- United States

- /

- Oil and Gas

- /

- NYSE:OKE

Did ONEOK's (OKE) Steady Dividend Decision Just Shift Its Investment Narrative?

Reviewed by Simply Wall St

- On July 16, 2025, ONEOK's board declared a quarterly dividend of US$1.03 per share, keeping the payout unchanged from the prior quarter, and set an annualized dividend of US$4.12 per share for payment on August 14 to shareholders of record as of August 1.

- This steady dividend signals the company’s focus on delivering consistent capital returns, which can help reinforce shareholder confidence during periods of market uncertainty.

- We’ll consider how ONEOK’s move to maintain its dividend payout shapes the outlook for its resilience and capital return strategy.

ONEOK Investment Narrative Recap

To own shares of ONEOK, investors need to believe in the long-term demand for U.S. natural gas and NGL infrastructure, the company's ability to retain its leading market position, and the prospect of continued shareholder returns through dividends. The latest decision to keep the quarterly dividend steady at US$1.03 per share supports short-term confidence but does not materially alter the primary catalyst of earnings growth from recent acquisitions or address the chief short-term risk tied to revenue losses from divested assets.

The most relevant recent announcement is ONEOK’s Q1 2025 earnings report, which showed a significant year-on-year increase in revenue to US$8,043 million but a slight dip in net income. This earnings cadence reinforces the company's capacity to fund ongoing dividends, even as it manages the impacts of asset sales and focuses on integrating acquisition-driven growth.

By contrast, investors should be conscious of ongoing exposure to commodity price swings and how that might affect the company's...

Read the full narrative on ONEOK (it's free!)

ONEOK's outlook forecasts $31.2 billion in revenue and $4.3 billion in earnings by 2028. This implies a 7.8% annual revenue growth rate and a $1.3 billion increase in earnings from the current $3.0 billion.

Uncover how ONEOK's forecasts yield a $102.53 fair value, a 26% upside to its current price.

Exploring Other Perspectives

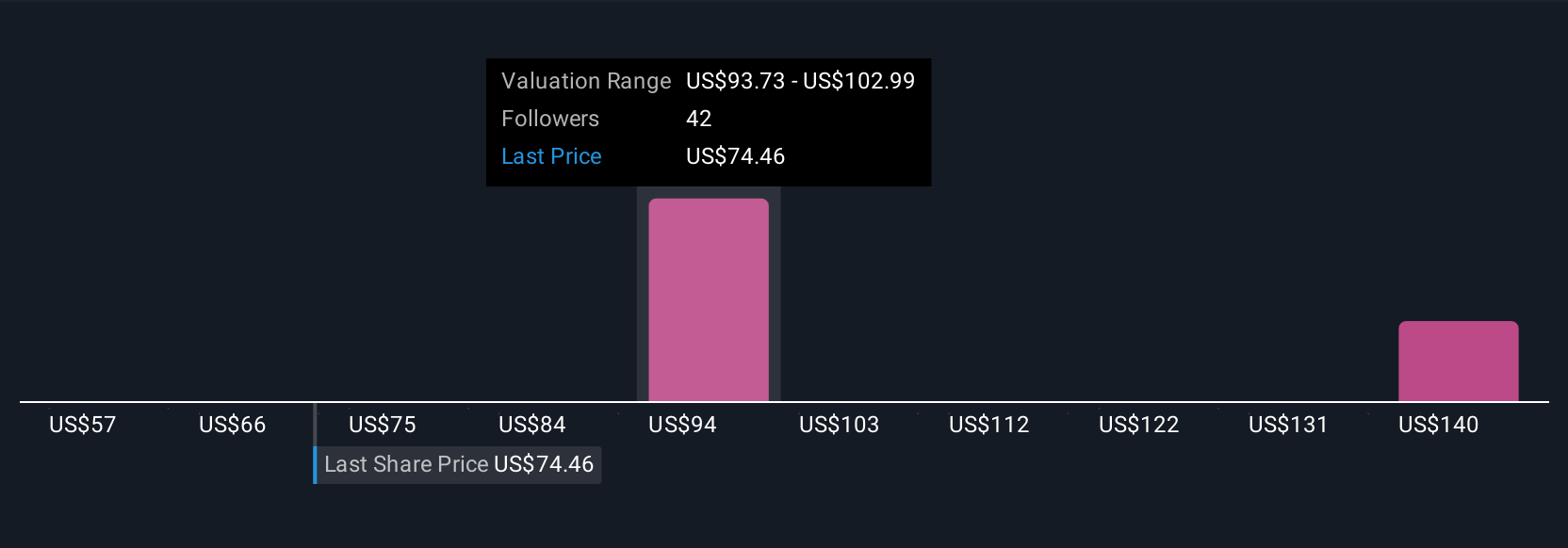

You’ll find that fair value estimates from five members of the Simply Wall St Community range from US$56.66 to US$171.07 per share. With this diversity of opinion, keep in mind that earnings from new projects and acquisitions remain the key catalyst influencing overall expectations for ONEOK’s medium-term growth.

Build Your Own ONEOK Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ONEOK research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ONEOK research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ONEOK's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OKE

ONEOK

Operates as a midstream service provider of gathering, processing, fractionation, transportation, storage, and marine export services in the United States.

6 star dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives