- United States

- /

- Energy Services

- /

- NYSE:OIS

Further weakness as Oil States International (NYSE:OIS) drops 12% this week, taking five-year losses to 76%

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. It hits us in the gut when we see fellow investors suffer a loss. Spare a thought for those who held Oil States International, Inc. (NYSE:OIS) for five whole years - as the share price tanked 76%. And we doubt long term believers are the only worried holders, since the stock price has declined 43% over the last twelve months. Furthermore, it's down 24% in about a quarter. That's not much fun for holders.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

See our latest analysis for Oil States International

Oil States International wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over half a decade Oil States International reduced its trailing twelve month revenue by 7.9% for each year. That's not what investors generally want to see. If a business loses money, you want it to grow, so no surprises that the share price has dropped 12% each year in that time. It takes a certain kind of mental fortitude (or recklessness) to buy shares in a company that loses money and doesn't grow revenue. That is not really what the successful investors we know aim for.

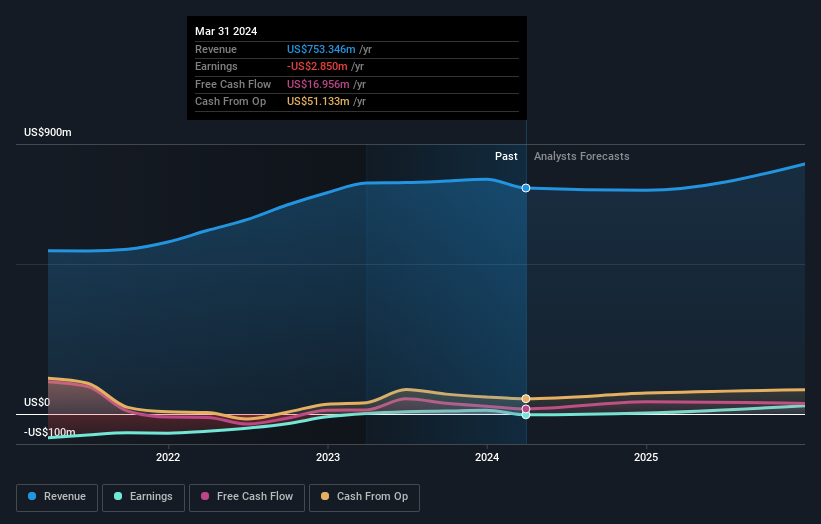

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Take a more thorough look at Oil States International's financial health with this free report on its balance sheet.

A Different Perspective

Investors in Oil States International had a tough year, with a total loss of 43%, against a market gain of about 24%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 12% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You could get a better understanding of Oil States International's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:OIS

Oil States International

Through its subsidiaries, provides engineered capital equipment and products for the energy, industrial, and military sectors worldwide.

Undervalued with excellent balance sheet.