- United States

- /

- Oil and Gas

- /

- NYSE:PBF

PBF Energy (PBF): Evaluating Valuation as Investors Eye AI-Driven Demand Before Q3 Earnings

Reviewed by Simply Wall St

PBF Energy (PBF) saw a surge in its stock price as investors moved quickly ahead of the company’s third quarter earnings report. The excitement centers on PBF’s exposure to growing energy demand, mainly from US data center expansion related to artificial intelligence.

See our latest analysis for PBF Energy.

This week’s rally adds to what has been a year of energetic momentum for PBF, with a 90-day share price return near 40 percent and a year-to-date gain of 26 percent. Longer-term total shareholder returns remain remarkable. Brief refinery hiccups and muted analyst moves have not slowed interest, as investors appear focused on PBF’s leverage to structural energy demand shifts.

If the excitement around AI-driven energy needs has you searching for additional opportunities, it is a great moment to broaden your scope and discover fast growing stocks with high insider ownership

With PBF shares soaring and optimism running high, investors now face a key question: is the current price a bargain that underestimates future growth, or has the recent rally already priced in all the upside?

Most Popular Narrative: 26% Overvalued

PBF Energy’s most widely followed narrative puts its fair value at $26.75, significantly below the recent closing price of $33.81. This signals that the stock’s latest surge may already reflect overly optimistic growth expectations, raising important questions about future upside.

Company-wide cost reduction and business improvement initiatives (RBI) are on track to deliver $230 million of annualized savings by end-2025 and $350 million by end-2026, mainly through lower OpEx and CapEx. These are expected to sustainably improve net margins and free cash flow over the next several years.

Curious about how ambitious cost cuts and margin improvements shape this valuation call? The real story lies in how future profitability, revenue progression, and margin shifts intersect. Wondering what else could justify or challenge the fair value? The full narrative unpacks every compelling detail.

Result: Fair Value of $26.75 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing regulatory pressures and volatile fuel demand could quickly change the outlook and challenge key narrative assumptions for PBF in coming quarters.

Find out about the key risks to this PBF Energy narrative.

Another View: Attractive Value Story

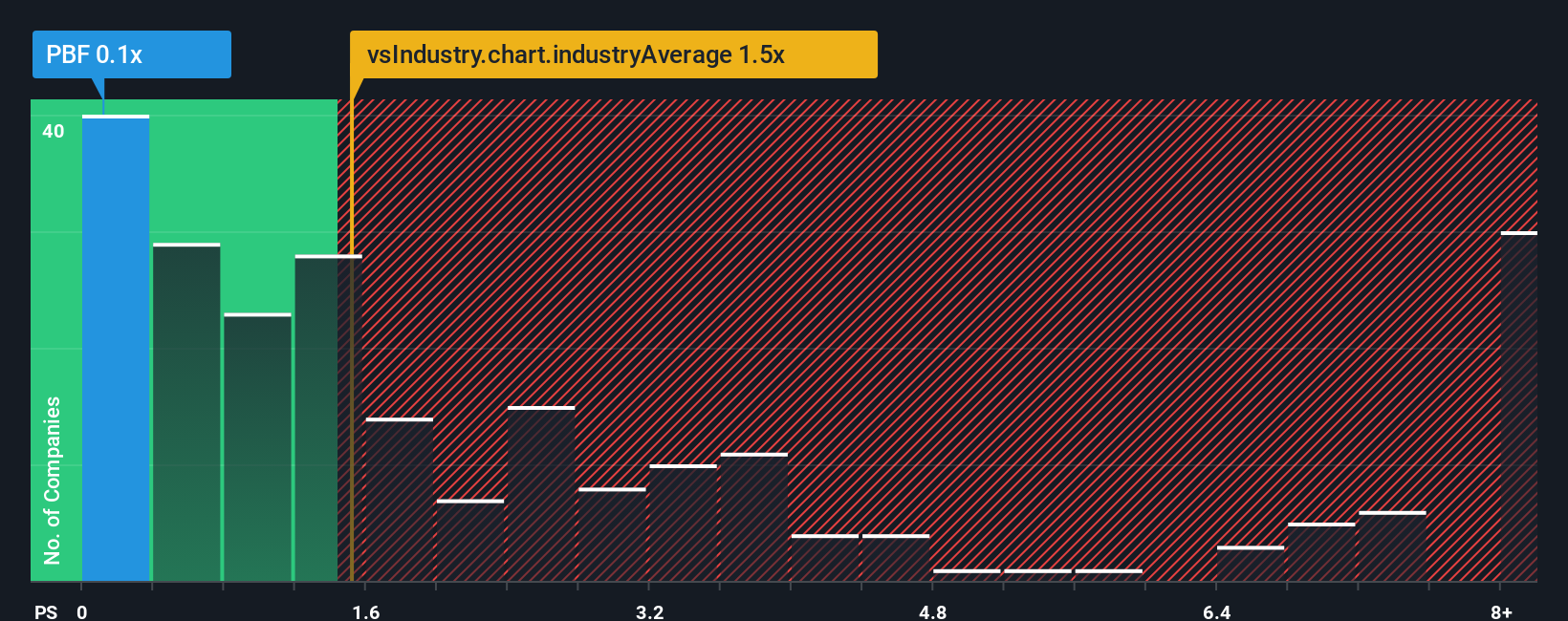

While many see PBF as overvalued compared to fair value estimates, a look at its price-to-sales ratio presents a different perspective. The company is trading at just 0.1x revenue, which is significantly lower than both the US oil and gas industry average of 1.5x and the peer average of 0.3x. This also compares favorably to its own fair ratio of 0.5x. Such a deep discount suggests investors might be overlooking a potential value opportunity. Is this too good to be true, or a risk worth taking?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PBF Energy Narrative

If these perspectives do not match your own, you can dive into the data, challenge the findings, and quickly build your own view in just a few minutes. Do it your way

A great starting point for your PBF Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more exceptional investment ideas?

Smart investors know that chasing just one stock rarely pays off long term. Don’t miss out on the market’s next big winners by capitalizing on forward-thinking trends with targeted strategies right now.

- Secure reliable income streams when you tap into these 17 dividend stocks with yields > 3%, featuring companies with robust yields above 3% that can power up your portfolio.

- Unlock growth potential and gain an edge by reviewing these 27 AI penny stocks, where emerging AI opportunities are transforming entire industries.

- Get ahead of Wall Street by spotting tomorrow’s market favorites among these 877 undervalued stocks based on cash flows, designed to showcase strong businesses priced for opportunity.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PBF

PBF Energy

Through its subsidiaries, engages in refining and supplying petroleum products.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives