in the spotlight and help explain its recent share price resilience.

- Looking at classic valuation metrics, Phillips 66 earns a value score of 2 out of 6, meaning it's undervalued in 2 checks. Next, we will explore what those numbers mean and introduce a perspective on valuation that could change the way you view the stock by the end of this article.

Phillips 66 scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Phillips 66 Discounted Cash Flow (DCF) Analysis

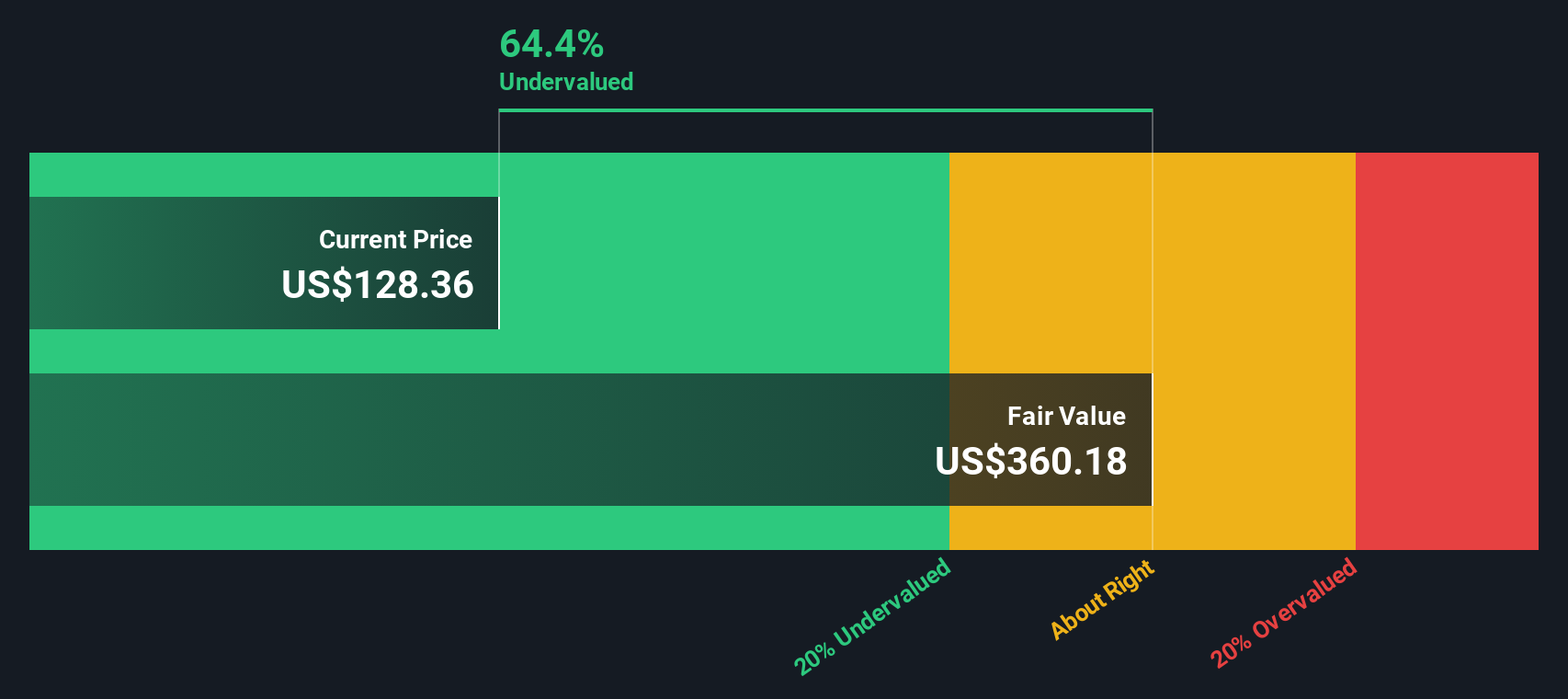

A Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and discounting them back to today using a risk-adjusted rate. This gives investors a sense of what the business is truly worth based on its future earning power, rather than just its current earnings or assets.

For Phillips 66, the current Free Cash Flow stands at $1.48 Billion. Analysts project that Free Cash Flow will grow significantly in the coming years, reaching approximately $7.08 Billion by 2029. While analysts provide cash flow forecasts for up to five years, further growth beyond that is extrapolated using Simply Wall St's methods. These projections rely on a 2 Stage Free Cash Flow to Equity model to reflect both near-term forecasts and longer-term growth estimates.

Based on these cash flow projections, the DCF model calculates an intrinsic fair value of $356.14 per share. Compared to the current share price, the analysis suggests the stock is trading at a 61.8% discount to its intrinsic value, which indicates that Phillips 66 may be significantly undervalued at current levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Phillips 66 is undervalued by 61.8%. Track this in your watchlist or portfolio, or discover 839 more undervalued stocks based on cash flows.

Approach 2: Phillips 66 Price vs Earnings

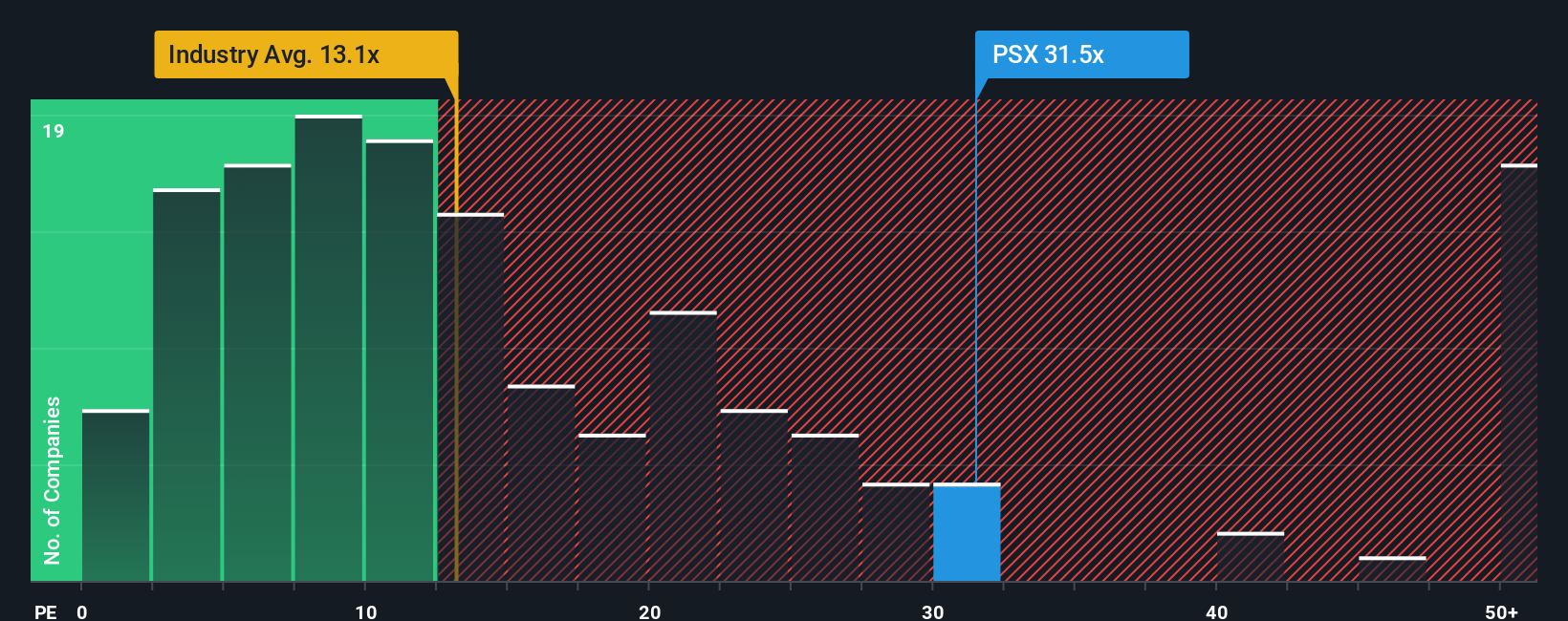

The Price-to-Earnings (PE) ratio is widely used to value profitable companies because it measures what investors are willing to pay today for a dollar of future earnings. For established businesses like Phillips 66, the PE ratio offers a quick glance at how the market views the stock’s long-term earnings potential.

Growth prospects and risk appetite play an important role in deciding what is a "normal" or "fair" PE ratio for a company. Faster growing firms, or those perceived as lower risk, tend to command higher PE ratios. Slower growers or riskier businesses often trade at lower PE multiples.

At the moment, Phillips 66 trades at a PE ratio of 36.64x. When compared to the Oil and Gas industry average of 12.88x and its peer group average of 27.38x, the stock appears to be more expensive on simple surface-level comparisons.

However, Simply Wall St’s proprietary "Fair Ratio" for Phillips 66 is 23.15x. This Fair Ratio is a more nuanced benchmark that takes into account not just the company’s earnings growth, but also its profit margins, industry trends, market cap, and underlying risks. It serves as a better yardstick than simply comparing to industry or peer averages, which often overlook important company-specific factors.

Comparing the current PE ratio (36.64x) to its Fair Ratio (23.15x) suggests the stock is overvalued based on earnings multiples.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Phillips 66 Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, intuitive way to capture your perspective on a company by linking its story — why you believe it will succeed or struggle — to your own assumptions about its future revenue, profit margins, and fair value.

Narratives connect the dots between the company's business drivers and a financial forecast, turning your view of Phillips 66 into an actionable estimate of what the stock is actually worth. On Simply Wall St’s platform, millions of investors build and share these Narratives right within the Community page, making it easy and accessible for anyone to start, update, or compare viewpoints.

By creating a Narrative, you see instantly whether, based on your assumptions, Phillips 66 is a buy or a sell, comparing your calculated Fair Value to the current market price to help make informed decisions. In addition, Narratives stay dynamic and up to date, automatically adjusting as new information such as news, earnings, or analyst changes becomes available.

For example, one investor focused on margin expansion and steady growth calculates a fair value for Phillips 66 at $268.71, while another, more cautious about revenue declines and profit risks, arrives at $145.20. This shows how your outlook can directly guide your investment choices.

Do you think there's more to the story for Phillips 66? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSX

Phillips 66

Operates as an energy manufacturing and logistics company in the United States, the United Kingdom, Germany, and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives