- United States

- /

- Oil and Gas

- /

- NYSE:NVGS

Did Ammonia-Fueled Ship JV With Amon Maritime Just Shift Navigator Holdings' (NVGS) Investment Narrative?

Reviewed by Simply Wall St

- On July 14, 2025, Navigator Holdings formed a joint venture with Amon Maritime to construct two 51,530 cubic meter ammonia-fueled carriers in Norway, set for deliveries in 2028, with each ship also capable of carrying liquefied petroleum gas and supported by Norwegian government grants.

- This move positions Navigator Holdings at the forefront of clean shipping technology adoption and secures multi-year charters, reflecting a shift toward more sustainable and reliable revenue sources.

- We'll explore how the planned addition of ammonia-fueled vessels with long-term charters shapes Navigator Holdings' investment outlook.

Navigator Holdings Investment Narrative Recap

To be a shareholder in Navigator Holdings, one needs to believe in the firm’s ability to capitalize on the global shift to low-carbon shipping while managing near-term challenges in petrochemical trade flows. The recent joint venture with Amon Maritime could reinforce longer-term revenue streams through secured charters but does not materially alter the most important catalyst, which is expanded capacity at Morgan's Point, nor does it reduce nearer-term risks tied to potential slowdowns in US natural gas liquids production or contract repricing across the fleet.

Among the company’s latest updates, the completion of the Morgan's Point terminal expansion is especially relevant. With ethylene export capacity tripling, this supports Navigator Holdings’ efforts to boost recurring revenue, although the pace at which additional contract volumes are secured may depend on the same market forces that create risk for new order investment and competition.

However, investors should also be mindful that while new chartered, ammonia-fueled vessels offer long-term revenue clarity, ongoing exposure to US NGL supply trends means...

Read the full narrative on Navigator Holdings (it's free!)

Navigator Holdings' outlook suggests $494.1 million in revenue and $138.0 million in earnings by 2028. This implies an annual revenue decline of 4.5% and an earnings increase of $52.4 million from current earnings of $85.6 million.

Exploring Other Perspectives

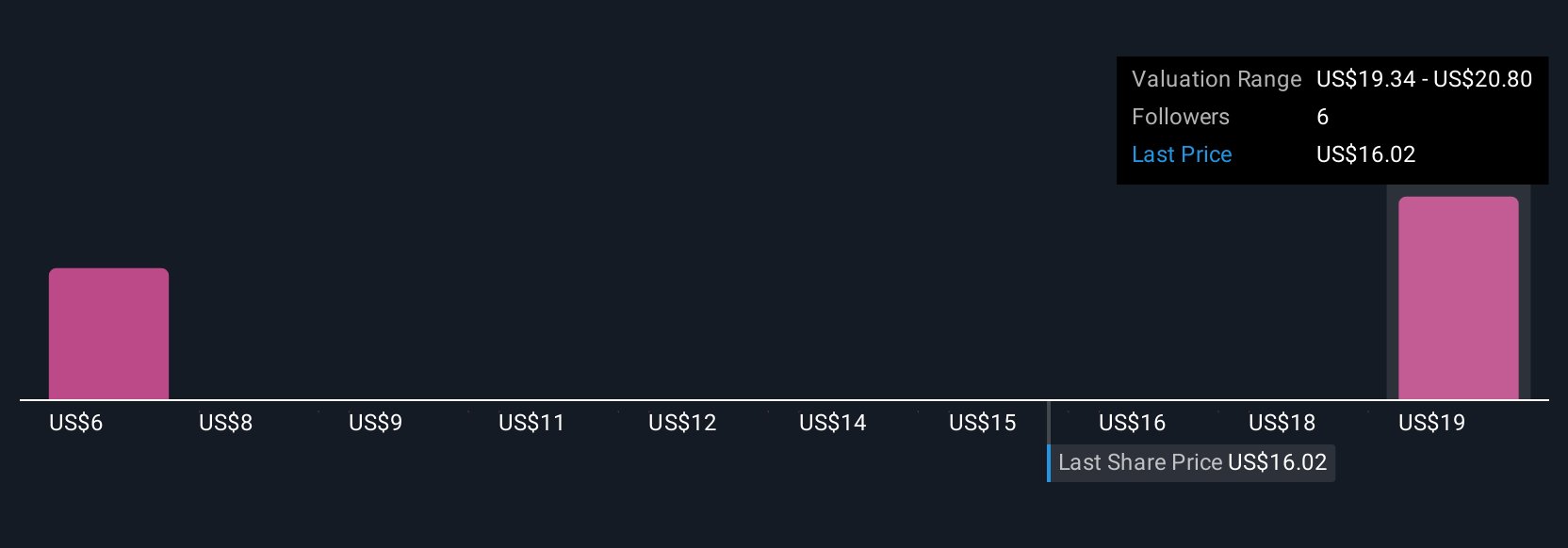

Two members of the Simply Wall St Community estimate fair values between US$6.20 and US$22.25 for Navigator Holdings. While these views vary widely, the expanded ethylene export capacity remains the key catalyst shaping many performance expectations.

Build Your Own Navigator Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Navigator Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Navigator Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Navigator Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 26 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Navigator Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NVGS

Navigator Holdings

Owns and operates a fleet of liquefied gas carriers worldwide.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives