- United States

- /

- Oil and Gas

- /

- NYSE:OVV

How Investors May Respond To Ovintiv (OVV) Higher Output Amid Falling Revenue and Raised Production Guidance

Reviewed by Sasha Jovanovic

- Ovintiv Inc. recently reported third quarter 2025 results, highlighting a year-over-year decrease in revenue and net income despite achieving higher total production and natural gas output compared to the prior year.

- Alongside reaffirming its dividend and announcing increased production guidance for both 2025 and 2026, Ovintiv continued share repurchases under its ongoing buyback program.

- We'll examine how Ovintiv's increased production targets and solid operational output may reshape the company's investment outlook going forward.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Ovintiv Investment Narrative Recap

To be an Ovintiv shareholder right now, you have to believe that efficiency gains and robust North American shale output will outweigh commodity price volatility and margin pressures. This quarter’s drop in revenue and earnings, despite higher production and reaffirmed dividend, does little to materially shift immediate catalysts, recovery will still hinge on stable hydrocarbon prices and operational cost control, while exposure to regional price swings remains the biggest risk in the near term.

Among several announcements, the update to Ovintiv’s 2026 production guidance stands out. The company intends to deliver higher oil and condensate volumes next year with disciplined capital outlays, reinforcing long-term growth potential while also underscoring the need for consistent reserve replacement, a key operational catalyst that supports future earnings and share price resilience.

By contrast, investors should be aware that if shale basin-specific price erosion persists, the company’s production growth alone may not...

Read the full narrative on Ovintiv (it's free!)

Ovintiv's outlook anticipates $8.6 billion in revenue and $2.3 billion in earnings by 2028. This implies a 1.5% annual revenue decline and a $1.7 billion increase in earnings from current earnings of $595 million.

Uncover how Ovintiv's forecasts yield a $51.82 fair value, a 32% upside to its current price.

Exploring Other Perspectives

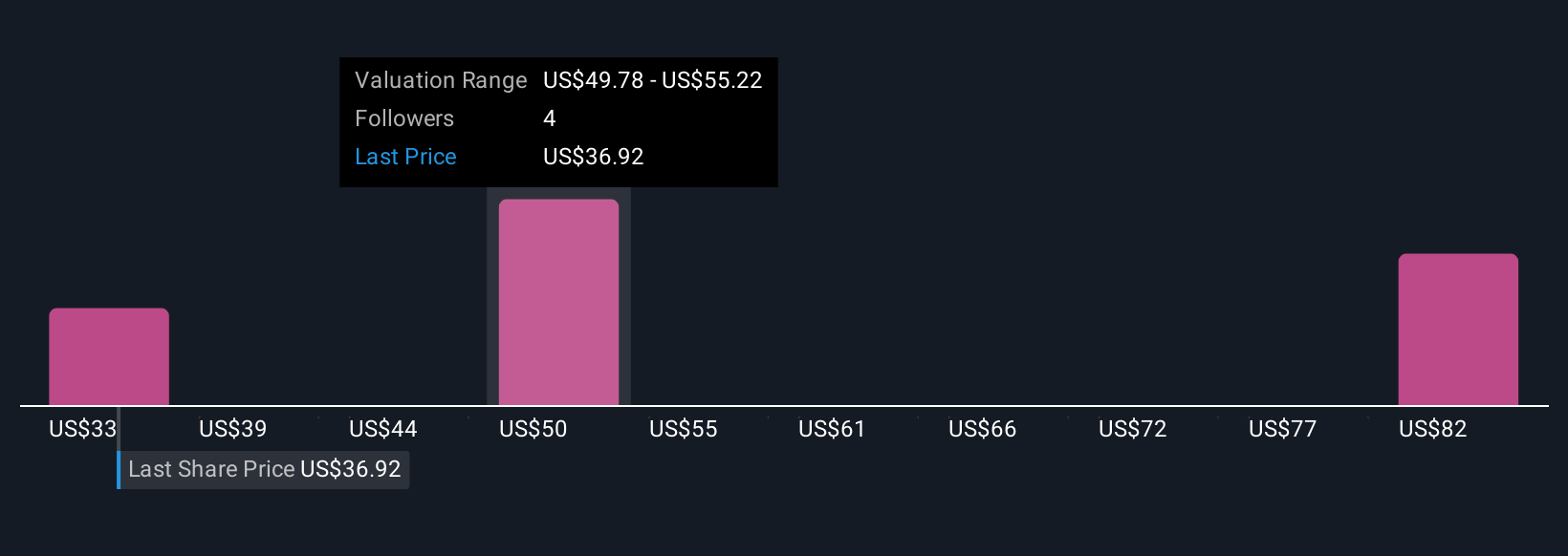

Five independent fair value estimates from the Simply Wall St Community span US$33.47 to US$87.29 per share, reflecting highly varied outlooks on Ovintiv’s potential. Still, with regional gas price volatility highlighted as a critical risk, it is clear that your assumptions could steer sharply different return expectations, see how the community’s viewpoints stack up against your own.

Explore 5 other fair value estimates on Ovintiv - why the stock might be worth 15% less than the current price!

Build Your Own Ovintiv Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ovintiv research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Ovintiv research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ovintiv's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OVV

Ovintiv

Explores, develops, produces, and markets natural gas, oil, and natural gas liquids in North America.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives