- United States

- /

- Energy Services

- /

- NYSE:NBR

Lacklustre Performance Is Driving Nabors Industries Ltd.'s (NYSE:NBR) Low P/S

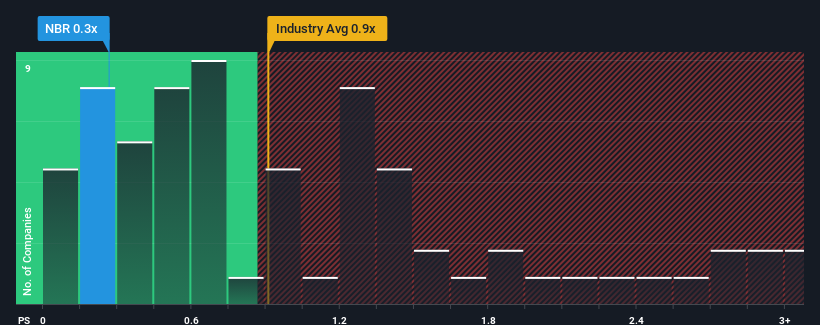

Nabors Industries Ltd.'s (NYSE:NBR) price-to-sales (or "P/S") ratio of 0.3x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Energy Services industry in the United States have P/S ratios greater than 0.9x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Nabors Industries

How Has Nabors Industries Performed Recently?

Nabors Industries' revenue growth of late has been pretty similar to most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. Those who are bullish on Nabors Industries will be hoping that this isn't the case.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Nabors Industries.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Nabors Industries' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 25%. As a result, it also grew revenue by 26% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 3.9% over the next year. That's shaping up to be materially lower than the 13% growth forecast for the broader industry.

In light of this, it's understandable that Nabors Industries' P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Nabors Industries' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Nabors Industries with six simple checks.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Nabors Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NBR

Nabors Industries

Provides drilling and drilling-related services for land-based and offshore oil and natural gas wells in the United States and internationally.

Fair value with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives