- United States

- /

- Oil and Gas

- /

- NYSE:OVV

Ovintiv (OVV) Valuation Check After 12-Year Cedar LNG Export Deal and Montney Growth Push

Reviewed by Simply Wall St

Ovintiv (OVV) just locked in a 12 year liquefaction deal at Cedar LNG, securing export capacity that gives its Montney gas a direct lane into Asian markets and a fresh long term revenue lever.

See our latest analysis for Ovintiv.

Yet the stock has been drifting lower in recent months, with a 90 day share price return of about minus 10 percent even as the 5 year total shareholder return sits near 187 percent. This suggests long term value creation while near term momentum cools ahead of the LNG upside actually showing up in the numbers.

If this LNG move has you rethinking where growth might come from next, it could be worth scouting other energy names through fast growing stocks with high insider ownership to see what else fits your strategy.

With shares down more than 10 percent this year, even as analysts estimate roughly 45 percent upside, is Ovintiv quietly trading at a discount, or has the market already priced in the LNG-fueled growth story?

Most Popular Narrative: 28.4% Undervalued

With the narrative fair value sitting at $51.82 against Ovintiv's last close of $37.11, the current share price implies a sizable valuation gap that hinges on future earnings power and margin expansion actually materializing.

Analysts expect earnings to reach $2.3 billion (and earnings per share of $7.54) by about September 2028, up from $595.0 million today.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.2x on those 2028 earnings, down from 17.9x today.

If you want to see what powers that jump in earnings without revenue growth to match, and why the implied profit engine rivals far leaner operators, dig into the full narrative to uncover the margin math and multiple reset behind this valuation call.

Result: Fair Value of $51.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent shale oversupply or faster than expected energy transition could compress margins and undermine the long term LNG-anchored growth thesis.

Find out about the key risks to this Ovintiv narrative.

Another View: Market Ratios Send a Different Signal

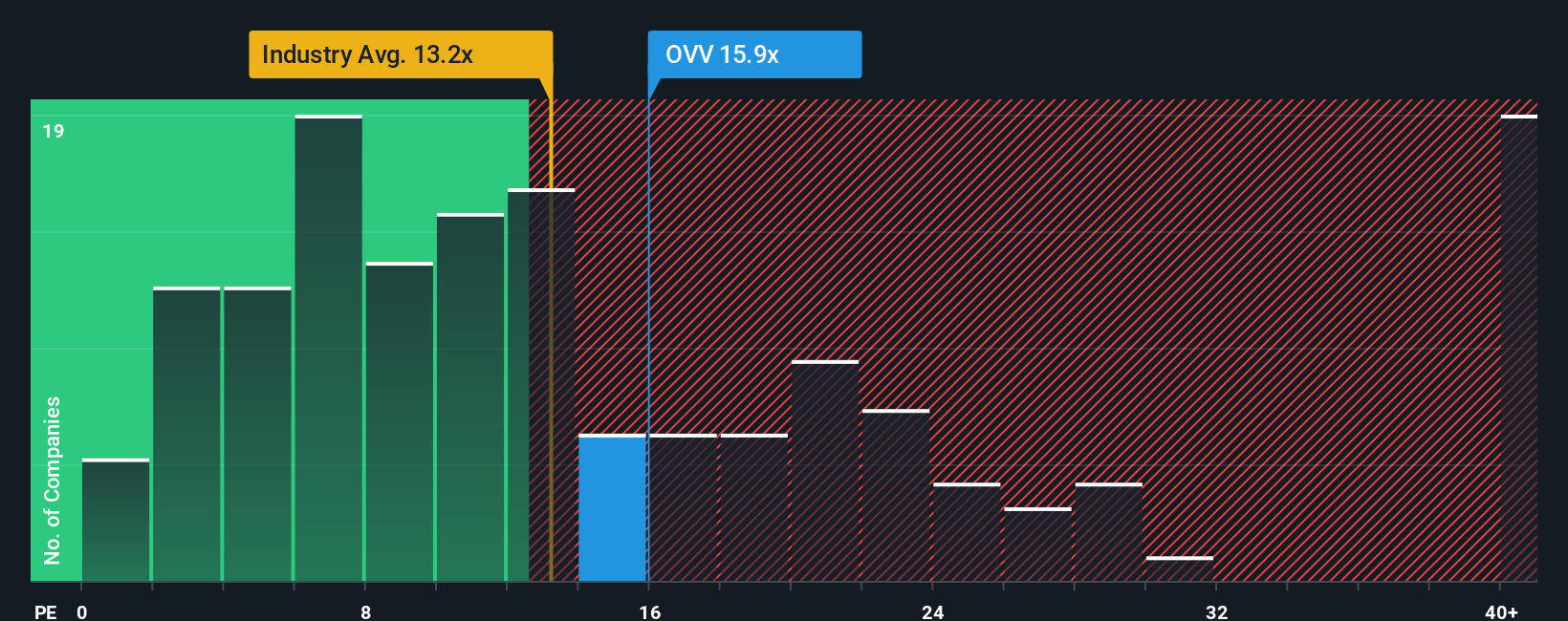

While the narrative fair value paints Ovintiv as 28.4 percent undervalued, its current price to earnings ratio of 39.8 times looks rich beside the US Oil and Gas industry at 13 times, peers at 12.3 times, and even its own 26 times fair ratio. This suggests real de rating risk if sentiment turns.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ovintiv Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Ovintiv research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, lock in your next set of opportunities by using the Simply Wall St Screener to surface focused, data driven stock ideas that match your style.

- Catch early stage momentum and sharpen your risk reward edge with these 3614 penny stocks with strong financials that already show solid fundamentals beneath their small market caps.

- Position ahead of structural change by targeting these 29 healthcare AI stocks that are reshaping diagnostics, treatment pathways, and medical efficiency with real world AI adoption.

- Secure potential bargains by filtering for these 914 undervalued stocks based on cash flows where strong cash flows and resilient balance sheets are not yet fully reflected in market prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OVV

Ovintiv

Explores, develops, produces, and markets natural gas, oil, and natural gas liquids in North America.

Moderate risk and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion