- United States

- /

- Oil and Gas

- /

- NYSE:OKE

Does ONEOK's (OKE) Unchanged Dividend Reveal Steadfast Confidence or Heightened Caution?

Reviewed by Sasha Jovanovic

- Earlier this month, ONEOK, Inc.'s board of directors declared a quarterly dividend of US$1.03 per share, maintaining its payout from the previous quarter and setting an annualized rate of US$4.12 per share, payable to shareholders on November 14, 2025.

- The decision to keep the dividend steady comes amid concerns from analysts about the company's declining momentum, financial risks, and weak earnings outlook.

- We'll examine how the reaffirmed dividend, despite analyst caution, shapes the outlook for ONEOK's investment narrative and future performance.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

ONEOK Investment Narrative Recap

To be a ONEOK shareholder, you need to believe in the sustained global demand for US natural gas and NGLs, ongoing infrastructure expansions in key shale basins, and the company’s potential for stable cash flows despite sector volatility. The recently reaffirmed US$1.03 per share dividend does not materially change the most important short-term catalyst, growing throughput and export potential, but it also doesn’t lower the biggest risk, which remains earnings sensitivity to narrowing commodity spreads and integration of recent acquisitions.

The most directly relevant recent announcement is the repeated affirmation of the quarterly US$1.03 per share dividend, which, despite recent underperformance and analyst caution, signals ongoing confidence in near-term cash generation. Consistency in payouts may support investor sentiment, but with financial risks persisting, especially those tied to debt and acquisition integration, attention remains on upcoming earnings reports and future strategic moves.

In contrast to the company’s steady dividend, investors should be aware that continued muted growth expectations due to tight commodity price spreads could mean...

Read the full narrative on ONEOK (it's free!)

ONEOK's outlook anticipates $34.0 billion in revenue and $4.2 billion in earnings by 2028. This scenario is based on an annual revenue growth rate of 6.7% and a $1.1 billion increase in earnings from the current level of $3.1 billion.

Uncover how ONEOK's forecasts yield a $90.84 fair value, a 31% upside to its current price.

Exploring Other Perspectives

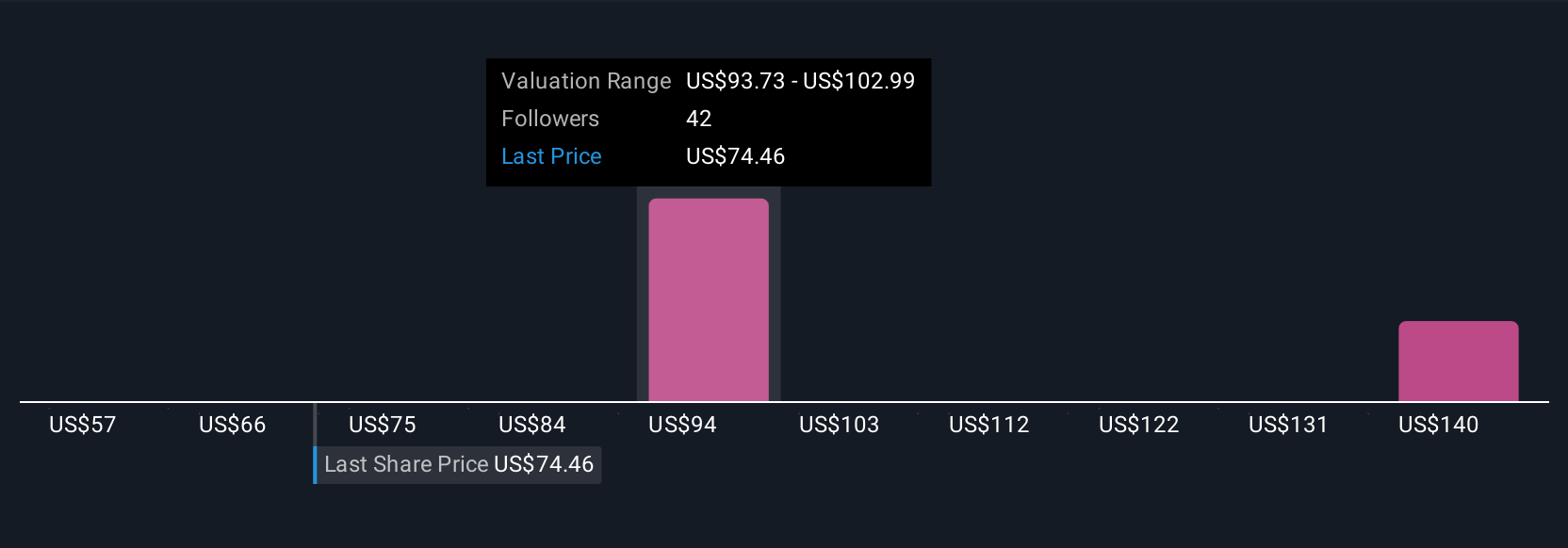

Nine members of the Simply Wall St Community estimate ONEOK’s fair value ranging from US$65 to US$152.73 per share. With so many outlooks and current risks around margin pressure from low commodity spreads, be sure to check the full spectrum of views before drawing your own conclusions.

Explore 9 other fair value estimates on ONEOK - why the stock might be worth over 2x more than the current price!

Build Your Own ONEOK Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ONEOK research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ONEOK research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ONEOK's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OKE

ONEOK

Operates as a midstream service provider of gathering, processing, fractionation, transportation, storage, and marine export services in the United States.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives