- United States

- /

- Energy Services

- /

- NYSE:OII

How Investors Are Reacting To Oceaneering International (OII) Securing bp Caspian Sea Well Intervention Contract

Reviewed by Sasha Jovanovic

- Oceaneering International, Inc. recently announced that its Offshore Projects Group secured a contract from bp Exploration (Caspian Sea) Ltd. to provide riserless light well intervention services in the Azeri-Chirag-Deepwater Gunashli oilfield, with field operations expected to start in the fourth quarter of 2025.

- This new contract highlights Oceaneering's continued ability to win multi-well campaigns in major offshore development regions and further supports its project backlog.

- We'll examine how the bp contract award in the Caspian Sea contributes to the evolving investment narrative for Oceaneering International.

We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Oceaneering International Investment Narrative Recap

Oceaneering International investors must believe in the company’s ability to continually secure large offshore contracts and adapt its core business to balance cyclical energy service demand with the growth of higher-margin, less-cyclical divisions such as ADTech. While the new bp Caspian Sea contract adds visibility to Oceaneering’s project backlog, it does not materially change the immediate catalysts or near-term risks, which still hinge on sector capital spending and the pace of energy transition.

The recent third-quarter earnings announcement stands out alongside the contract win. Sales and net income rose year-over-year, and full-year net income guidance remains solid. This continued earnings improvement supports Oceaneering’s ability to withstand industry cyclicality, but caution remains warranted as project awards alone do not guarantee sustained growth if capital allocation trends shift away from traditional oil and gas.

But investors should be aware that, despite contract momentum, the risk of declining offshore oil and gas demand from decarbonization efforts...

Read the full narrative on Oceaneering International (it's free!)

Oceaneering International's outlook anticipates $3.1 billion in revenue and $185.9 million in earnings by 2028. This projection is based on an annual revenue growth rate of 4.2%, but reflects a decrease in earnings of $16.3 million from the current $202.2 million.

Uncover how Oceaneering International's forecasts yield a $22.38 fair value, a 4% downside to its current price.

Exploring Other Perspectives

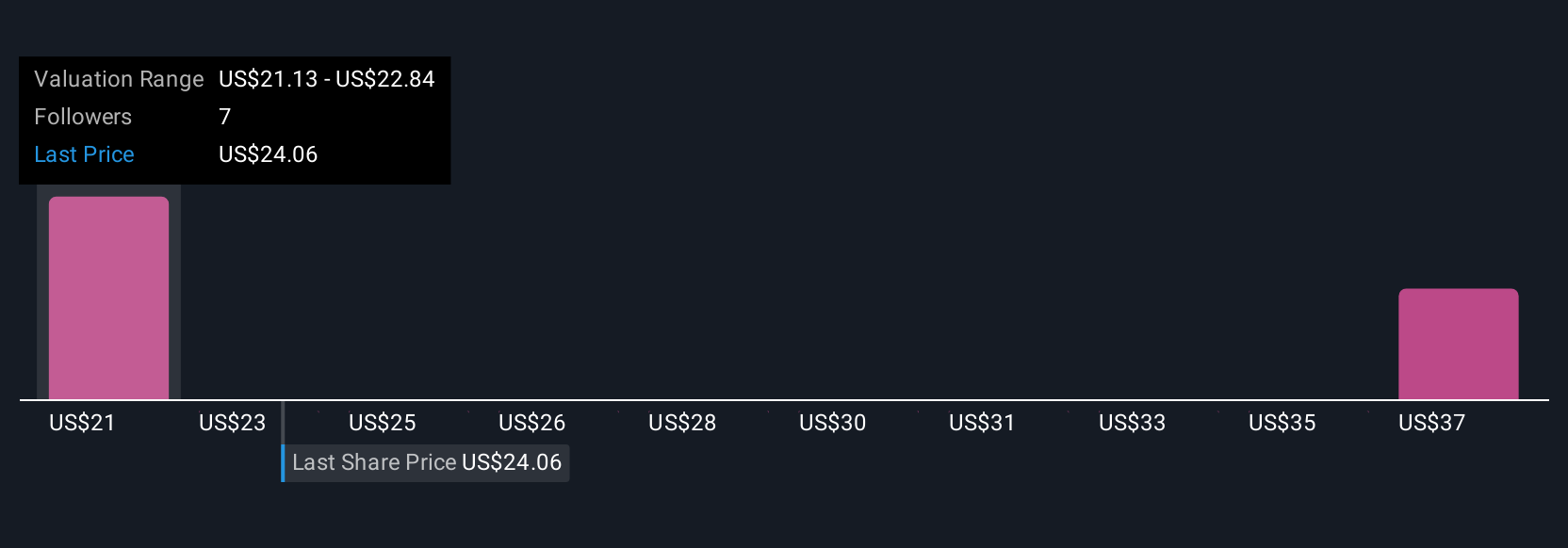

Simply Wall St Community members estimated Oceaneering’s fair value between US$21.43 and US$38.40, based on three distinct forecasts. Investor consensus still faces the challenge of capital flows moving away from traditional oilfield services, a key concern for Oceaneering’s outlook.

Explore 3 other fair value estimates on Oceaneering International - why the stock might be worth 8% less than the current price!

Build Your Own Oceaneering International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oceaneering International research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Oceaneering International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oceaneering International's overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OII

Oceaneering International

Provides engineered services and products, and robotic solutions to the offshore energy, defense, aerospace, manufacturing, and entertainment industries in the United States, Africa, the United Kingdom, Norway, Brazil, Asia, Australia, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives