- United States

- /

- Oil and Gas

- /

- NYSE:PARR

A Look at Par Pacific Holdings’s Valuation Following Major Hawaii Renewable Fuels Joint Venture Completion

Reviewed by Simply Wall St

Par Pacific Holdings (PARR) has completed a joint venture with Mitsubishi Corporation and ENEOS Corporation to develop Hawaii’s largest renewable fuels manufacturing facility. This move strengthens Par Pacific’s presence in low-carbon energy production across the region.

See our latest analysis for Par Pacific Holdings.

Momentum around Par Pacific Holdings has been exceptional lately, with the share price surging 141% year to date and notching a 139% total shareholder return over the past year. The recent renewable fuels joint venture, paired with growing analyst confidence, has only amplified enthusiasm among investors watching for further growth catalysts.

If you want to spot more market leaders making transformative moves, now is a smart moment to broaden your investing lens and check out fast growing stocks with high insider ownership

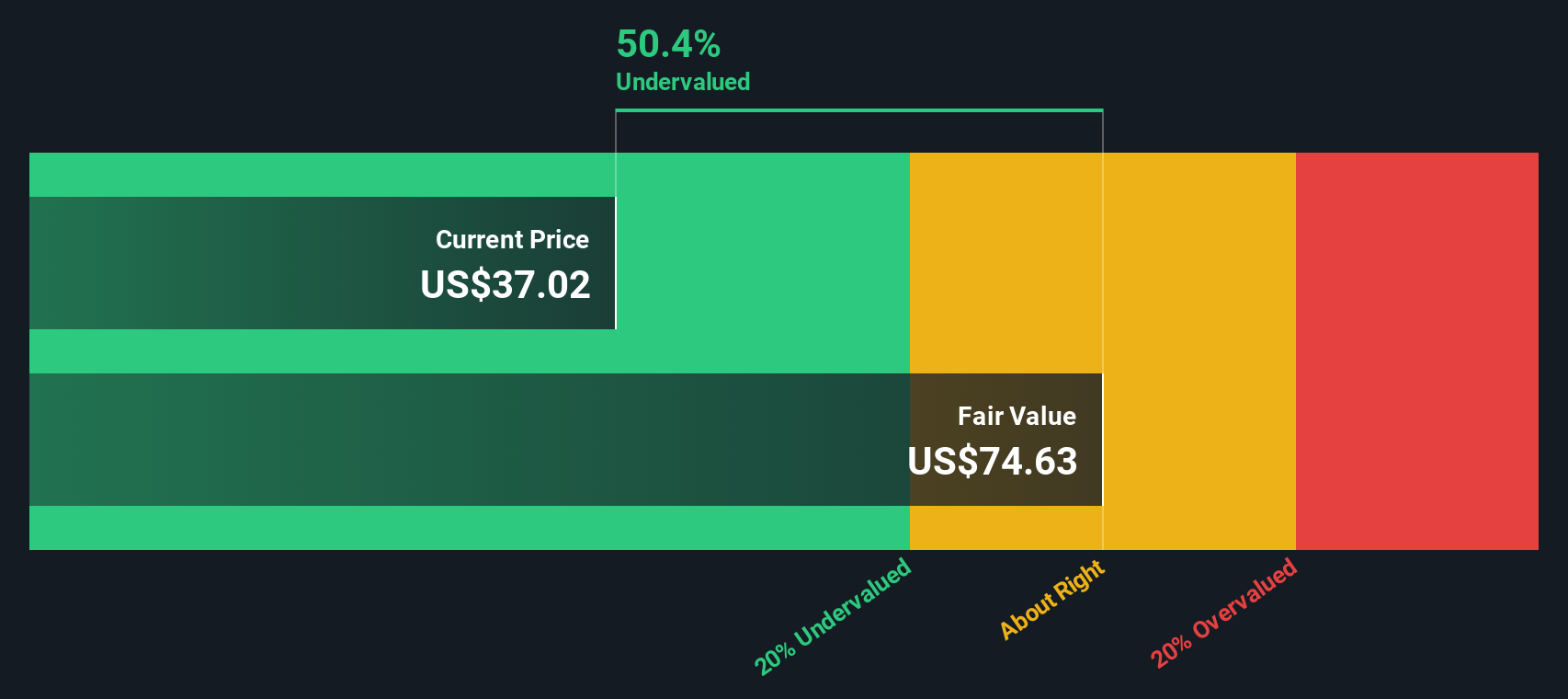

With the stock surging and optimism surrounding the new venture, investors now face a key question: Is Par Pacific still undervalued, or has the market already factored in the company’s next phase of growth?

Most Popular Narrative: 2% Overvalued

Par Pacific’s most widely followed valuation points to a fair value just below the current price, suggesting the recent surge may have priced in much of the expected momentum. Let’s look closer at what’s driving this stance from market watchers: here is a direct line from the narrative shaping expectations.

The strategic partnership with Mitsubishi and ENEOS, along with the upcoming SAF (Sustainable Aviation Fuel) project launch, positions Par Pacific for growth in renewable fuels. This enhances market access, leverages global feedstock procurement expertise, and is expected to positively contribute to earnings and net margin expansion starting in 2026.

Want to know how this big partnership changes the game? It all comes down to bold projections for future earnings and stronger profit margins. The full narrative reveals just how much these upgrades could move the needle, and what valuation multiples analysts believe are within reach.

Result: Fair Value of $39.63 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent dependence on older refineries and stricter regional regulations could disrupt operations or pressure profits. This could potentially challenge the current upbeat outlook.

Find out about the key risks to this Par Pacific Holdings narrative.

Another View: Discounted Cash Flow Model Points to Upside

While price-based metrics suggest Par Pacific might be overvalued, our SWS DCF model offers a different perspective. This approach estimates the company is actually undervalued by more than 23% compared to its fair value of $52.87. Does this paint a more optimistic scenario than market multiples suggest?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Par Pacific Holdings Narrative

If you want to interpret the numbers differently or enjoy drawing your own conclusions, you can put together your own narrative from scratch in just a few minutes. Do it your way

A great starting point for your Par Pacific Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Accelerate your investing by taking advantage of unique screeners that spotlight standout stocks across future-focused sectors and proven value opportunities. Make your research work harder for you and act while these trends are just heating up.

- Tap into a surge of artificial intelligence innovation by reviewing these 27 AI penny stocks with strong potential to disrupt entire industries and deliver long-term growth.

- Boost your portfolio’s income with these 17 dividend stocks with yields > 3% offering consistent yields above 3% while maintaining solid fundamental strength.

- Seize opportunities among deep value plays by evaluating these 875 undervalued stocks based on cash flows identified using robust cash flow benchmarks and market-tested analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PARR

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives