- United States

- /

- Oil and Gas

- /

- NYSE:MTDR

Matador Resources (MTDR): Profit Margin Decline Challenges Bullish Narrative Despite Low Valuation

Reviewed by Simply Wall St

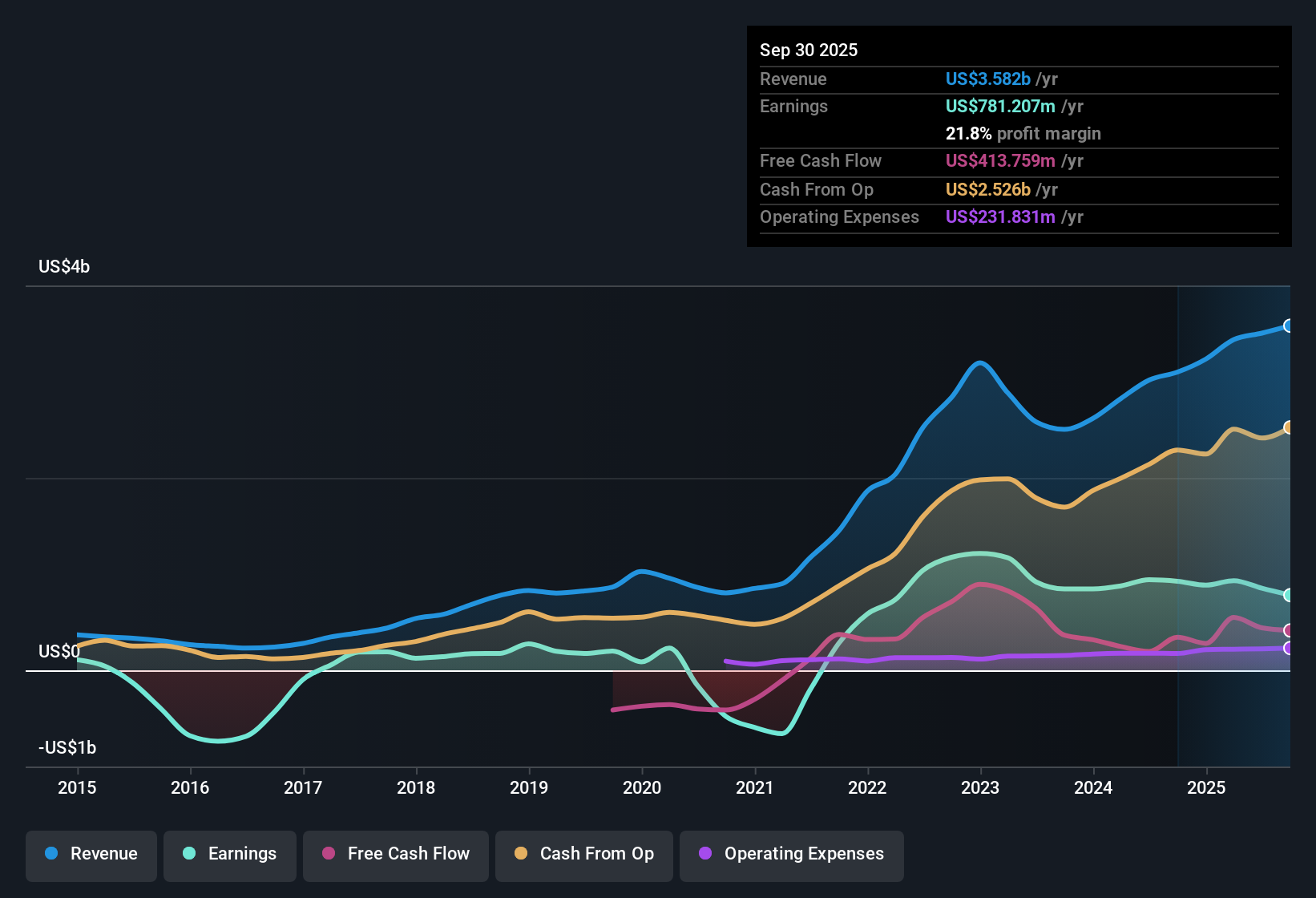

Matador Resources (MTDR) reported net profit margins of 22%, down from 29.9% a year ago, highlighting a contraction in profitability. While the company became profitable over the past five years with a robust 32.6% annual earnings growth rate, recent statements make clear that earnings growth has turned negative year-over-year. Investors watching closely may note that, despite currently trading at a Price-to-Earnings Ratio of 6.3x, which is below both peer and industry averages, the company’s forecasted earnings growth of 7.02% and revenue growth of 6.2% per year lag the broader US market, capping the upside of an otherwise attractive value profile.

See our full analysis for Matador Resources.Next, we'll see how the latest results stack up against the most common narratives about Matador, examining where the numbers fit and where they challenge investor expectations.

See what the community is saying about Matador Resources

DCF Fair Value Far Outpaces Analysts’ Target

- DCF fair value is $125.05, which is more than triple the current share price of $39.68 and nearly double the analysts' consensus target of $61.56. This represents a much wider valuation gap than peer companies typically display.

- Analysts' consensus narrative emphasizes that the share price is materially lower than their $61.56 target, reflecting expectations of ongoing, though slowing, earnings and revenue growth.

- Consensus highlights that future profit margins are expected to fall to 19.5% in three years, and earnings are forecast to slip slightly by 2028 despite top-line revenues climbing to $4.3 billion.

- This narrative notes that for the consensus target to be met, Matador would need to trade at a price-to-earnings ratio of 11.9x, almost double today’s 6.3x. This suggests that either share price expansion or multiple re-rating must occur to justify the target.

Rapidly closing the DCF gap could upend consensus expectations for Matador, as sustained undervaluation and margin risk both pull against a higher multiple. 📊 Read the full Matador Resources Consensus Narrative.

Margin Declines Test Growth Momentum

- Net profit margin compressed from 29.9% last year to 22% currently, while analyst models project a further decline toward 19.5% in three years. This shows rapid margin erosion even amid forecast revenue growth.

- According to the analysts' consensus narrative, midstream expansion and operational efficiencies are expected to help stabilize margins, but concentrated asset exposure increases the stakes if drilling costs or regulations rise.

- Consensus points to Matador’s aggressive cost controls and multi-zone Delaware Basin development as supportive factors, though margin headwinds will test whether these improvements are enough to offset industry pressures.

- Persistent cost inflation or any regulatory change could pressure both operating leverage and cash flow, causing actual margins to diverge from even cautious consensus forecasts.

Peer Discount Deepens but Growth Lags Market

- Matador’s price-to-earnings ratio of 6.3x trades at a sizable discount to both peer (11.1x) and US Oil and Gas industry (12.9x) multiples, even though forecasted earnings growth of 7.02% annually trails the wider US market.

- The analysts' consensus narrative contends that this valuation gap offers attractive relative value for long-term investors, but slower projected growth and narrow asset concentration could limit re-rating potential.

- Consensus explicitly challenges the idea that cheapness alone guarantees upside, flagging that further margin contraction or adverse events in the Delaware Basin could prevent Matador from closing the valuation gap versus peers.

- Improved capital allocation, including buybacks and rising dividends, is highlighted by consensus as a way Matador may sustain investor returns even if growth remains below broader markets.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Matador Resources on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the data from a different angle? Share your take in just minutes and shape a narrative that reflects your viewpoint: Do it your way

A great starting point for your Matador Resources research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Matador’s shrinking profit margins, slower earnings growth, and concentrated asset exposure present real challenges to sustaining consistent upward momentum.

If you’re looking for companies that keep growing with fewer surprises, check out stable growth stocks screener (2093 results) to discover businesses delivering reliable gains year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTDR

Matador Resources

An independent energy company, engages in the acquisition, exploration, development, and production of oil and natural gas resources in the United States.

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives