- United States

- /

- Oil and Gas

- /

- NYSE:OXY

Reassessing Occidental Petroleum’s Value After Sector Deal Rumors and Recent Price Gains

Reviewed by Bailey Pemberton

- Ever wondered whether Occidental Petroleum is a hidden value play or if the current share price already factors in the best-case scenario? You're in the right place for a straightforward, deep-dive look at how the numbers really add up.

- Recently, Occidental Petroleum's share price moved up 3.5% over the past week and 2.1% in the last month. It is still down 14.2% for the year and 12.7% over the past twelve months, which is evidence that sentiment about its prospects is shifting.

- News of continued global demand for energy and industry-wide deal rumors have been grabbing headlines, providing fresh angles for investors to reexamine Occidental’s potential. The market has clearly responded to these developments, especially as sector peers make strategic moves to bolster their own growth stories.

- The company's current valuation score is 2 out of 6, meaning there are definitely some areas where the stock may be undervalued. Before diving into the traditional ways analysts assess value, stick around for a new approach to valuation that could help spot the real winners.

Occidental Petroleum scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Occidental Petroleum Discounted Cash Flow (DCF) Analysis

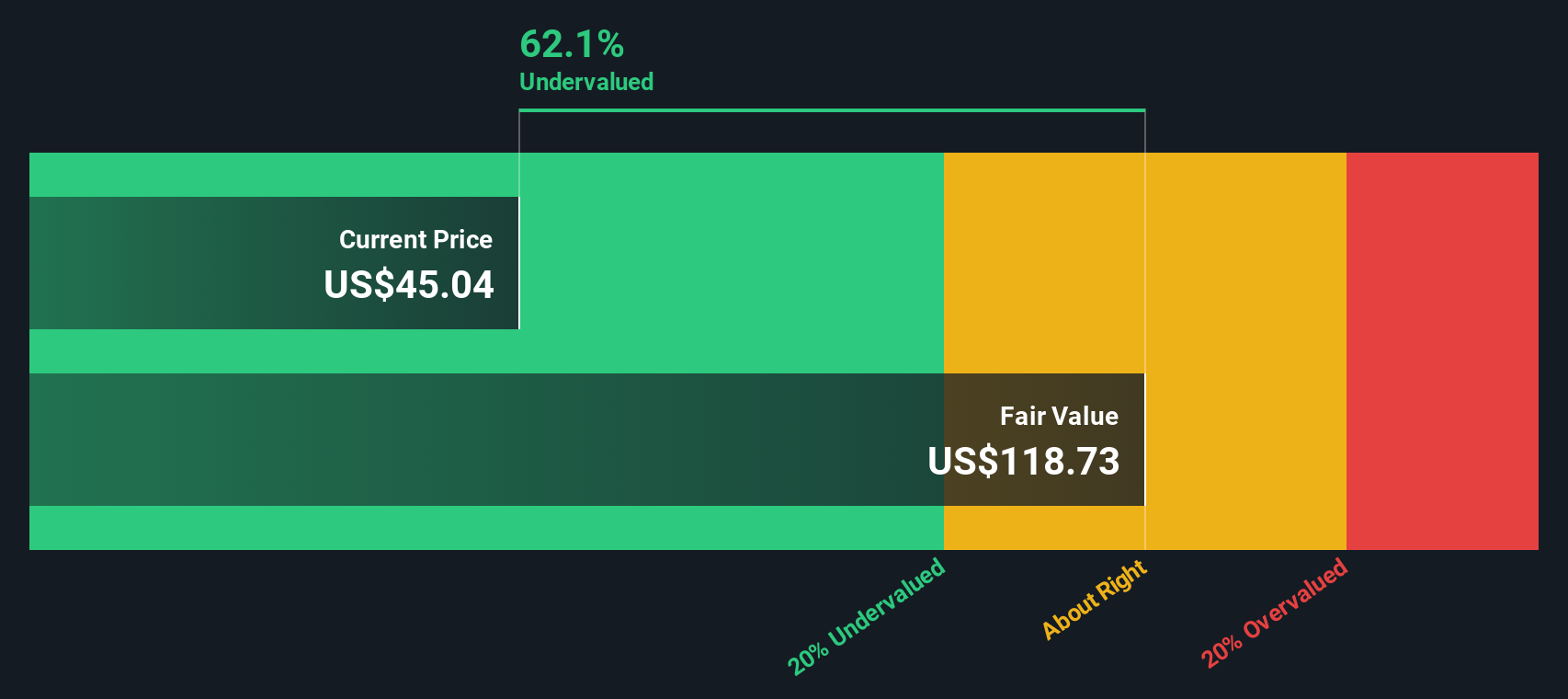

The Discounted Cash Flow (DCF) model is a widely used valuation method that estimates a company's intrinsic value by projecting its future cash flows and then discounting them back to today's value. This approach helps investors determine whether a stock is trading below or above its fair value.

For Occidental Petroleum, the DCF model looks at its Free Cash Flow, which currently stands at approximately $4.4 billion. Analyst forecasts cover the next few years. Beyond five years, Simply Wall St extends these projections to provide a longer-term perspective. By 2029, free cash flow is projected to be $3.17 billion, with annual fluctuations reflected across the decade as observed in the ten-year discounted cash flow estimates.

Based on this two-stage DCF calculation, the model estimates the company’s intrinsic value at $67.67 per share. This figure is about 36.8% higher than the current price, indicating a significant margin of safety and suggesting that the stock may be underappreciated by the market.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Occidental Petroleum is undervalued by 36.8%. Track this in your watchlist or portfolio, or discover 879 more undervalued stocks based on cash flows.

Approach 2: Occidental Petroleum Price vs Earnings (PE)

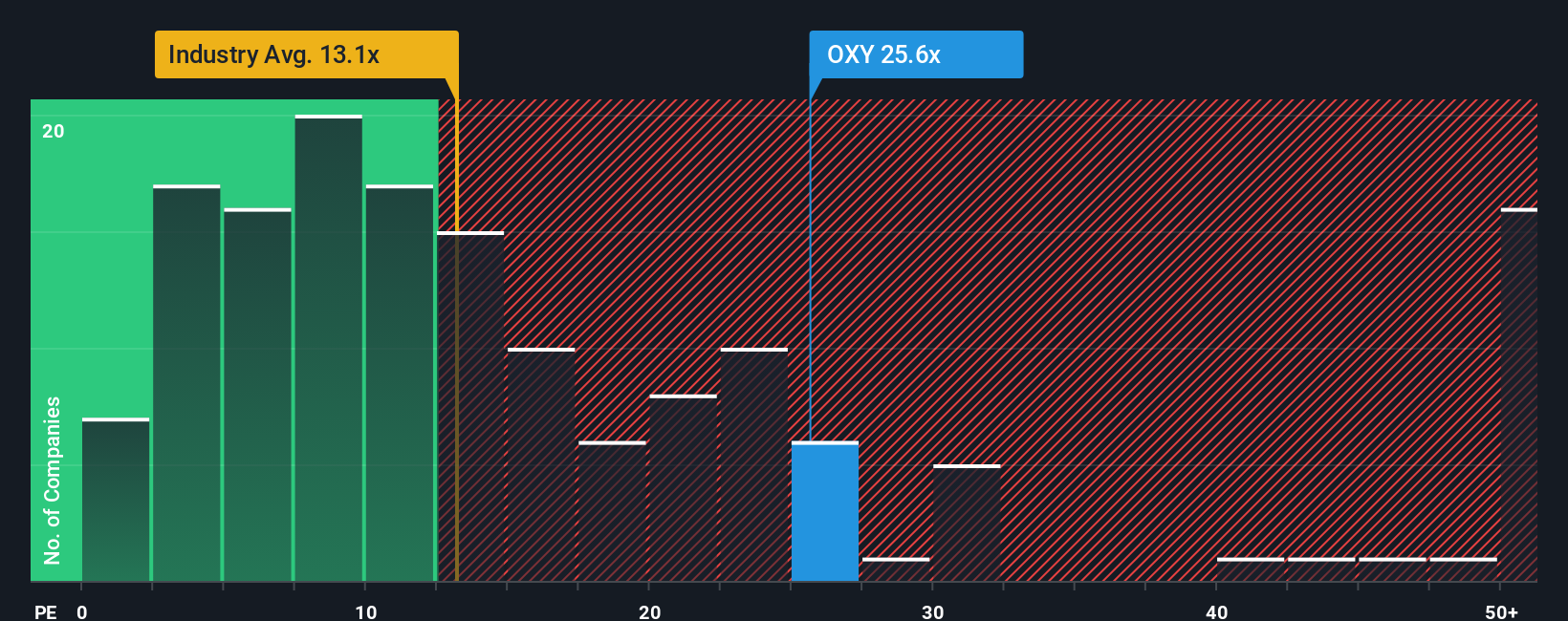

The Price-to-Earnings (PE) ratio is a popular valuation tool for profitable companies like Occidental Petroleum because it connects a company’s market value directly to its bottom line. For investors, the PE ratio shines especially when earnings are positive, providing a clearer view of what you are actually paying for each dollar earned.

It is important to remember that a "normal" or "fair" PE ratio often depends on earnings growth expectations and risk. Higher growth typically supports a higher PE, while more risk often pulls that number lower.

Currently, Occidental Petroleum trades at a PE ratio of 28.9x. For comparison, the average PE ratio among its oil and gas industry peers is 25.5x, and the broader industry sits considerably lower at 13.9x. These benchmarks offer a snapshot of how the market is valuing similar companies.

This is where Simply Wall St’s “Fair Ratio” steps in. Based on factors like Occidental’s earnings growth, profit margins, market cap, risks, and the broader industry, Simply Wall St calculates a fair PE ratio for Occidental at 21.2x. This proprietary metric goes further than a simple peer or industry average by weighing company-specific fundamentals that truly drive value.

Comparing the actual PE (28.9x) to the Fair Ratio (21.2x), Occidental Petroleum’s shares currently look overvalued using this method. The market appears to be factoring in either stronger growth or lower risk than justified by the company’s fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Occidental Petroleum Narrative

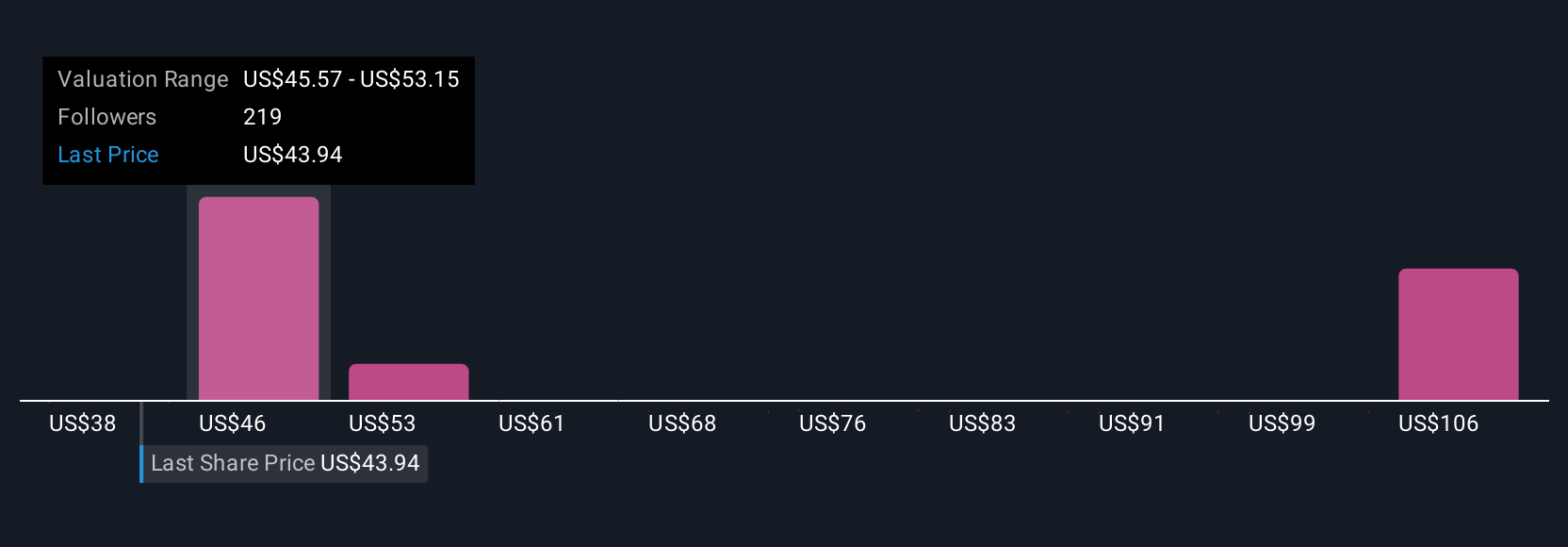

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives, a simple yet powerful framework that empowers you to tell your own story about a company’s future and link it directly to the numbers that matter most: fair value, future revenue, earnings, and profit margins.

With Narratives, you can lay out your personal view on Occidental Petroleum’s business prospects, whether you believe in bold growth driven by its carbon capture innovation or are cautious about oil price risks and industry headwinds. Each Narrative transparently connects your expectations about Occidental's strategy, market position, and risks to a detailed financial forecast and an estimated fair value per share. This makes it far easier to assess whether the current price represents an opportunity or a warning sign.

Best of all, Narratives are available in the Simply Wall St Community, where millions of investors use them to track their perspectives and respond as new events, such as earnings or major deals, update underlying estimates in real time.

For example, some investors see Occidental's fair value as high as $67.67, focusing on long-term CCS and oil leadership, while others estimate it at $40.00, reflecting concerns about debt and industry transitions. Narratives let you see, share, and evaluate these perspectives side by side to power your own investment decisions.

Do you think there's more to the story for Occidental Petroleum? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OXY

Occidental Petroleum

Engages in the acquisition, exploration, and development of oil and gas properties in the United States and internationally.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives