- United States

- /

- Energy Services

- /

- NYSE:NOV

NOV (NOV) Margin Miss Reinforces Investor Concerns on Profitability and Dividend Sustainability

Reviewed by Simply Wall St

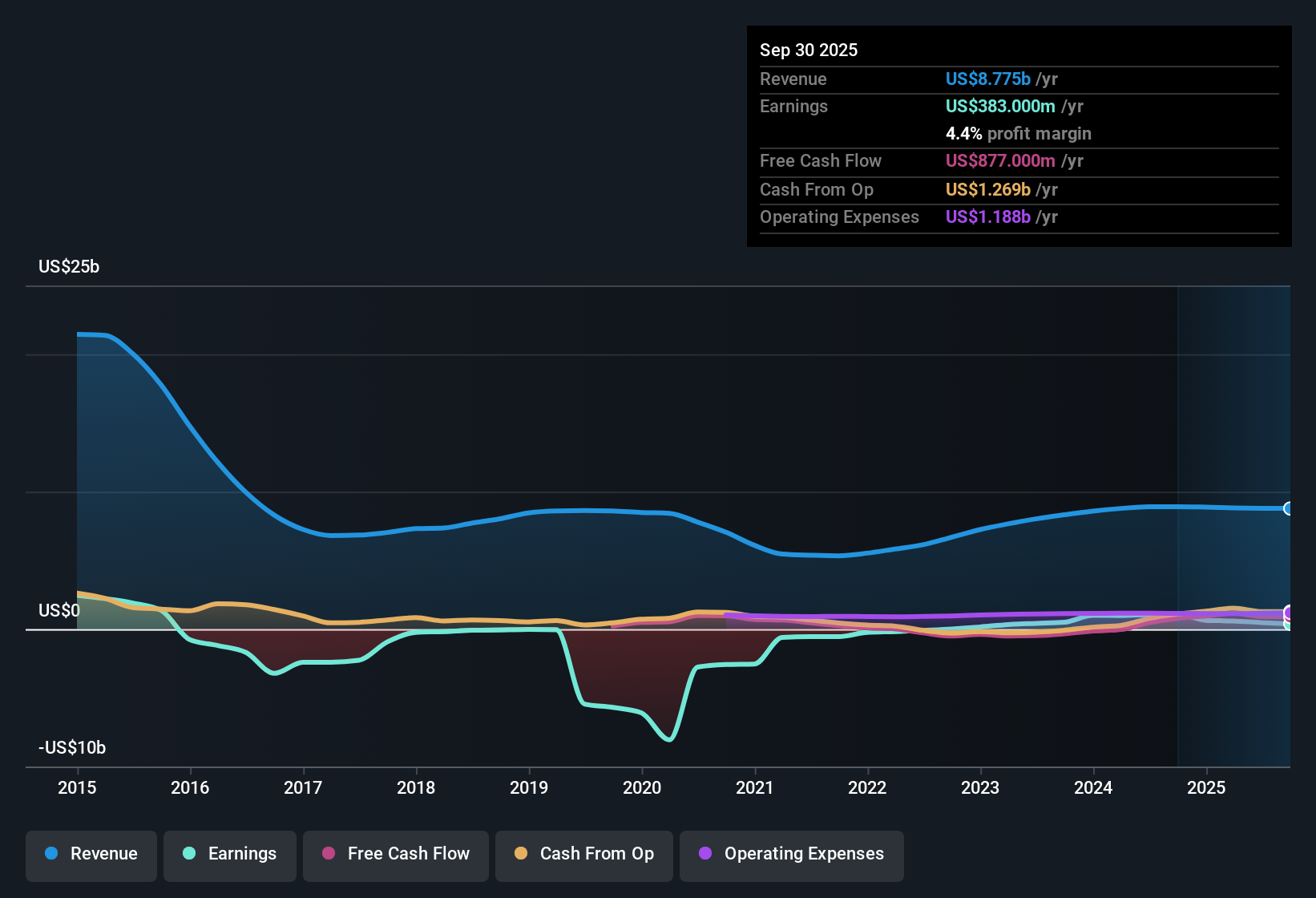

NOV (NOV) posted net profit margins of 4.4%, down from last year’s 12%. Earnings have surged by an impressive 73% per year over the past five years, and NOV has now achieved consistent profitability. While revenue is forecast to grow at a modest 1.2% annually, annual earnings are projected to increase by 9.6%. Investors are weighing the softer margins and dividend sustainability against NOV’s solid history of earnings growth and attractive valuation.

See our full analysis for NOV.Next, we will set NOV’s performance and profit metrics against the market narratives that shape investor sentiment. This will highlight where the latest numbers confirm expectations and where they raise fresh questions.

See what the community is saying about NOV

Margin Pressure Lingers Despite Cost Cuts

- Net profit margins are currently at 4.4%, materially down from last year’s 12%. Cost reductions of $100 million annually are targeted by late 2026 to support profitability.

- Consensus narrative notes that industry inflation, global supply disruptions, and more price-sensitive customers threaten NOV's ability to achieve margin recovery. Automation and digital investments are underway to address these challenges.

- Analysts expect profit margins to gradually increase from 5.4% today to 6.1% in three years. However, margin expansion may be a slow climb in light of competitive price pressure and delayed offshore project orders.

- The focus on cost cutting and process improvement is seen as a buffer. Any sustained market or commodity weakness could make margin progress hard to sustain.

- Recent results reinforce analysts’ concerns that margin upside will be a challenge to capture over the medium term, lending support to the more cautious consensus view that recovery will take time. 📊 Read the full NOV Consensus Narrative.

Market Share Opportunities Outside North America

- Analysts forecast NOV’s revenue to decrease by 0.7% annually over the next three years. However, they point to accelerating offshore and international activity, such as deepwater and LNG infrastructure builds, as major catalysts for longer-term growth.

- The consensus narrative highlights that expansion in global offshore drilling and non-North American resource projects could offset stagnant North American demand. This could create a platform for broader technology sales and higher aftermarket revenue.

- Expected gains from advanced drilling and production tech are positioned to capture new demand if major project backlogs clear starting in 2026.

- International energy security investments, along with a push for automation and digital solutions, could boost structural revenue and recurring sales even as some geographic regions lag.

Attractive Valuation Versus Peers and DCF Fair Value

- NOV’s price-to-earnings ratio stands at 14.5x, below both the US Energy Services industry average of 16.3x and the peer group average of 37.5x. The current share price of $14.95 trades nearly 30% below the DCF fair value of $21.20.

- According to the consensus narrative, these discounted multiples and the fair value gap heavily support the investment case for value-oriented investors. However, analysts see the sector’s margin and growth risks as weighing on NOV’s near-term rerating.

- The consensus analyst price target of $15.30 is 2.3% above today’s share price, indicating modest upside if moderate growth assumptions play out. There could be larger potential if sector tailwinds return.

- Uncertainty in aftermarket performance, global trade policy, and macro demand remain flagged as factors that could keep NOV on the wrong side of industry multiples if those headwinds persist.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for NOV on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the figures? Share your insights and shape your narrative in just a few minutes, then Do it your way.

A great starting point for your NOV research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

NOV’s pressured margins, sluggish revenue outlook, and uncertain pace of recovery highlight risks for investors seeking steady and reliable results.

If you want companies showing consistent success through different market cycles, use our stable growth stocks screener (2116 results) to focus on businesses delivering sustainable growth and resilient performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NOV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NOV

NOV

Designs, constructs, manufactures, and sells systems, components, and products for oil and gas drilling and production, and industrial and renewable energy sectors in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives