- United States

- /

- Oil and Gas

- /

- NYSE:PR

Has Permian Resources Been Left Behind After Latest Price Drop in 2025?

Reviewed by Bailey Pemberton

So, you have your eye on Permian Resources and you are trying to figure out whether this energy stock is primed for a comeback or is flashing a warning light. After all, it is not every day you see a company down nearly 10% over the past week, off more than 14% in the last month, and still nursing a loss of almost 17% for the year to date. If that pain feels fresh, you are not alone. Plenty of investors are watching these recent dips and wondering if the market is just being cautious or missing something valuable under the surface.

Here is the twist that makes things really interesting. Despite the past year's nearly 10% decline, zoom out further and Permian Resources is still up an eye-popping 1,860% over the past five years. Growth like that does not happen by accident. It is clear that long-term investors have been rewarded for sticking with the company. Recent volatility has come with broader market shifts in the energy sector and ongoing changes in risk appetite, but those big returns prove this is not just another one-hit wonder.

How can a stock with such swings be assessed as undervalued? Permian Resources passes all six core valuation checks for undervaluation, earning a perfect valuation score of 6. We are going to break down what those checks actually mean, and just how they point to opportunity, but stick around because there is an even deeper way to understand valuation that might shift your thinking before you make your next move.

Why Permian Resources is lagging behind its peers

Approach 1: Permian Resources Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth today based on its future projected cash flows, which are then discounted back to the present value. Essentially, this approach values Permian Resources by forecasting the money it will generate and adjusting for time and risk.

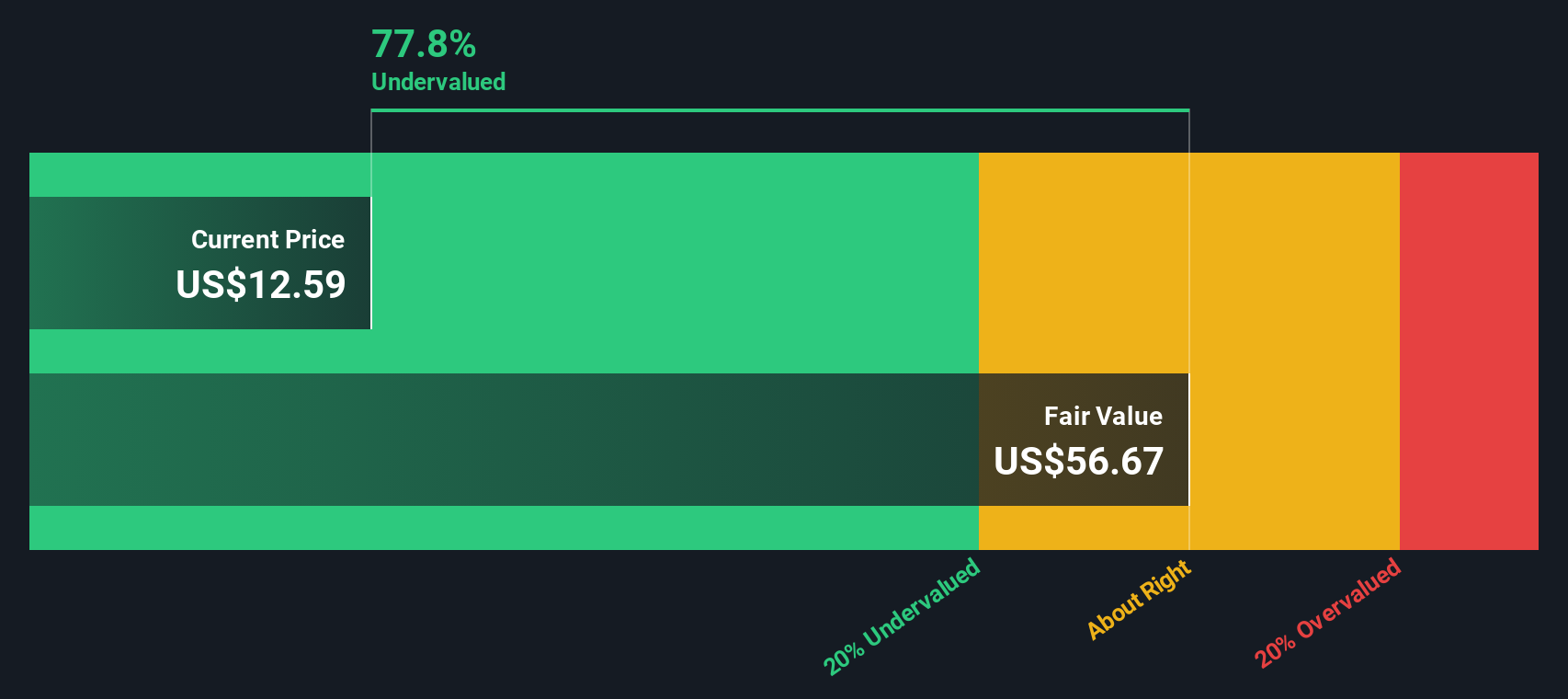

Permian Resources generated $742.7 million in free cash flow over the last twelve months. Analysts predict robust growth, with annual free cash flow expected to rise to approximately $2.04 billion by 2029. These projections are based on analyst estimates for the first five years, with further long-term growth forecasted by Simply Wall St using industry-appropriate assumptions. All cash flows are calculated in US dollars.

Based on this model, the estimated intrinsic value per share for Permian Resources stands at $56.93. This suggests the stock may be trading at a significant discount. The DCF valuation implies it is 78.3% undervalued compared to its current market price.

For investors, this signals that Permian Resources could offer considerable value, especially for those with a long-term horizon.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Permian Resources is undervalued by 78.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Permian Resources Price vs Earnings

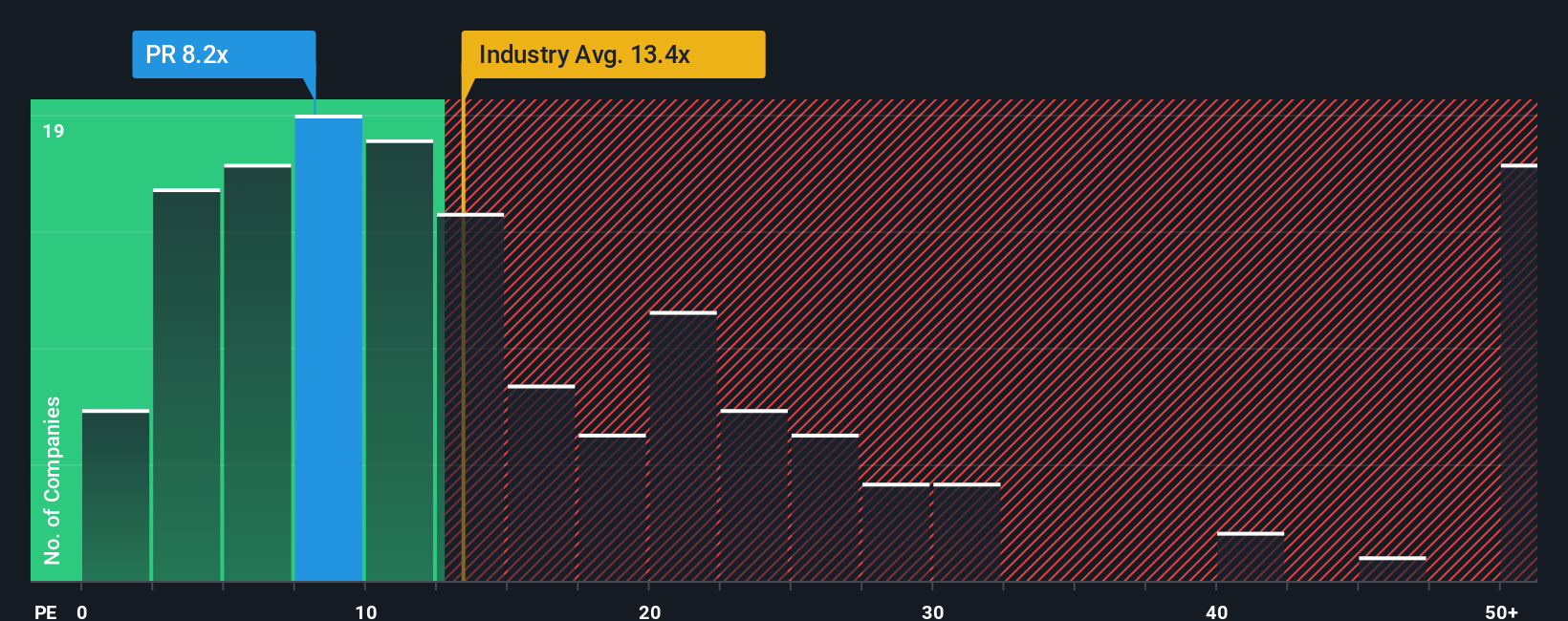

The price-to-earnings (PE) ratio is the preferred valuation metric for profitable companies like Permian Resources because it directly measures how much investors are willing to pay for each dollar of earnings. This makes the PE ratio especially useful for comparing companies that are actually delivering profits, rather than just growing revenues or assets.

What counts as a "normal" or "fair" PE ratio depends on expectations for future growth and perceptions of risk. Companies expected to grow faster or with more stable earnings typically trade at higher PE ratios, while those with less certainty or more risk often see a lower multiple.

Permian Resources currently trades at a PE ratio of 8.03x. For context, this is well below both the Oil and Gas industry average of 13.13x and the average for its peers, which sits at 15.81x. This initial comparison suggests a potential undervaluation, but context matters.

This is where Simply Wall St's "Fair Ratio" comes in. The Fair Ratio is a proprietary measure that considers a wide range of factors including the company’s forecast earnings growth, profit margins, risk profile, market capitalization, and the broader industry backdrop. Unlike simple industry or peer comparisons, the Fair Ratio tells you what multiple is actually deserved given all relevant circumstances.

Permian Resources' Fair Ratio is 16.22x, which is more than double its current PE of 8.03x. This significant gap is a strong signal that the market may be significantly undervaluing Permian Resources based on earnings fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Permian Resources Narrative

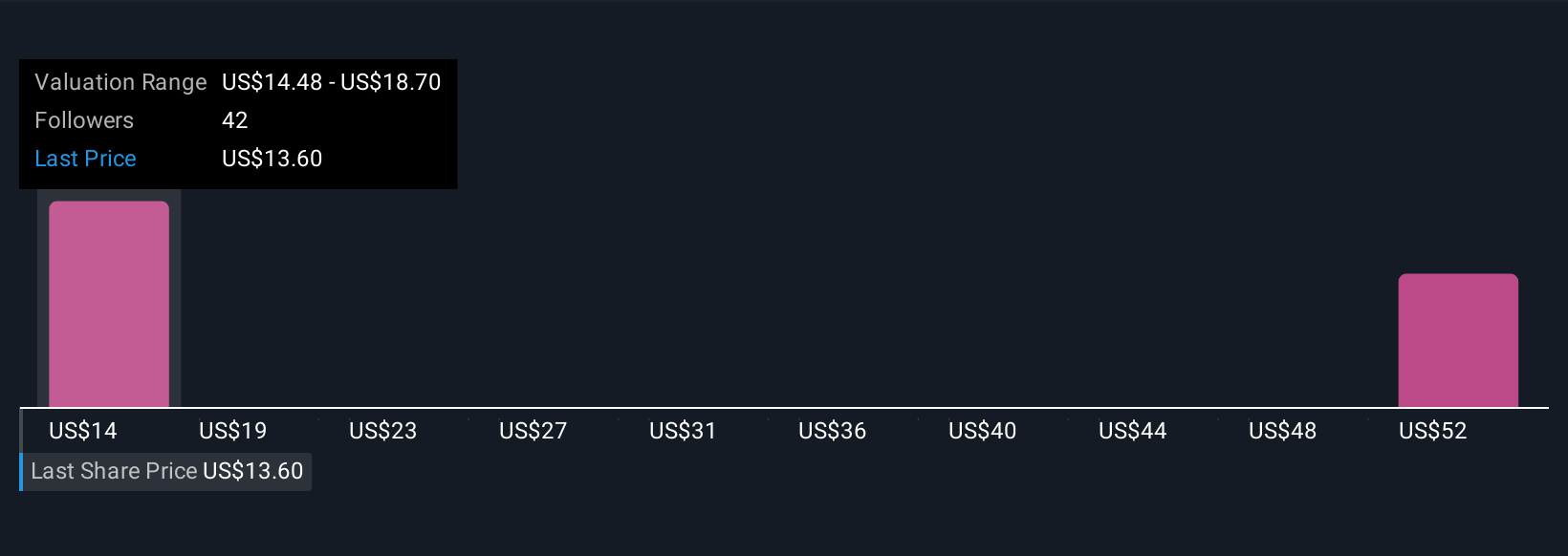

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story or perspective about a company that goes beyond simple numbers, allowing you to combine your assumptions about Permian Resources' future (such as revenue, earnings, and profit margins) with your estimate of its fair value.

Narratives link a company's story to a financial forecast and then to a fair value, empowering you to see exactly why you or others might view the stock as undervalued or overvalued. On Simply Wall St’s platform, Narratives are easy to create and available on the Community page, where millions of investors share and compare their views.

With Narratives, you can decide whether to buy, sell, or hold by weighing your own Fair Value against the current Price. Because new news or earnings updates instantly refresh each Narrative, your analysis is always current. For example, some investors believe new Gulf Coast agreements and regulatory shifts will unlock future earnings and set a fair value as high as $22 for Permian Resources, while others foresee challenges and set their fair value closer to $14. That range reflects the power of Narratives, allowing you to tailor your investment decision to your own thesis, supported by transparent forecasts and up-to-date insights.

Do you think there's more to the story for Permian Resources? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PR

Permian Resources

An independent oil and natural gas company, focuses on the development of crude oil and associated liquids-rich natural gas reserves in the United States.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives