- United States

- /

- Oil and Gas

- /

- NYSE:PR

How Investors Are Reacting To Permian Resources (PR) Fresh Wave of Bullish Analyst Reaffirmations

Reviewed by Sasha Jovanovic

- In recent days, multiple Wall Street firms, including UBS and Mizuho, reiterated positive ratings on Permian Resources and adjusted their research views, signaling confidence in the company’s outlook within the oil and gas sector.

- This cluster of upbeat analyst opinions, paired with an overall "Outperform" consensus, underscores how professional sentiment can influence investor perception and trading activity.

- Now, we'll explore how this wave of reaffirmed positive analyst sentiment interacts with Permian Resources' existing investment narrative and outlook.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Permian Resources Investment Narrative Recap

To own Permian Resources, you need to believe in its ability to convert its Permian Basin scale, efficiency and infrastructure access into resilient free cash flow despite commodity price uncertainty and ongoing drilling needs. The recent wave of reaffirmed positive analyst ratings, including higher price targets, reinforces confidence but does not materially change the near term balance between the key catalyst of realizing better pricing from transportation agreements and the core risk of oil and gas price volatility.

Among recent updates, the 2025 production guidance increase, driven by stronger well results, connects directly to the bullish analyst stance by highlighting the company’s capacity to grow volumes within its existing asset base. If that higher production can be paired with premium pricing through optimized marketing and transport agreements, it may be supportive for sustaining free cash flow, although this remains heavily exposed to swings in underlying commodity prices.

Yet while analyst sentiment is constructive, investors still need to weigh how vulnerable those higher production volumes remain to...

Read the full narrative on Permian Resources (it's free!)

Permian Resources’ narrative projects $6.1 billion revenue and $1.4 billion earnings by 2028.

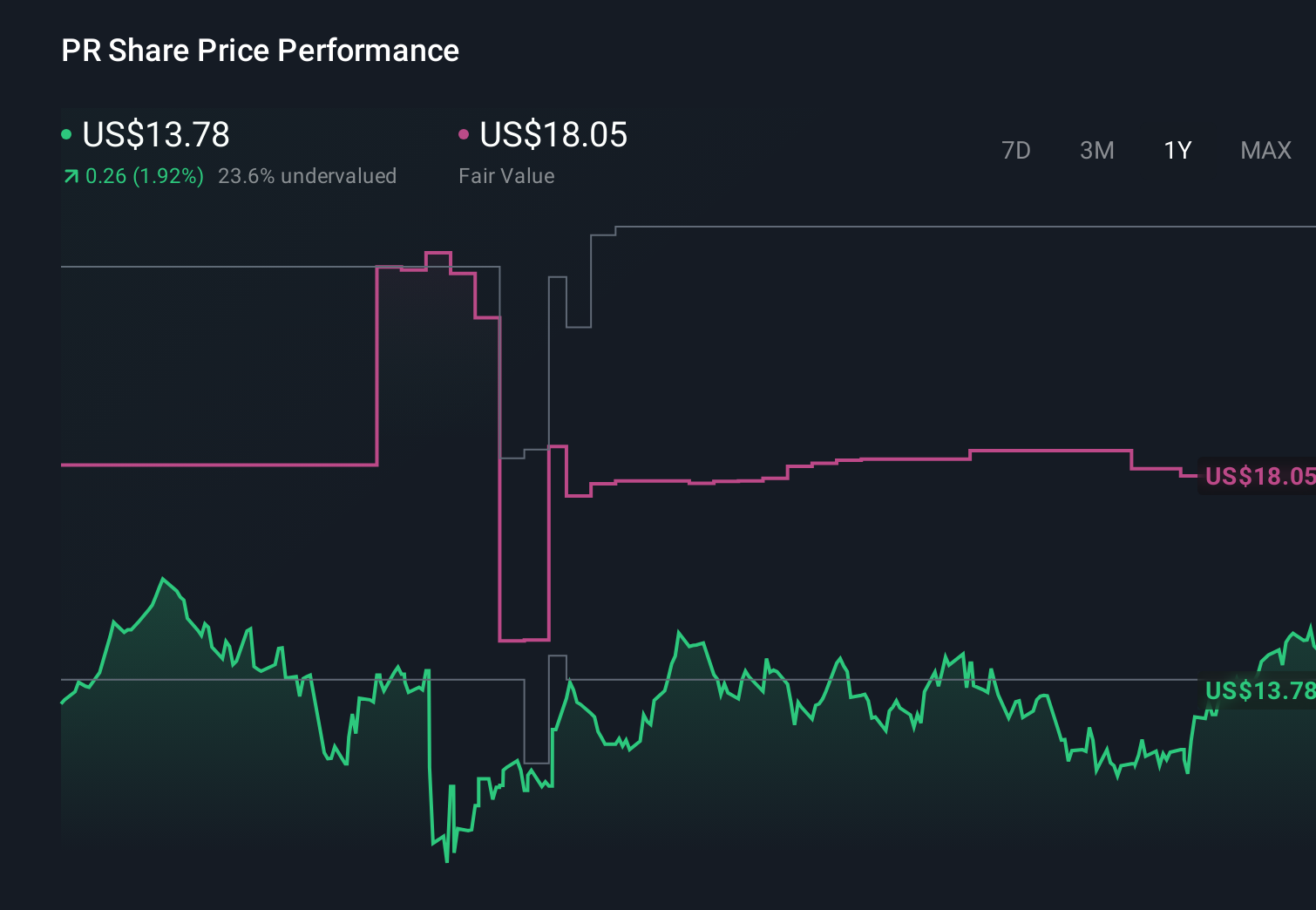

Uncover how Permian Resources' forecasts yield a $18.05 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community range widely, from about US$14.48 to US$66.94 per share, underscoring how differently individual investors view Permian Resources. Set against this, the recent cluster of bullish analyst ratings highlights how professional and retail perspectives can diverge, especially when commodity price uncertainty still looms large for the company’s future performance.

Explore 4 other fair value estimates on Permian Resources - why the stock might be worth just $14.48!

Build Your Own Permian Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Permian Resources research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Permian Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Permian Resources' overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PR

Permian Resources

An independent oil and natural gas company, focuses on the development of crude oil and associated liquids-rich natural gas reserves in the United States.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)