- United States

- /

- Oil and Gas

- /

- NYSE:OVV

A Fresh Look at Ovintiv (NYSE:OVV) Valuation After Profit Drop and Increased Production Outlook

Reviewed by Simply Wall St

Ovintiv (NYSE:OVV) released its third quarter results, revealing both revenue and net income declines year over year. At the same time, the company lifted its 2025 production outlook and signaled potential growth for 2026.

See our latest analysis for Ovintiv.

Recent weeks have seen Ovintiv's shares rebound, with a 1-month share price return of 5.4% as investors weigh higher production guidance and a steady dividend against softer profits. However, momentum has faded in the broader context, with the 1-year total shareholder return at -10.6%.

If you're curious about what else is making waves beyond energy, now is the perfect time to explore fast growing stocks with high insider ownership and uncover new opportunities.

With Ovintiv posting falling profits while raising output targets and trading well below analyst price targets, the question for investors remains: Is Wall Street overlooking upside potential, or has future growth already been fully reflected in the share price?

Most Popular Narrative: 25.1% Undervalued

The latest widely followed narrative estimates a fair value of $51.82 for Ovintiv, well above its recent closing price of $38.81. This persistent gap is fueling debate over whether the market is missing something in the energy producer’s turnaround plans. Here is one of the driving catalysts behind that bullish outlook:

Disciplined capital allocation (including structural cost reductions, debt paydown, and aggressive share buybacks) is set to drive durable increases in earnings per share and further upside for equity valuation as capital markets recognize improved net margins and cash flow per share growth.

Ever wonder what assumptions underpin such a high fair value? The narrative is built on bold projections for earnings, profit margins, and share reduction. These numbers could reset expectations for this stock. Curious which forecasts drive these bullish estimates? Read the full story to uncover the details.

Result: Fair Value of $51.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent inflation in energy services or stricter regulations could erode Ovintiv’s margins. This could challenge the optimistic outlook driving current valuations.

Find out about the key risks to this Ovintiv narrative.

Another View: What Do Price Ratios Say?

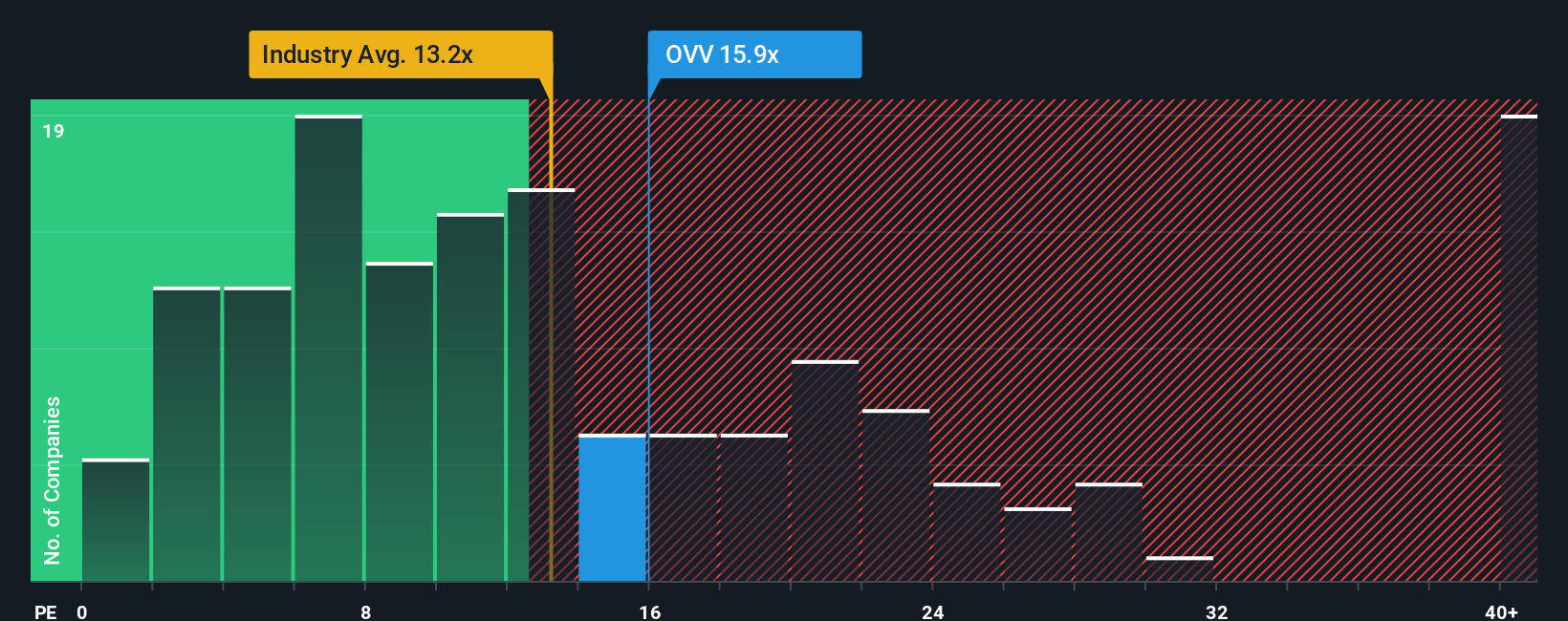

While fair value estimates point to Ovintiv being undervalued, traditional valuation ratios suggest a different story. Ovintiv currently trades at a price-to-earnings ratio of 41.6x, much higher than both industry peers (12.9x average) and its fair ratio of 36.3x. Such a premium suggests the market is already expecting outsized future growth. Does this expose investors to disappointment if targets are missed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ovintiv Narrative

If you see things differently or want to dive deeper, take a few minutes to analyze the numbers yourself and craft your own narrative. Do it your way.

A great starting point for your Ovintiv research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Act now to spot fresh opportunities that others miss. Your next top performer could be just a click away with these powerful stock screeners from Simply Wall Street:

- Maximize growth potential by tapping into these 876 undervalued stocks based on cash flows that the market may be overlooking right now.

- Capture industry-defining innovation by checking out these 26 AI penny stocks as artificial intelligence reshapes entire sectors.

- Boost your portfolio’s income with these 15 dividend stocks with yields > 3% offering reliable yields well above the average.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OVV

Ovintiv

Explores, develops, produces, and markets natural gas, oil, and natural gas liquids in North America.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives