- United States

- /

- Oil and Gas

- /

- NYSE:OKE

Does ONEOK’s Recent 32% Drop Signal Opportunity for Investors in 2025?

Reviewed by Bailey Pemberton

Trying to decide what to do with your ONEOK shares in a market like this? You are not alone, and there is plenty to think about. After all, ONEOK has seen a serious rollercoaster in its price action lately. Just in the past month, shares fell 6.9% and are down an eye-opening 32.6% year-to-date, which can feel unsettling. Yet, if you step back, you will notice that the company has powered out an impressive 211.8% return over five years, showing that long-term holders have been rewarded despite recent volatility.

The latest move has not come out of nowhere. Recent developments around energy infrastructure investments and shifting expectations for pipeline demand have been front and center in the news, nudging ONEOK’s perceived risk and growth prospects. While these headlines have brought new uncertainty to the midstream energy space, they also speak to the resilience and adaptability that long-term investors look for.

The real story for many investors, though, is valuation. By most measures, ONEOK currently scores a 5 out of 6 on our in-depth value checklist, suggesting the stock is undervalued across nearly every key metric we track. Next, we are going to break down these different valuation approaches so you can see how ONEOK stacks up. Plus, stick around until the end because there is one even better way to think about what this company is really worth.

Why ONEOK is lagging behind its peers

Approach 1: ONEOK Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a company by projecting its future cash flows and discounting them back to today’s dollar value. With this method, investors gain insight into what the business might truly be worth, independent of current market sentiment or short-term price swings.

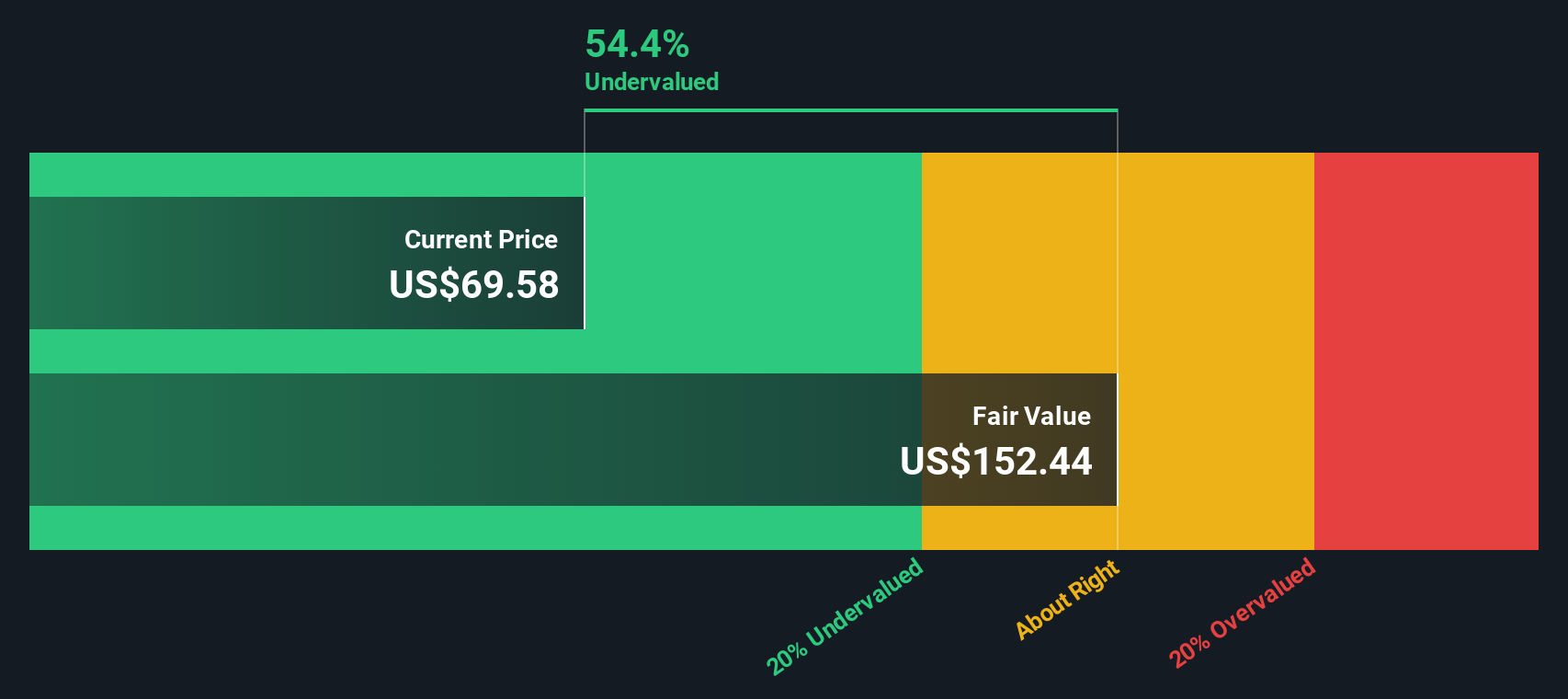

For ONEOK, the latest reported Free Cash Flow (FCF) stands at approximately $2.91 Billion over the last twelve months. Analysts provide projections for the next five years, after which Free Cash Flow numbers are extrapolated for the longer term. Based on current forecasts and model assumptions, ONEOK’s annual FCF is expected to grow, with Simply Wall St estimating it to reach nearly $6.04 Billion by 2035.

When these cash flows are discounted to the present using a two-stage Free Cash Flow to Equity approach, ONEOK’s intrinsic value comes out to $153.41 per share. This figure suggests the stock trades at a 55.3% discount to its estimated fair value, making it look significantly undervalued at current prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ONEOK is undervalued by 55.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: ONEOK Price vs Earnings (PE Ratio)

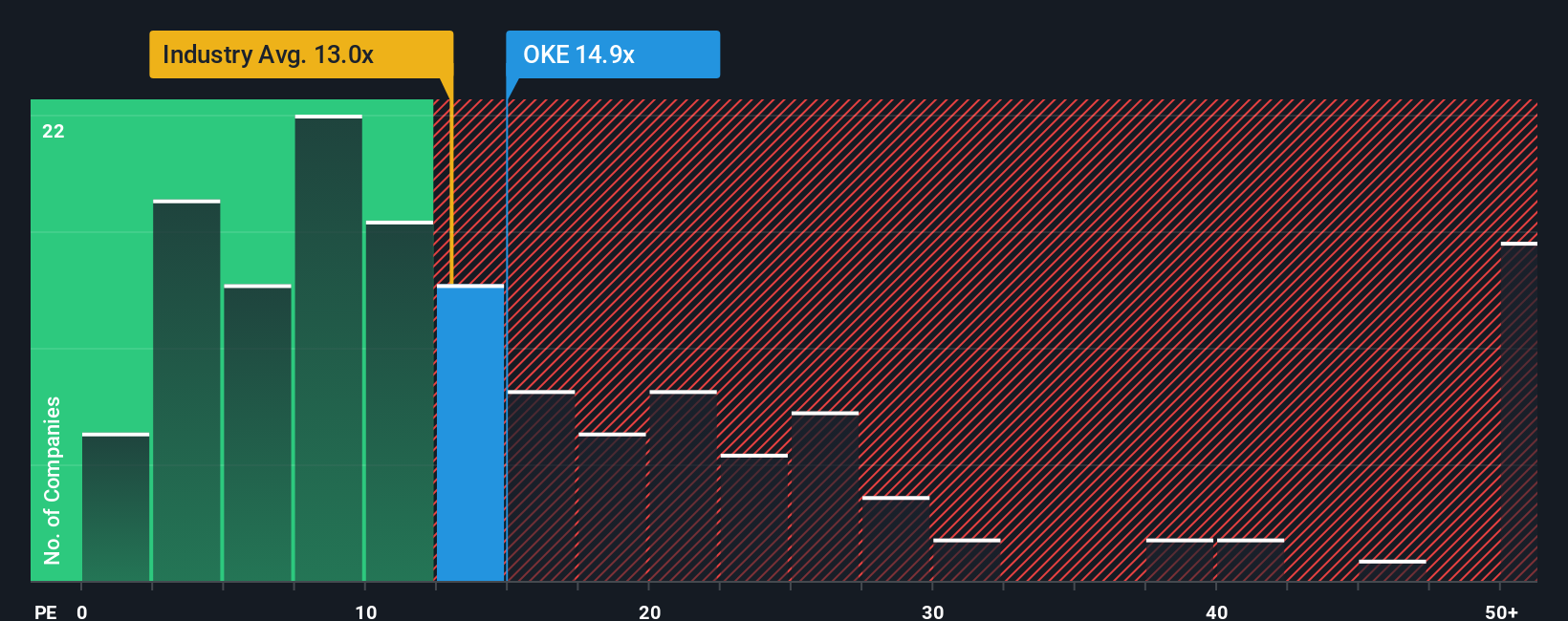

The Price-to-Earnings (PE) ratio is a favored tool for valuing profitable companies like ONEOK because it reflects how much investors are willing to pay for each dollar of earnings. As the company generates steady profits, the PE ratio offers a clear picture of how the market values its current and potential earnings capacity.

What is considered a “normal” or “fair” PE ratio often depends on expectations for growth and the underlying risks the business faces. Fast-growing companies or those with lower risk are usually awarded a higher PE, while slower growers or riskier stocks typically see a lower ratio.

Right now, ONEOK trades at a PE ratio of 14.0x. This is close to its average peer PE of 14.5x and a bit above the oil and gas industry average of 12.8x. However, not all companies are created equal. This is where Simply Wall St’s proprietary “Fair Ratio” comes in. For ONEOK, the Fair Ratio is calculated to be 18.8x, based on a blend of factors like its earnings growth outlook, profit margins, risk profile, market cap, and industry influences.

Relying solely on peer, sector, or industry averages can often miss nuances in a company’s fundamentals. The Fair Ratio digs deeper by considering what sets ONEOK apart and quantifies the multiple that is appropriate given all the factors that matter most for its valuation.

Comparing the current PE of 14.0x with the Fair Ratio of 18.8x, the company appears undervalued by this approach. This suggests the market may be underappreciating ONEOK’s quality and potential.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ONEOK Narrative

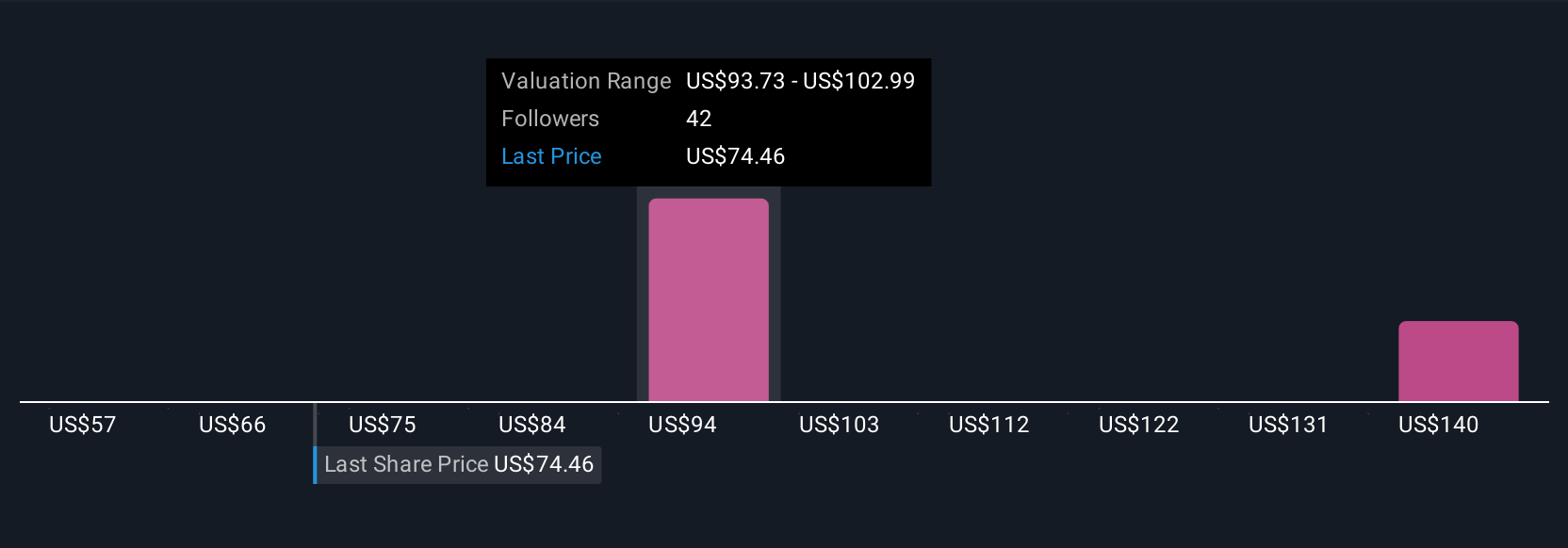

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your chance to create the story you see behind ONEOK’s numbers, linking your personal perspective about the business, whether optimistic or cautious, to forecasts for key metrics like revenue growth, profit margins, and future earnings. Narratives guide you through translating your outlook into a tailored financial forecast, which then leads directly to your own fair value estimate.

With Narratives, deciding when to buy or sell becomes more accessible. By comparing your Fair Value to ONEOK’s current price, you can instantly see whether you believe the market is overpricing or underpricing the company based on your assumptions. Best of all, Narratives on Simply Wall St’s Community page are dynamic and always up to date, reflecting the latest news, earnings, and expert insights. This gives you an adaptable way to stay informed as situations change.

For example, one investor’s Narrative might reflect high confidence in ONEOK’s growth and margins, resulting in a projected fair value of $126, while another’s more cautious view, concerned about commodity volatility and debt, produces a fair value closer to $82. No matter what story you believe, Narratives turn your perspective into an actionable valuation, so you can invest with conviction and clarity.

Do you think there's more to the story for ONEOK? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OKE

ONEOK

Operates as a midstream service provider of gathering, processing, fractionation, transportation, storage, and marine export services in the United States.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives