- United States

- /

- Oil and Gas

- /

- NYSE:OXY

Does the Recent Slide Make Occidental Petroleum a Hidden Opportunity for 2025?

Reviewed by Bailey Pemberton

- Curious if Occidental Petroleum is actually a bargain right now? You are not alone, as plenty of investors are wondering if the current price reflects the true value of the business.

- After a 19.7% slide over the past year and down 19.1% so far this year, the stock's moves have turned heads, especially following a five-year gain of 276.1% that still looms large in investor memories.

- Recently, Occidental has drawn attention due to news surrounding its significant carbon capture investments and its expansion in the Permian Basin. Both of these factors fuel speculation on its future growth and risk profile. Increased activity in the energy industry, together with Occidental’s headline-making initiatives in climate strategy, have added new context to these recent price changes.

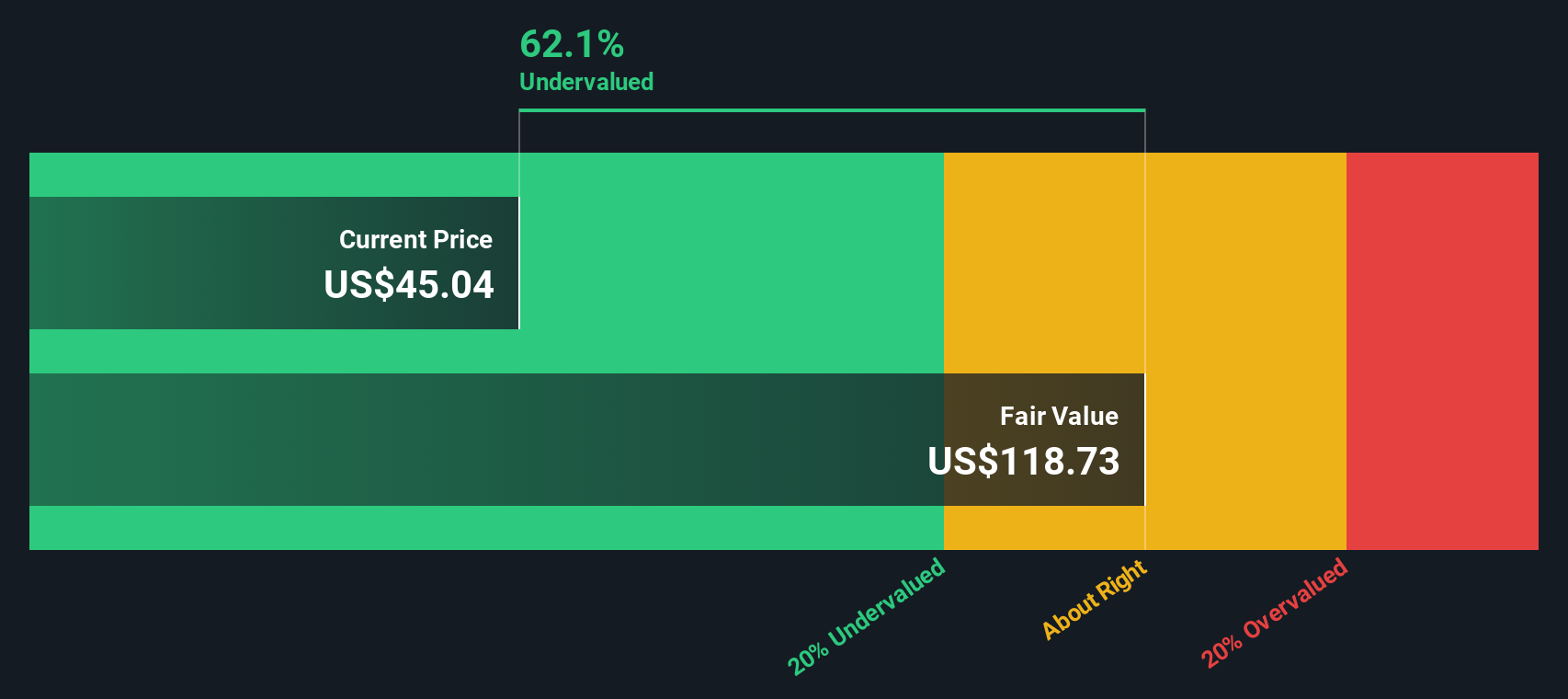

- According to our checks, Occidental scores a 4 out of 6 on our valuation scale, meaning it's undervalued in most but not all areas. Next, we will break down what goes into that score using a range of valuation approaches. By the end of the article, we will share an even better way to evaluate the real worth of the company.

Find out why Occidental Petroleum's -19.7% return over the last year is lagging behind its peers.

Approach 1: Occidental Petroleum Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting those amounts back to their present value. This approach helps investors gauge what a business might truly be worth today based on its expected financial performance.

For Occidental Petroleum, the current Free Cash Flow stands at approximately $5.6 billion. Analyst estimates suggest that annual free cash flow may decrease over the coming years, with projections for 2029 indicating around $3.2 billion. Notably, analysts provide detailed forecasts up to five years out. Further estimates are extrapolated to complete the ten-year outlook.

According to the DCF model, the intrinsic value of Occidental Petroleum is $66.06 per share. When compared with the current market price, this valuation signals the stock is trading at a 39.0% discount. This suggests it is significantly undervalued at present.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Occidental Petroleum is undervalued by 39.0%. Track this in your watchlist or portfolio, or discover 861 more undervalued stocks based on cash flows.

Approach 2: Occidental Petroleum Price vs Earnings

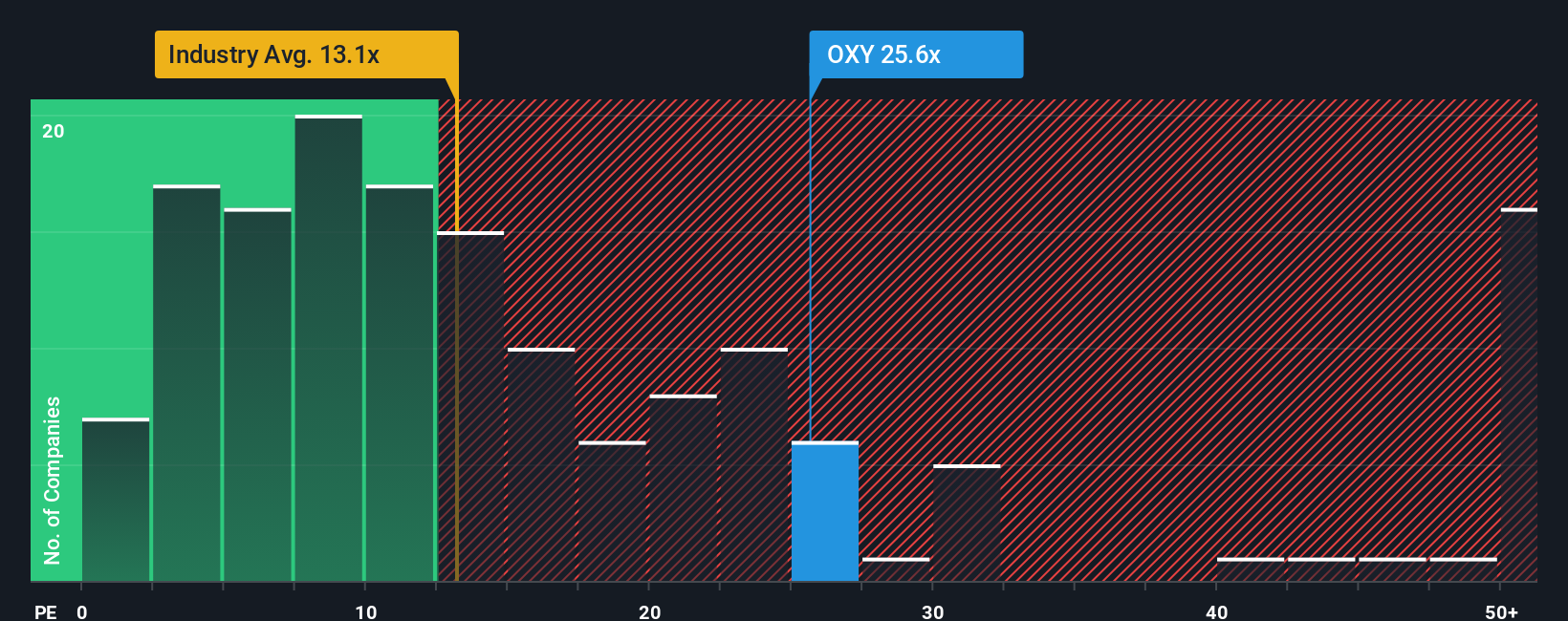

The Price-to-Earnings (PE) ratio is a widely used valuation metric, particularly suitable for profitable companies like Occidental Petroleum. It provides investors with a simple way to assess how much they are paying for each dollar of earnings, making it easier to compare across different businesses and sectors.

Growth expectations and risk play a significant role in determining what counts as a “normal” or “fair” PE ratio for a stock. Companies with strong growth prospects or lower perceived risks can usually support a higher PE, while slow-growing or riskier firms often trade at lower multiples.

Occidental Petroleum currently trades at a PE ratio of 22.9x, which sits above the Oil and Gas industry average of 13.4x but slightly below the average for its peers at 24.8x. However, beyond industry and peer comparisons, Simply Wall St provides a proprietary “Fair Ratio” metric, calculated at 18.8x for Occidental. The Fair Ratio reflects company-specific factors such as expected earnings growth, profit margins, industry context, market capitalization, and unique risks, giving a more personalized benchmark than a simple peer or sector average.

Relying solely on the industry average or peer comparisons can be misleading, as not all companies face the same market dynamics or future prospects. The Fair Ratio, by considering the full set of relevant company and sector details, offers a better sense of what Occidental should reasonably trade at given its circumstances.

Since Occidental’s actual PE ratio (22.9x) is above its Fair Ratio (18.8x) by more than 0.10, the shares appear to be trading on the expensive side relative to what would be expected given its fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1402 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Occidental Petroleum Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives.

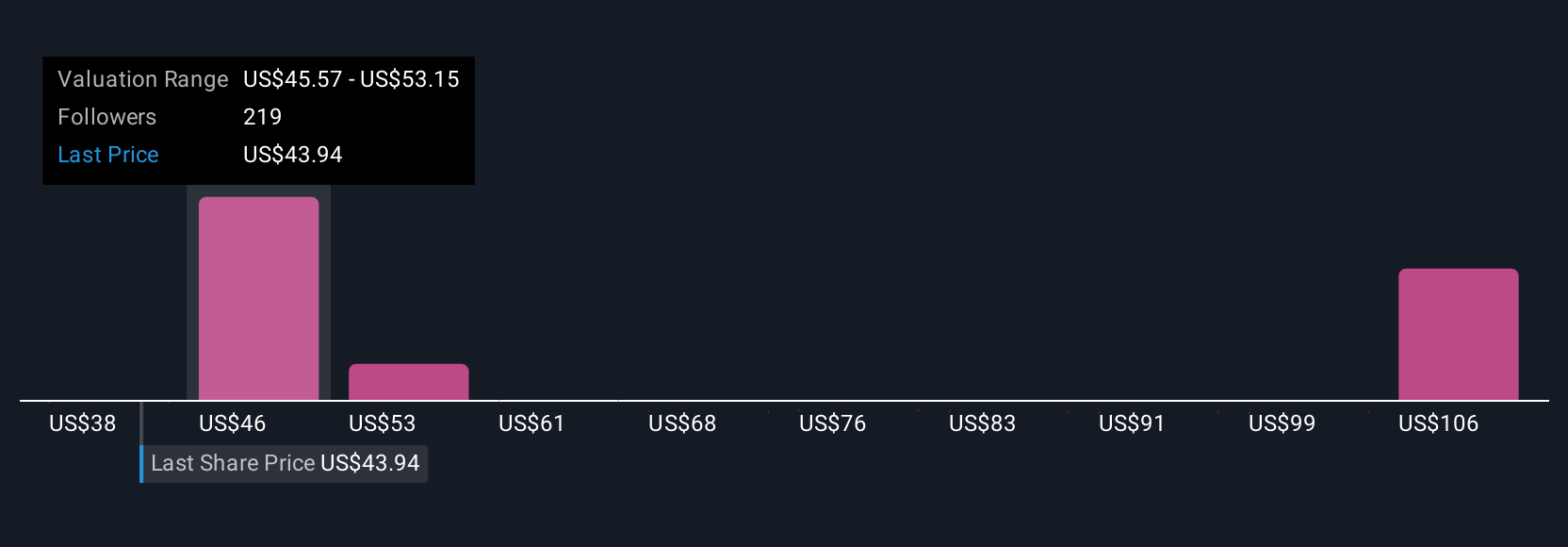

A Narrative is your personalized story connecting what you believe about a company's future, such as its growth drivers, risks, and key initiatives, with the numbers behind its value, including forecasts for revenue, earnings, margins, and fair price.

This approach helps you go beyond simple metrics by articulating why you expect a company like Occidental Petroleum to succeed (or not) and linking that perspective to specific financial projections. This ultimately results in a fair value estimate grounded in your outlook.

Narratives are an easy, interactive tool available on Simply Wall St's Community page. They make dynamic decision-making accessible to millions of investors, with no modeling or spreadsheets required.

They empower you to know when to buy or sell by tracking how your fair value diverges from the current price. Narratives automatically update as new news, earnings reports, or company events occur, so your Narrative is never out of date.

For example, one Occidental Petroleum Narrative might reflect high conviction in carbon capture and margin expansion, giving a fair value near $64 per share. Another, more cautious about oil dependency and debt, might see a fair value closer to $40 per share.

No matter your viewpoint, Narratives help you invest with clarity and confidence by tying your story, forecasts, and fair value together in one place.

Do you think there's more to the story for Occidental Petroleum? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OXY

Occidental Petroleum

Engages in the acquisition, exploration, and development of oil and gas properties in the United States and internationally.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives