- United States

- /

- Oil and Gas

- /

- NYSE:PARR

Here's Why We Think Par Pacific Holdings (NYSE:PARR) Might Deserve Your Attention Today

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Par Pacific Holdings (NYSE:PARR). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for Par Pacific Holdings

How Fast Is Par Pacific Holdings Growing Its Earnings Per Share?

In the last three years Par Pacific Holdings' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. Impressively, Par Pacific Holdings' EPS catapulted from US$4.83 to US$8.66, over the last year. Year on year growth of 80% is certainly a sight to behold.

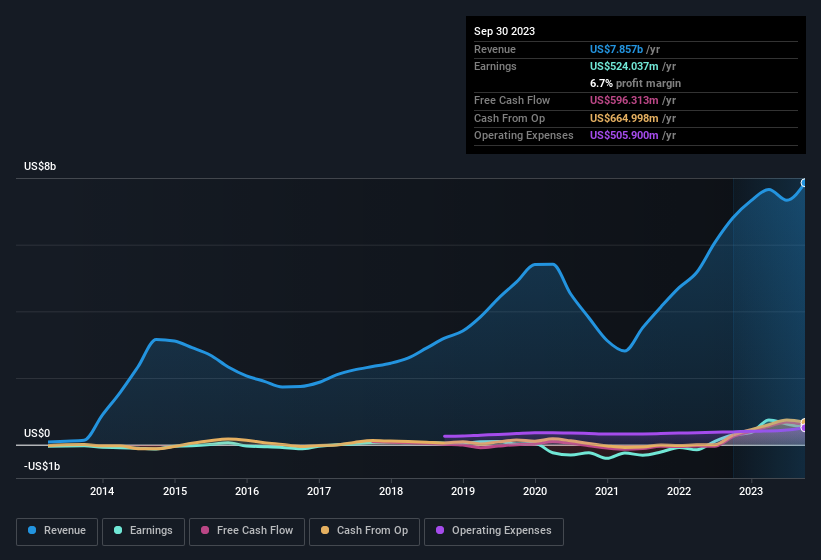

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of Par Pacific Holdings shareholders is that EBIT margins have grown from 5.3% to 7.9% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Par Pacific Holdings' forecast profits?

Are Par Pacific Holdings Insiders Aligned With All Shareholders?

It's pleasing to see company leaders with putting their money on the line, so to speak, because it increases alignment of incentives between the people running the business, and its true owners. Shareholders will be pleased by the fact that insiders own Par Pacific Holdings shares worth a considerable sum. With a whopping US$56m worth of shares as a group, insiders have plenty riding on the company's success. This should keep them focused on creating long term value for shareholders.

Should You Add Par Pacific Holdings To Your Watchlist?

Par Pacific Holdings' earnings per share growth have been climbing higher at an appreciable rate. This level of EPS growth does wonders for attracting investment, and the large insider investment in the company is just the cherry on top. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So at the surface level, Par Pacific Holdings is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. You still need to take note of risks, for example - Par Pacific Holdings has 1 warning sign we think you should be aware of.

Although Par Pacific Holdings certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:PARR

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives