- United States

- /

- Oil and Gas

- /

- NYSE:NGL

NGL Energy Partners (NGL): Valuation in Focus Following Strong Q2 Results and Water Solutions Growth

Reviewed by Simply Wall St

NGL Energy Partners (NGL) just posted stronger-than-expected second-quarter numbers, along with a positive update from its Water Solutions segment. Management also detailed new steps in lowering debt and supporting growth, moves investors have been waiting to see.

See our latest analysis for NGL Energy Partners.

NGL Energy Partners’ efforts to streamline its balance sheet and grow its high-margin Water Solutions segment have fueled a dramatic shift in sentiment, especially as energy markets remain choppy. The stock has surged with an 80% 3-month share price return and a 108% total shareholder return over the past year, signaling strong momentum and growing investor confidence in the turnaround story.

If NGL’s rebound has you rethinking your strategy, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

Yet with NGL Energy Partners' stock soaring and its turnaround gaining attention, investors are left to wonder if all the potential upside has already been reflected, or whether the current price still offers a buying opportunity as the market considers future growth.

Price-to-Sales of 0.4x: Is it justified?

NGL Energy Partners trades at a 0.4x price-to-sales ratio, notably undercutting the averages seen in both its industry and among peer companies. At a last close price of $9.83, the stock is positioned well below the US Oil and Gas sector’s average, signaling apparent value for investors benchmarking by sales multiples.

The price-to-sales ratio captures what the market is willing to pay for each dollar of company revenue. For a diversified energy business like NGL, which operates through Water Solutions, Crude Oil Logistics, and Liquids Logistics, this multiple provides a snapshot of how reliably revenue converts to future growth or profitability. This is an especially relevant metric given volatile earnings across the sector.

This low multiple signals the market may be underestimating NGL’s recovery and growth trajectory. Compared with the US Oil and Gas industry’s average of 1.5x, and a peer average of 1.9x, NGL’s shares look discounted. However, it's important to note that the stock is trading above the estimated fair price-to-sales ratio of 0.3x, a level the market could move toward if sentiment shifts or forecasts change.

Explore the SWS fair ratio for NGL Energy Partners

Result: Price-to-Sales of 0.4x (UNDERVALUED)

However, slowing annual revenue growth and ongoing net losses could challenge NGL's current momentum if operational improvements do not accelerate from this point.

Find out about the key risks to this NGL Energy Partners narrative.

Another View: Discounted Cash Flow Tells a Different Story

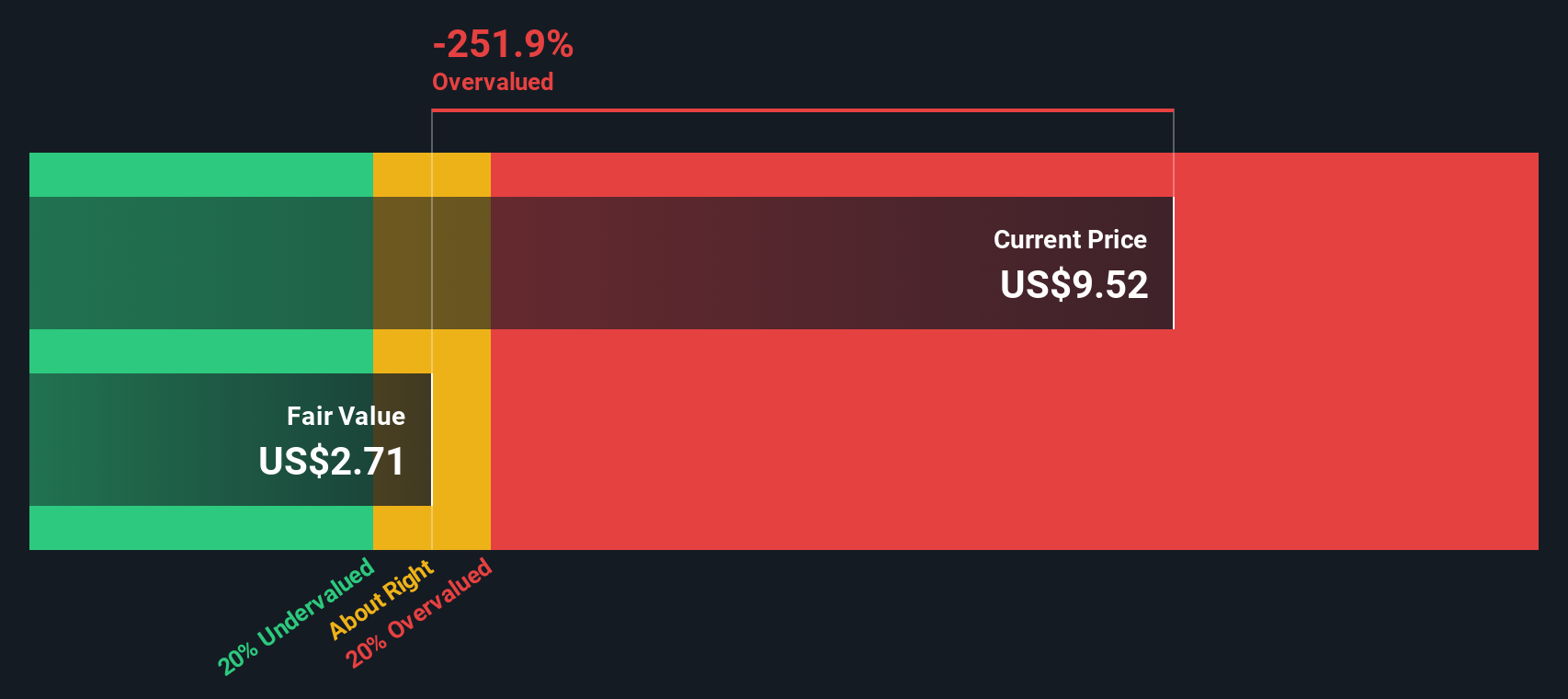

Looking at NGL Energy Partners through the lens of our DCF model offers a marked contrast. The SWS DCF model estimates fair value at $2.71, which is significantly below the current price of $9.83. This suggests the market may be getting ahead of itself. Could the share price be overestimating the pace or certainty of a turnaround?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NGL Energy Partners for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 916 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NGL Energy Partners Narrative

If you think there’s more to the story, or want to dig into the numbers yourself, it’s easy to build your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding NGL Energy Partners.

Looking for more investment ideas?

Smart investors know opportunity is everywhere. Don’t let a great pick slip past you. Strengthen your portfolio by finding stocks that match your goals and interests.

- Jump on breakthroughs in artificial intelligence by analyzing these 25 AI penny stocks companies at the forefront of machine learning and automation.

- Act on potential bargains by reviewing these 916 undervalued stocks based on cash flows that trade below their real value based on strong fundamentals and future cash flows.

- Seize reliable income streams by checking out these 15 dividend stocks with yields > 3% offering attractive yields above 3% for stable, long-term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NGL Energy Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NGL

NGL Energy Partners

Engages in the transportation, storage, blending, and marketing of crude oil, natural gas liquids, refined products/renewables, and water solutions in the United States.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026