- United States

- /

- Oil and Gas

- /

- NYSE:PR

Will Permian Resources' (PR) New Market Access Reshape Its Long-Term Value Proposition?

Reviewed by Sasha Jovanovic

- In the past month, Permian Resources announced enhancements to its transportation and marketing agreements, increasing access to key Gulf Coast and non-Waha hubs and positioning the company to secure premium pricing for crude and natural gas.

- This operational shift is expected to uplift the company’s revenues and free cash flow, directly addressing ongoing investor concerns around growth expectations and risk.

- We'll explore how greater access to premium markets under these new agreements could influence Permian Resources’ broader investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Permian Resources Investment Narrative Recap

To be confident in Permian Resources as a shareholder, you need to believe that its access to premium Gulf Coast markets and ability to secure higher prices for its output will directly support free cash flow growth even during volatile commodity cycles. The recent expansion of transportation and marketing agreements potentially accelerates this catalyst by improving near-term revenue visibility, but ongoing risks tied to commodity price swings remain material and should not be overlooked.

The follow-on equity offering completed in September 2025, raising over US$623 million, is especially relevant against the backdrop of these new agreements. This capital influx provides Permian Resources with added financial flexibility to fund development and offset risks that come with maintaining production or pursuing future acquisitions. Yet, even with improved market access and a strengthened balance sheet, there remains the real possibility that...

Read the full narrative on Permian Resources (it's free!)

Permian Resources’ narrative projects $6.1 billion in revenue and $1.4 billion in earnings by 2028. This requires 6.1% yearly revenue growth and a $0.3 billion earnings increase from current earnings of $1.1 billion.

Uncover how Permian Resources' forecasts yield a $18.55 fair value, a 47% upside to its current price.

Exploring Other Perspectives

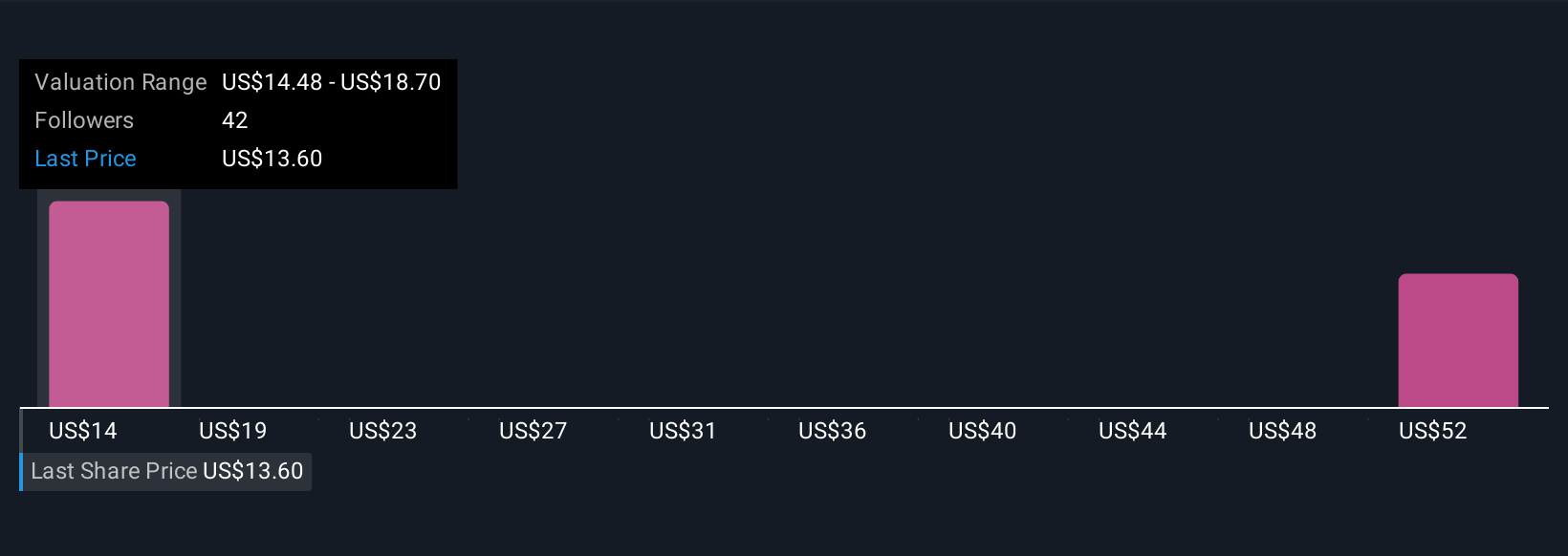

Five fair value estimates from the Simply Wall St Community span from US$11.70 to US$56.81 per share, reflecting wide-ranging views on Permian Resources’ future. With transportation and marketing catalysts in play, these numbers highlight how outcomes tied to commodity prices can shape the company’s performance outlook, so explore several perspectives before forming your own view.

Explore 5 other fair value estimates on Permian Resources - why the stock might be worth over 4x more than the current price!

Build Your Own Permian Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Permian Resources research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Permian Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Permian Resources' overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PR

Permian Resources

An independent oil and natural gas company, focuses on the development of crude oil and associated liquids-rich natural gas reserves in the United States.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives