- United States

- /

- Energy Services

- /

- NYSE:NE

Noble (NE) Margins Fall to 6.9%, Challenging Bullish Earnings Narratives

Reviewed by Simply Wall St

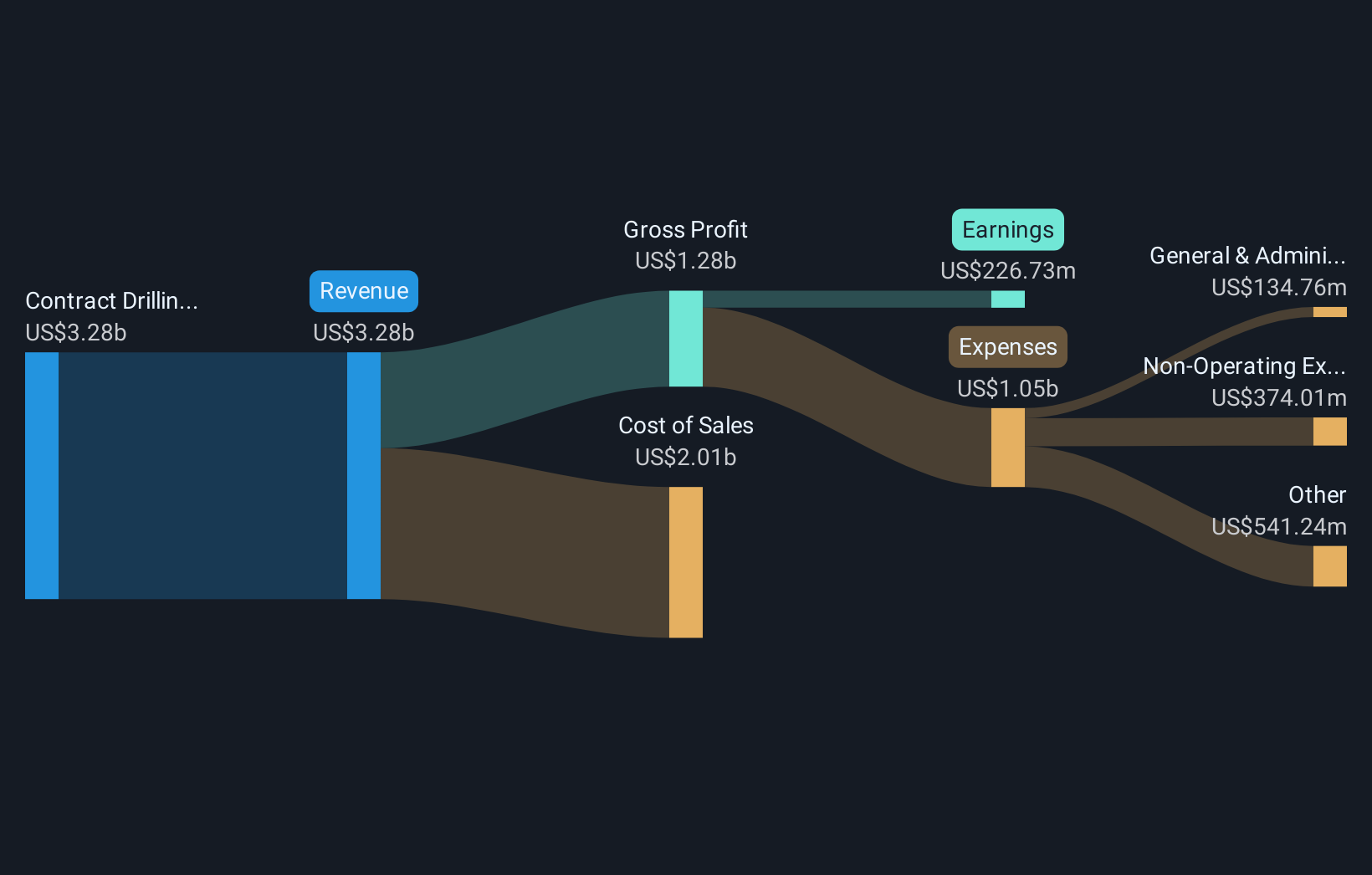

Noble (NE) posted a mixed set of results this quarter, with forecasted earnings set to climb 29.65% per year for the next three years. This pace sharply outpaces the broader US market’s 15.6% growth rate. Despite achieving an impressive 72.1% average annual earnings growth over the last five years and recently turning profitable, Noble’s latest year saw both negative earnings growth and a contraction in net profit margins. Net profit margins now stand at 6.9% compared to 19% previously. Revenue growth is projected at just 1.7% per year, which is well behind the US market average. The spotlight remains on margin pressure as investors weigh future upside potential against these setbacks.

See our full analysis for Noble.Next up, we’ll size up these headline figures against some of the most talked-about narratives to see which stories hold up and which ones get put to the test.

See what the community is saying about Noble

Guidance Hinges on Analyst Disagreement

- Analysts expect earnings to reach $351.2 million, or $2.38 per share, by September 2028, with views ranging widely from $228 million at the bearish end to $519 million at the bullish end.

- According to analysts' consensus view, upside could be driven by large offshore project pipelines and sector consolidation, supporting higher rig utilization and revenue.

- However, the considerable split in analyst forecasts highlights the unpredictability of industry recovery and introduces more uncertainty into the company’s growth path.

- Consensus notes sustained global demand for hydrocarbons and fleet modernization as potential long-term tailwinds, but also acknowledges risk if demand recovery is delayed or project pipelines slip.

- To see how these diverging analyst perspectives are shaping the bigger story, read the full narrative for Noble. 📊 Read the full Noble Consensus Narrative.

Premium PE Amid Market Risks

- Noble trades at a price-to-earnings ratio of 21x, above both the Energy Services industry average of 16.3x and the peer group’s 17.5x.

- Consensus narrative notes that, while premium multiples can reflect market confidence in future earnings growth, higher PE ratios heighten expectations and raise the stakes if margins fall short.

- Notably, analysts model a future PE of 19.1x by 2028, which is still above the industry’s 15.0x. This means investors anticipating a rerating may not see one even if growth materializes.

- Critics highlight that margin contraction and an industry pressured by weak spending could expose the share price to sharper downside if profit recovery lags forecasts.

DCF Valuation Flags Deep Discount

- The current share price of $29.95 is significantly below the DCF fair value estimate of $51.81.

- Analysts’ consensus narrative suggests that this discount could signal a value opportunity for those who believe in the company's long-term project pipeline and margin improvement, but that fair value depends on management executing successfully through market turbulence.

- There is a clear tension for investors: the valuation gap appears attractive, but it only closes if revenue actually rebounds and margins recover as forecasted.

- The price target based on consensus ($33.60) is also modestly above today’s price, so the market appears cautious about assuming a quick return to sector highs.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Noble on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the figures with a different perspective? Craft your viewpoint and put your stamp on the Noble story in just a few minutes. Do it your way

A great starting point for your Noble research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Noble’s volatile margins, inconsistent revenue growth, and exposure to sector swings could leave investors wary of future performance and stability.

If you want steadier returns, use stable growth stocks screener (2115 results) to focus on companies that consistently deliver solid results regardless of market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Noble might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NE

Noble

Operates as an offshore drilling contractor for the oil and gas industry worldwide.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives