- United States

- /

- Energy Services

- /

- NYSE:OII

Oceaneering International (OII): Valuation Review Following New Offshore Contract Win with bp Exploration

Reviewed by Simply Wall St

Oceaneering International (OII) just shared news of a contract win with bp Exploration, focused on riserless light well intervention services in the Azeri-Chirag-Deepwater Gunashli oilfield. This deal strengthens Oceaneering’s project pipeline and highlights its offshore expertise.

See our latest analysis for Oceaneering International.

Oceaneering International’s latest contract with bp builds on a year that has seen plenty of action, including a recent $10.1 million share buyback in September. While the current share price sits at $23.17, the stock’s 90-day share price return of 8.2% hints at renewed momentum. The one-year total shareholder return is still down over 20%. Over the longer term, however, shareholders are still well ahead, with a three-year total return of nearly 68% and a substantial 330% over five years.

If you’re curious what other names could be gaining momentum in industrials and energy, this is the perfect moment to step beyond the headline and discover fast growing stocks with high insider ownership

With the latest contract in hand and shares still trailing their highs, could Oceaneering be trading below its true value? Or is the market already factoring in the company’s future growth potential?

Most Popular Narrative: 3.6% Overvalued

Oceaneering International closed at $23.17, but the most-followed narrative sets its fair value just a shade lower at $22.38. As the market weighs offshore contract wins against sector headwinds, one narrative drives the valuation debate.

The ongoing global energy transition and intensifying decarbonization efforts continue to limit new offshore oil & gas developments, which threatens Oceaneering's long-term project backlog and could ultimately reduce future revenue growth as the addressable market gradually contracts. There is increasing investor and regulatory pressure to reallocate capital away from traditional oilfield service providers; this trend is likely to hinder capital flows to Oceaneering's core business lines, potentially compressing growth prospects, restraining order activity, and constraining revenue and profit expansion.

Want to know what pushes Oceaneering’s value above its price tag? There is a bold projection at play: slower future growth collides with shrinking margins. Find out which forecast numbers are fueling this dramatic valuation call. Curious? This narrative spells out the entire equation.

Result: Fair Value of $22.38 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued growth in Oceaneering’s defense contracts or a surge in high-margin robotics could quickly shift the outlook for both profits and valuation.

Find out about the key risks to this Oceaneering International narrative.

Another View: DCF Tells a Different Story

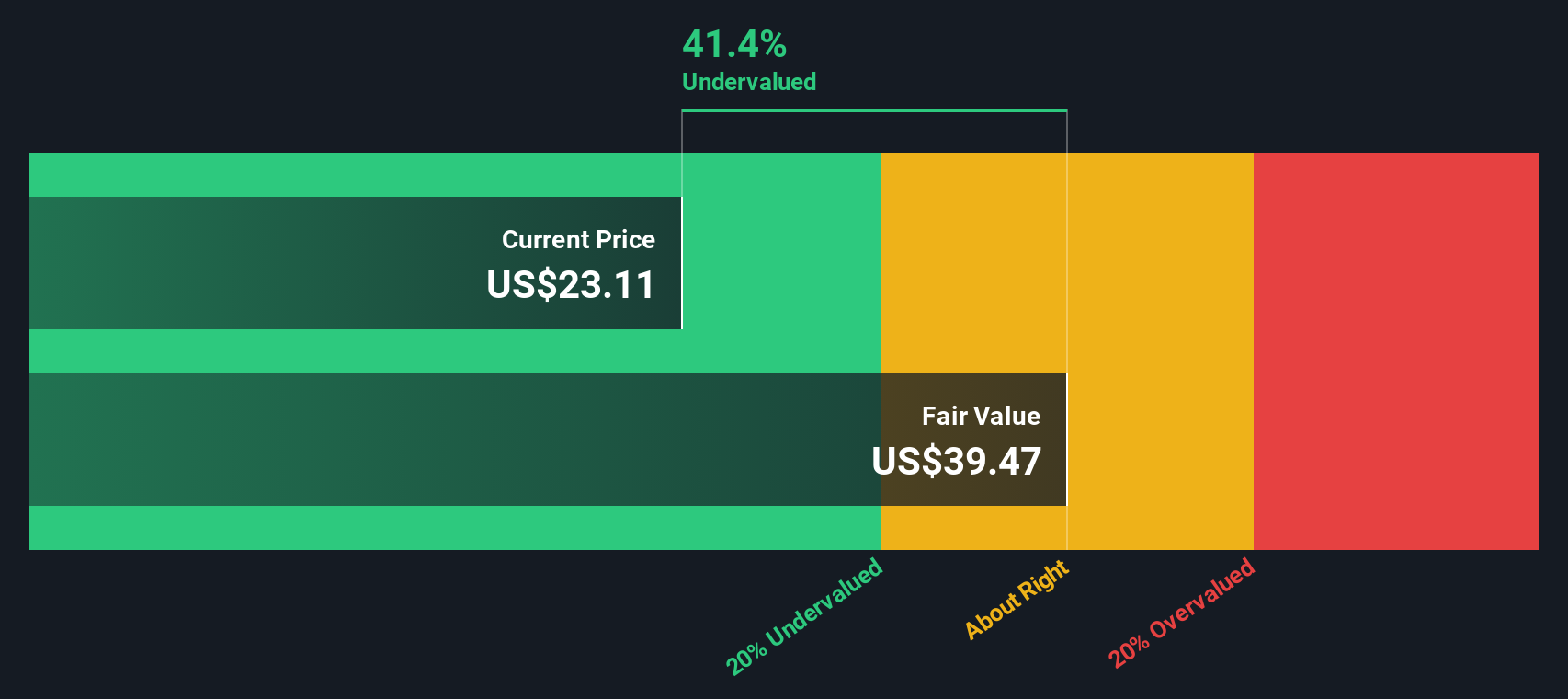

While analyst targets suggest Oceaneering is slightly overvalued, our DCF model paints a far more optimistic picture. According to this method, the shares trade nearly 48% below fair value. This sharp contrast raises the question: which method best reflects the company's real upside?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Oceaneering International Narrative

If this perspective doesn’t match your own, or you enjoy analyzing the numbers yourself, you can build a personal assessment in under three minutes. Do it your way

A great starting point for your Oceaneering International research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Compelling Investment Opportunities?

You’re on the brink of missing standout market movers. The smartest investors keep their watchlists fresh, and Simply Wall Street can surface your next breakout idea with these expert-sourced picks:

- Catch unbeatable income potential by targeting these 20 dividend stocks with yields > 3% with yields above 3% for powerful portfolio growth and regular cash flow.

- Tap into tomorrow’s technology winners and put your money behind innovation with these 25 AI penny stocks that are redefining entire industries using artificial intelligence.

- Accelerate your value strategy and grab overlooked stocks by starting your search with these 836 undervalued stocks based on cash flows based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OII

Oceaneering International

Provides engineered services and products, and robotic solutions to the offshore energy, defense, aerospace, manufacturing, and entertainment industries in the United States, Africa, the United Kingdom, Norway, Brazil, Asia, Australia, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives