- United States

- /

- Oil and Gas

- /

- NYSE:OKE

ONEOK (OKE) Valuation: How Do Strong Q3 Results and Upbeat Guidance Shape the Investment Case?

Reviewed by Simply Wall St

ONEOK (OKE) just released its third-quarter results, surprising investors with net income and earnings per share that came in above expectations. Revenue was also higher compared to last year, which points to recent operational gains.

See our latest analysis for ONEOK.

Despite topping earnings expectations and reporting stronger revenue growth, ONEOK’s momentum has yet to reverse a broad slide in the stock. The latest acquisitions and completed growth projects provided a short-term boost, but the company’s share price return remains down over 32% year-to-date as risk concerns persist. However, looking at the bigger picture, the 3-year total shareholder return stands at 32.6%, and for long-term holders, the 5-year total return is a standout 215%. This reminds investors that the stock has rewarded patience even during volatile stretches.

If ONEOK’s recovery theme resonates with you, now could be a prime moment to broaden your perspective and discover fast growing stocks with high insider ownership

Given the stock’s deep year-to-date decline, strong third-quarter performance, and sizable discount to analyst targets, is ONEOK currently undervalued, or has the market already priced in future growth prospects?

Most Popular Narrative: 23.9% Undervalued

Compared to its last close price, the most widely followed narrative currently values ONEOK at a notable premium. This points to a divergence between market sentiment and consensus fair value and sets the stage for examining exactly what supports such a bullish stance on the stock’s future trajectory.

Persistent growth in global demand for U.S. natural gas and NGLs, driven by increasing international energy needs and continued coal-to-gas switching, supports long-term volume throughput and higher utilization rates across ONEOK's midstream and export infrastructure, directly underpinning future revenue and EBITDA growth.

Want to know the bold math behind this price tag? This narrative’s valuation hinges on earnings growth and margin expansion, powered by bets on global energy appetite. See which eye-popping assumptions and ambitious financial forecasts are fueling such an optimistic fair value for ONEOK. Surprised by the gap? Discover the figures that really move the needle.

Result: Fair Value of $90.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent commodity price swings and integration challenges from recent acquisitions could easily undermine these optimistic projections in the near term.

Find out about the key risks to this ONEOK narrative.

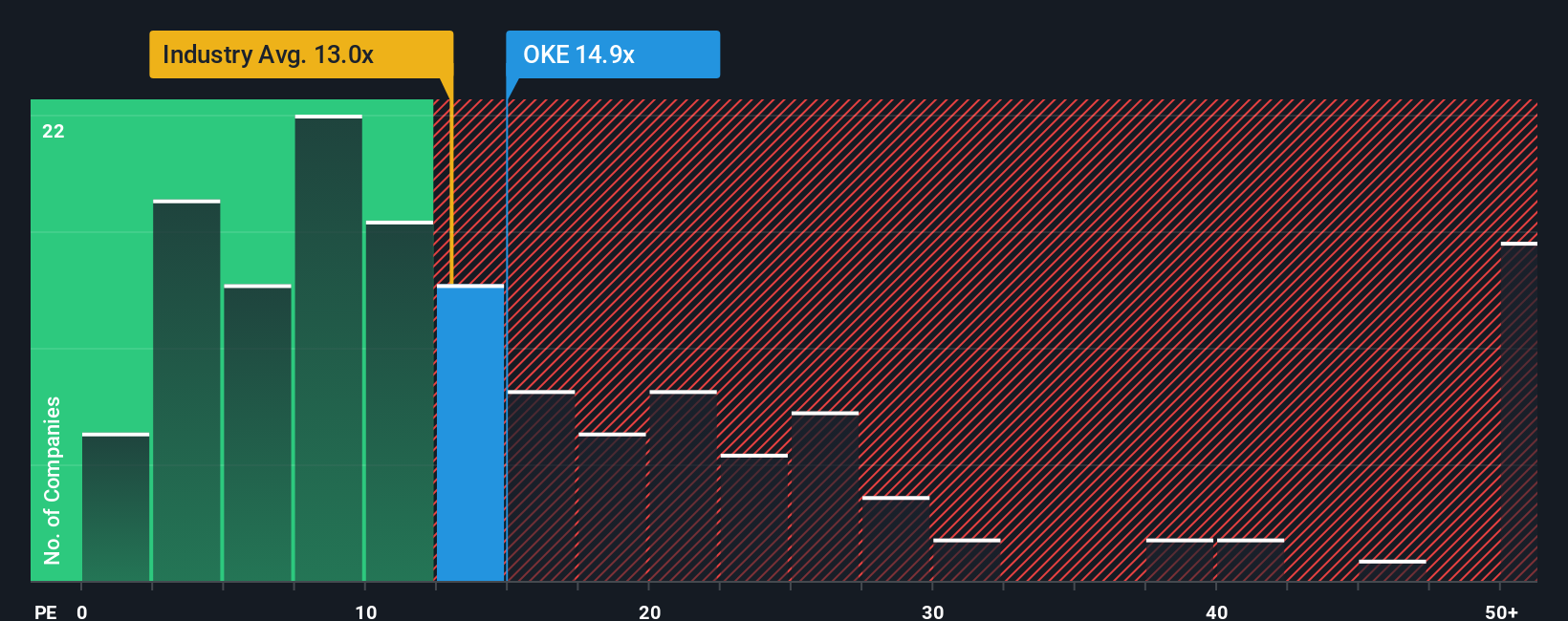

Another View: Comparing to Industry Ratios

Looking at valuation through the lens of the price-to-earnings ratio, ONEOK currently trades at 14.1x earnings. This makes it slightly more expensive than the US Oil and Gas industry average of 13.1x and in line with its peers at 14.5x. Notably, this is still below its fair ratio of 18.7x, which is a level the market could eventually move toward. This suggests a potential value gap but also highlights risk if the broader industry’s multiples decline. Should investors look more closely at where sentiment might shift next?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ONEOK Narrative

If the current perspective doesn’t fit your outlook or you’d rather dive into the numbers on your own, you can build your own narrative for ONEOK faster than you think. Do it your way

A great starting point for your ONEOK research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t leave your portfolio at a standstill. The best opportunities often hide just beyond your usual picks. Make your next move count with Simply Wall Street’s powerful ideas.

- Tap into the steady cash flow by targeting income potential with these 21 dividend stocks with yields > 3% featuring yields above 3% and proven payout histories.

- Ride the next wave of technological change with these 26 AI penny stocks presenting leaders in artificial intelligence and innovation-driven growth.

- Seize market inefficiencies by spotting potential bargains among these 867 undervalued stocks based on cash flows available at attractive discounts based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OKE

ONEOK

Operates as a midstream service provider of gathering, processing, fractionation, transportation, storage, and marine export services in the United States.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives