- United States

- /

- Oil and Gas

- /

- NYSE:PARR

Does Par Pacific Holdings’ Expansion Justify Its 168% Stock Surge in 2025?

Reviewed by Bailey Pemberton

- Curious if Par Pacific Holdings is a hidden value gem or if it might be running ahead of its fundamentals? Let's break down where the stock stands.

- It's been quite a ride for shareholders, with the stock jumping 9.5% in the past month and soaring an impressive 168.1% year-to-date.

- Much of this momentum has been spurred by Par Pacific Holdings' recent acquisition activity and ongoing expansion into new markets, which have captured attention across the energy sector. Market watchers are also noting regulatory updates affecting the oil and refining industry that could influence future margins.

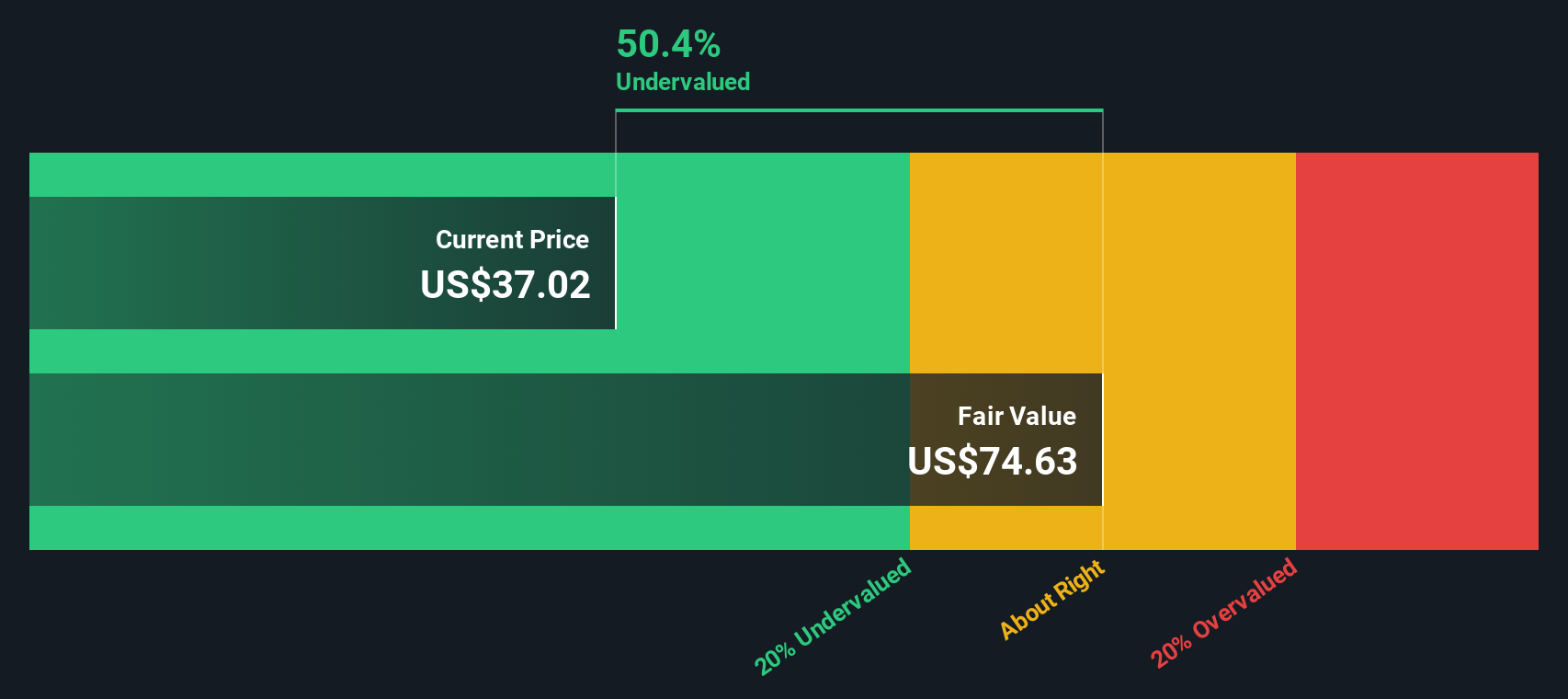

- On the valuation front, Par Pacific Holdings scores 4 out of 6 on our undervaluation checks, indicating it is attractive on several measures but not across the board. Next, we will look at the key ways analysts assess valuation, followed by a more holistic approach you may not have considered yet.

Approach 1: Par Pacific Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a method that estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. This approach relies on assumptions about how much cash Par Pacific Holdings will generate and what those future funds are worth in current terms. It provides an objective way to determine if the stock price is justified.

Par Pacific Holdings currently reports Free Cash Flow (FCF) of $224 million. Looking at analyst estimates and extrapolated projections, FCF is expected to reach around $146.9 million by 2028 and nearly $145.9 million by 2035. The intermediate years show a gradual decline before stabilizing. Notably, these longer-term figures rely on extrapolations rather than direct analyst estimates, reflecting the inherent uncertainty in forecasting beyond five years.

Using the DCF model based on these cash flow estimates, the intrinsic value of Par Pacific Holdings is calculated at $59.24 per share. This suggests the stock trades at a 24.5 percent discount to its estimated fair value, indicating that it is currently undervalued according to DCF analysis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Par Pacific Holdings is undervalued by 24.5%. Track this in your watchlist or portfolio, or discover 926 more undervalued stocks based on cash flows.

Approach 2: Par Pacific Holdings Price vs Earnings (PE)

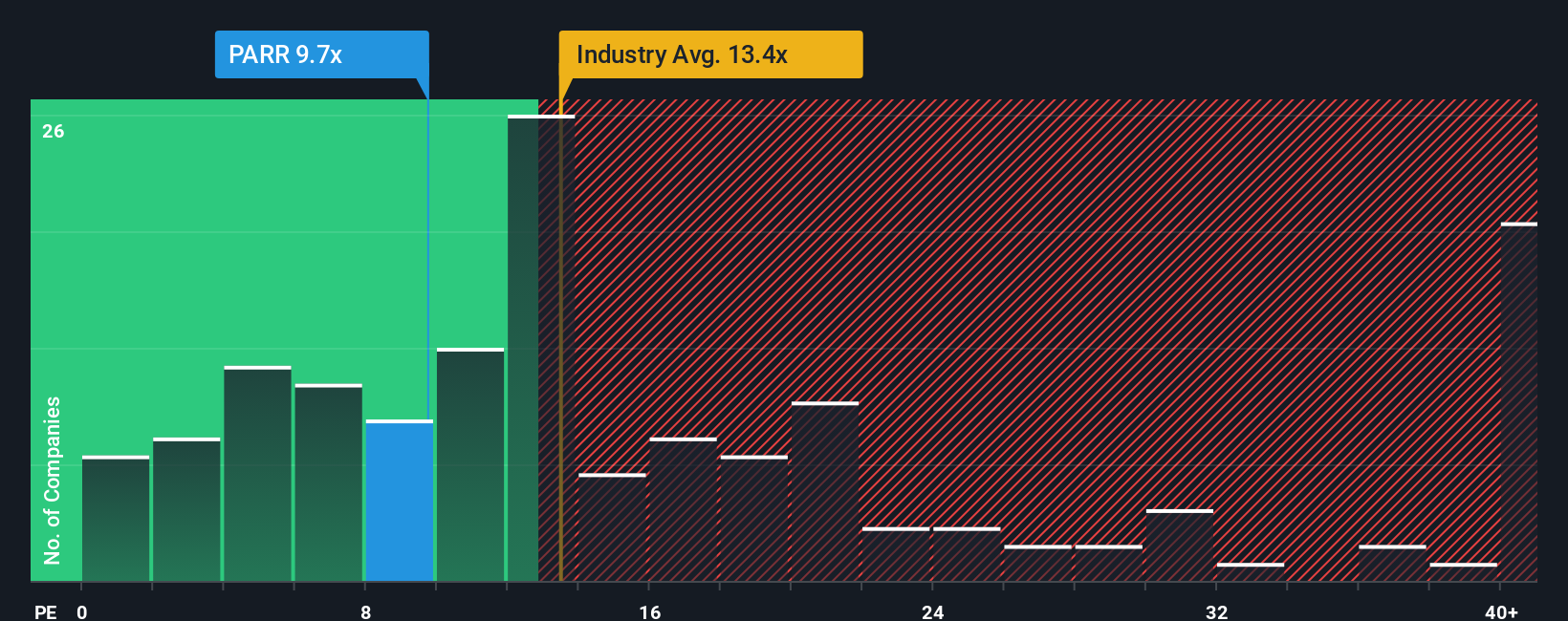

The Price-to-Earnings (PE) ratio is often the go-to valuation metric for profitable companies because it directly connects a company's share price to its earnings. For investors, PE is a quick way to gauge whether a stock is expensive or cheap relative to the profits it generates.

Growth expectations and risk play a key role in shaping what qualifies as a "normal" or "fair" PE ratio. Companies with stronger earnings growth, higher profit margins, or lower risk profiles often command higher PE ratios. More volatile or slower-growing businesses typically trade at a discount.

Currently, Par Pacific Holdings trades on a PE ratio of 9.5x. This is noticeably below the oil and gas industry average of 13.3x and far below the peer average of 23.2x. At a glance, this might suggest Par Pacific Holdings is undervalued compared to its sector and direct competitors.

However, a more nuanced picture emerges when we introduce the "Fair Ratio." Developed by Simply Wall St, the Fair Ratio represents a PE you would expect for the company based on its earnings growth, risk, profit margin, industry dynamics, and market capitalization. This proprietary measure is more comprehensive than simple industry or peer comparisons because it customizes expectations for Par Pacific’s unique business profile.

For Par Pacific Holdings, the Fair Ratio is estimated at 8.4x. Since its current PE of 9.5x is just slightly above this, and with less than a 0.10 absolute difference, shares appear to be trading at a level that is just about right for its current fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1434 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Par Pacific Holdings Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your own story, your perspective about a company’s future, built around your assumptions for its business drivers, such as revenue, earnings, and margins.

With Narratives, you connect the dots between why you believe a company will perform a certain way, what that means for its financial forecast, and how that translates to a Fair Value. This makes your investment view more tangible and evidence-based. Narratives are available on Simply Wall St's Community page and are used by millions of investors to see all views in one place. They are easy to create and update, even as new earnings or news are released.

This approach empowers you to confidently decide whether to buy or sell by comparing your Fair Value to the current Price and lets you adjust your view as circumstances change. For example, with Par Pacific Holdings, one investor might emphasize the growth in renewable projects and raise their Fair Value to $44 per share, while another might worry about regulatory risks or profit margin pressure and set their Fair Value as low as $23 per share.

Do you think there's more to the story for Par Pacific Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PARR

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success