- United States

- /

- Oil and Gas

- /

- NYSE:NRP

Natural Resource Partners (NRP): Exploring Valuation After Recent Period of Share Price Stability

Reviewed by Simply Wall St

See our latest analysis for Natural Resource Partners.

Despite a quiet month for the share price, Natural Resource Partners has built significant wealth for longer-term holders. The company posted a 2.31% total shareholder return over the past year and an impressive 892.56% over five years. Recent stability suggests that investors may be reassessing both growth prospects and risks after a period of remarkable gains.

If you’re curious to see what else is capturing investor attention right now, it could be the perfect time to broaden your perspective and discover fast growing stocks with high insider ownership

With solid returns on the table and a recent stretch of calm in the share price, the big question is whether Natural Resource Partners is trading at a bargain or if the market has already factored in all its future potential.

Price-to-Earnings of 9.4x: Is it justified?

Natural Resource Partners’ price-to-earnings ratio of 9.4x stands out sharply against peers, suggesting the market may be overlooking the company’s value at the current share price of $103.69.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each dollar of earnings. For a business like NRP, which has recently reported robust profits, the P/E ratio is a critical signal of market sentiment and expectations around future earnings stability.

NRP’s P/E comes in well below the peer average of 20.6x and is also significantly lower than the broader US Oil and Gas industry average of 13.9x. This substantial discount implies that the market is pricing NRP’s earnings at much lower multiples than competitors, a gap that could narrow if the company delivers steadier or stronger results in the coming periods.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 9.4x (UNDERVALUED)

However, market sentiment could shift if the company faces revenue declines or misses on net income growth. This could potentially challenge the undervaluation viewpoint.

Find out about the key risks to this Natural Resource Partners narrative.

Another View: SWS DCF Model Signals Deeper Undervaluation

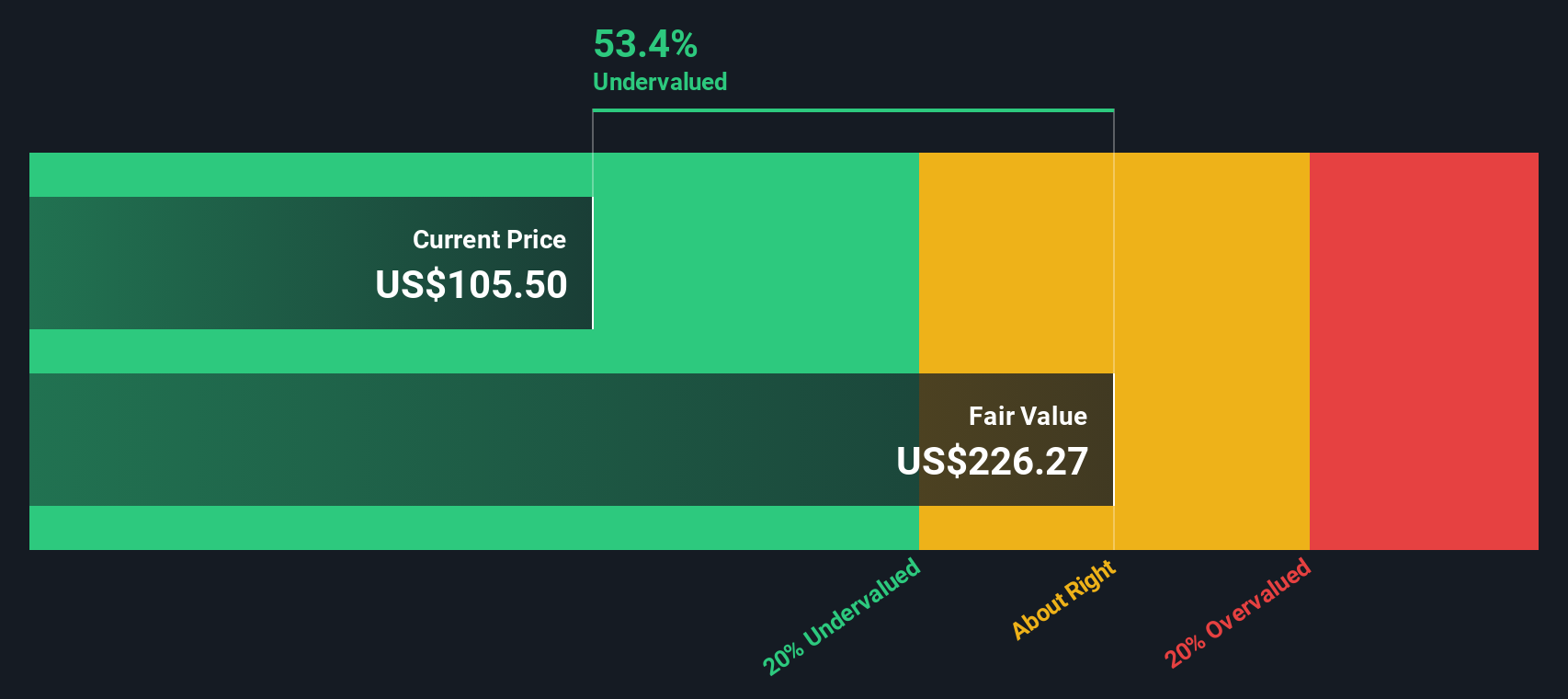

While the low price-to-earnings ratio points to value, our DCF model draws a starker picture. It suggests Natural Resource Partners is trading at a 54.2% discount to its estimated fair value, meaning the market may be overlooking meaningful upside if fundamentals hold up. Could the gap persist? Will investors take notice?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Natural Resource Partners for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 886 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Natural Resource Partners Narrative

If you have another angle or want to dig into the numbers firsthand, you can quickly shape your own story around Natural Resource Partners in just a few minutes. Do it your way

A great starting point for your Natural Resource Partners research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Ready for New Investment Opportunities?

Don’t let your next big winner slip by. The best ideas often come from looking beyond the obvious, and using robust tools to spot value others miss.

- Unlock the upside of undervalued companies with strong cash flow potential by starting your search through these 886 undervalued stocks based on cash flows.

- Capitalize on the rise of artificial intelligence by examining these 25 AI penny stocks with leading-edge technology and high growth profiles.

- Secure long-term passive income by focusing on these 16 dividend stocks with yields > 3% offering reliable yields above 3% for a stronger portfolio foundation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Natural Resource Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NRP

Natural Resource Partners

Owns, manages, and leases a portfolio of mineral properties in the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives