- United States

- /

- Oil and Gas

- /

- NYSE:NRT

Should You Be Adding North European Oil Royalty Trust (NYSE:NRT) To Your Watchlist Today?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like North European Oil Royalty Trust (NYSE:NRT). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide North European Oil Royalty Trust with the means to add long-term value to shareholders.

View our latest analysis for North European Oil Royalty Trust

How Fast Is North European Oil Royalty Trust Growing Its Earnings Per Share?

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So for many budding investors, improving EPS is considered a good sign. It is awe-striking that North European Oil Royalty Trust's EPS went from US$0.93 to US$3.29 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

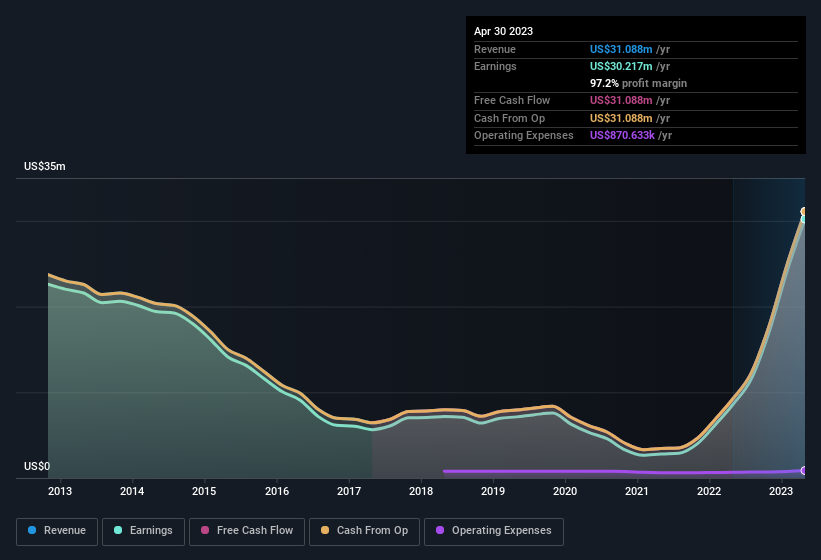

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that North European Oil Royalty Trust is growing revenues, and EBIT margins improved by 4.4 percentage points to 97%, over the last year. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

North European Oil Royalty Trust isn't a huge company, given its market capitalisation of US$112m. That makes it extra important to check on its balance sheet strength.

Are North European Oil Royalty Trust Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. For companies with market capitalisations under US$200m, like North European Oil Royalty Trust, the median CEO pay is around US$747k.

The CEO of North European Oil Royalty Trust only received US$140k in total compensation for the year ending October 2022. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does North European Oil Royalty Trust Deserve A Spot On Your Watchlist?

North European Oil Royalty Trust's earnings per share have been soaring, with growth rates sky high. With increasing profits, its seems likely the business has a rosy future; and it may have hit an inflection point. What's more, the fact that the CEO's compensation is quite reasonable is a sign that the company is conscious of excessive spending. So North European Oil Royalty Trust looks like it could be a good quality growth stock, at first glance. That's worth watching. Still, you should learn about the 2 warning signs we've spotted with North European Oil Royalty Trust.

Although North European Oil Royalty Trust certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if North European Oil Royalty Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NRT

North European Oil Royalty Trust

A grantor trust, holds overriding royalty rights covering gas and oil production in various concessions or leases in the Federal Republic of Germany.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives