- United States

- /

- Oil and Gas

- /

- NYSE:MTDR

Assessing Matador Resources After 25% Pullback and Surge in Free Cash Flow Projections

Reviewed by Bailey Pemberton

If you are sitting on the fence about what to do with Matador Resources stock, you are far from alone. Investors have witnessed the share price surge by an eye-popping 405.7% over the past five years, delivering hefty returns to those who stuck around for the whole ride. But lately, the mood has shifted a bit. The stock has slipped 25.9% year-to-date and is down 9.5% in the past month alone, despite a small 2.0% uptick this past week. This kind of volatility leaves many wondering whether the company is facing a change in risk perception or if there are fresh opportunities brewing under the surface.

Industry watchers and investors are buzzing about Matador’s valuation, especially after the stock now scores a perfect 6 out of 6 on undervaluation checks. That’s not something you see every day and signals that Matador is potentially flying under the radar for value-focused investors. With recent market shifts in the energy sector and commodity price swings, it’s no wonder many are eager to dig deeper.

So, how do we make sense of these numbers and really know if Matador Resources is a bargain, or if the risks are too big to ignore? Let’s walk through the classic valuation approaches that professionals use to size up a stock. At the end of the article, I’ll share an even smarter way to look at value.

Why Matador Resources is lagging behind its peers

Approach 1: Matador Resources Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. For Matador Resources, this approach relies on forecasting how much cash the business could generate in the coming years and then adjusting for the time value of money.

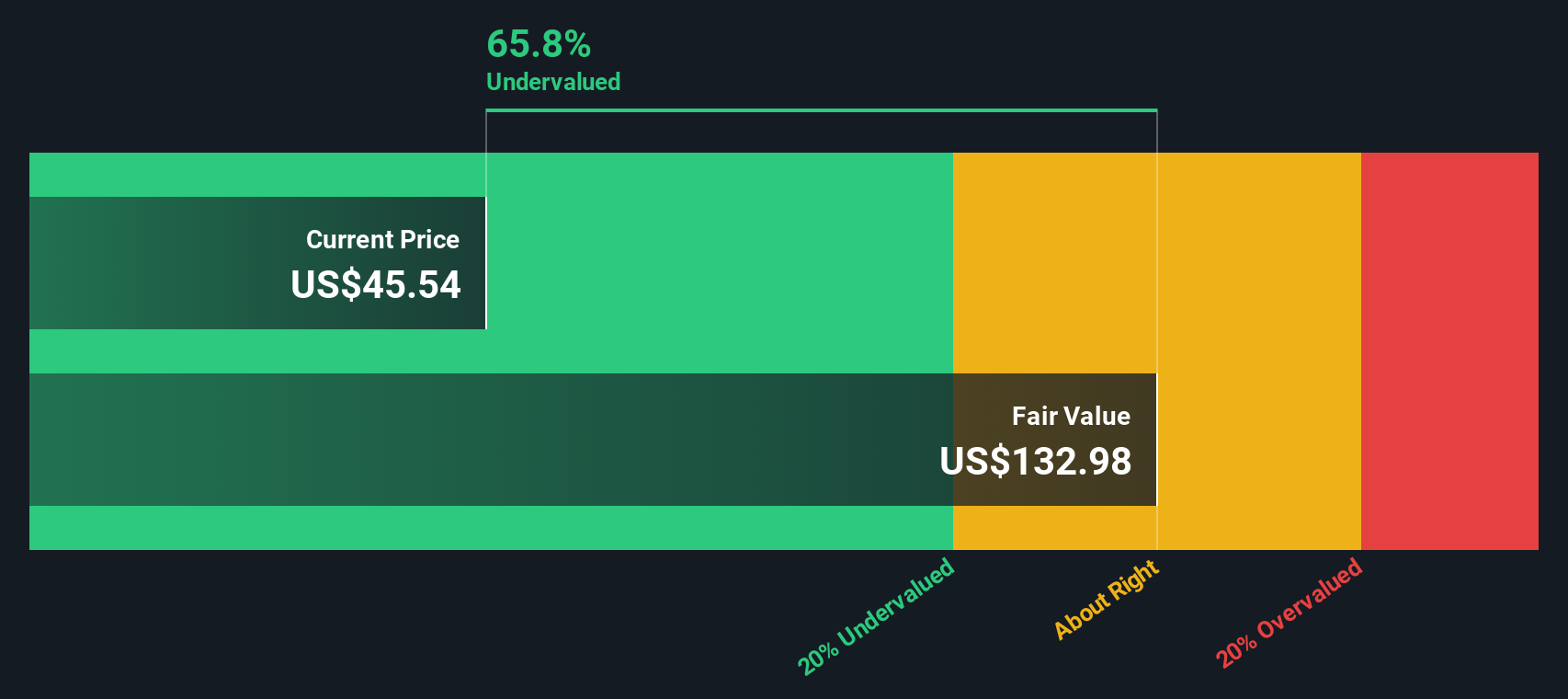

Matador’s most recent Free Cash Flow stands at $464.4 million. Analysts provide detailed predictions for the next five years, with free cash flow expected to rise to $910.4 million by 2029. Beyond that, Simply Wall St extrapolates further growth, giving investors a longer-term perspective. All financial figures are in US dollars and suggest steady cash generation well into the next decade.

Based on these forecasts and the 2 Stage Free Cash Flow to Equity model, Matador’s intrinsic value is calculated at $138.33 per share. This represents a striking 68.9% discount to the current trading price, meaning the stock appears significantly undervalued according to this DCF analysis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Matador Resources is undervalued by 68.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Matador Resources Price vs Earnings

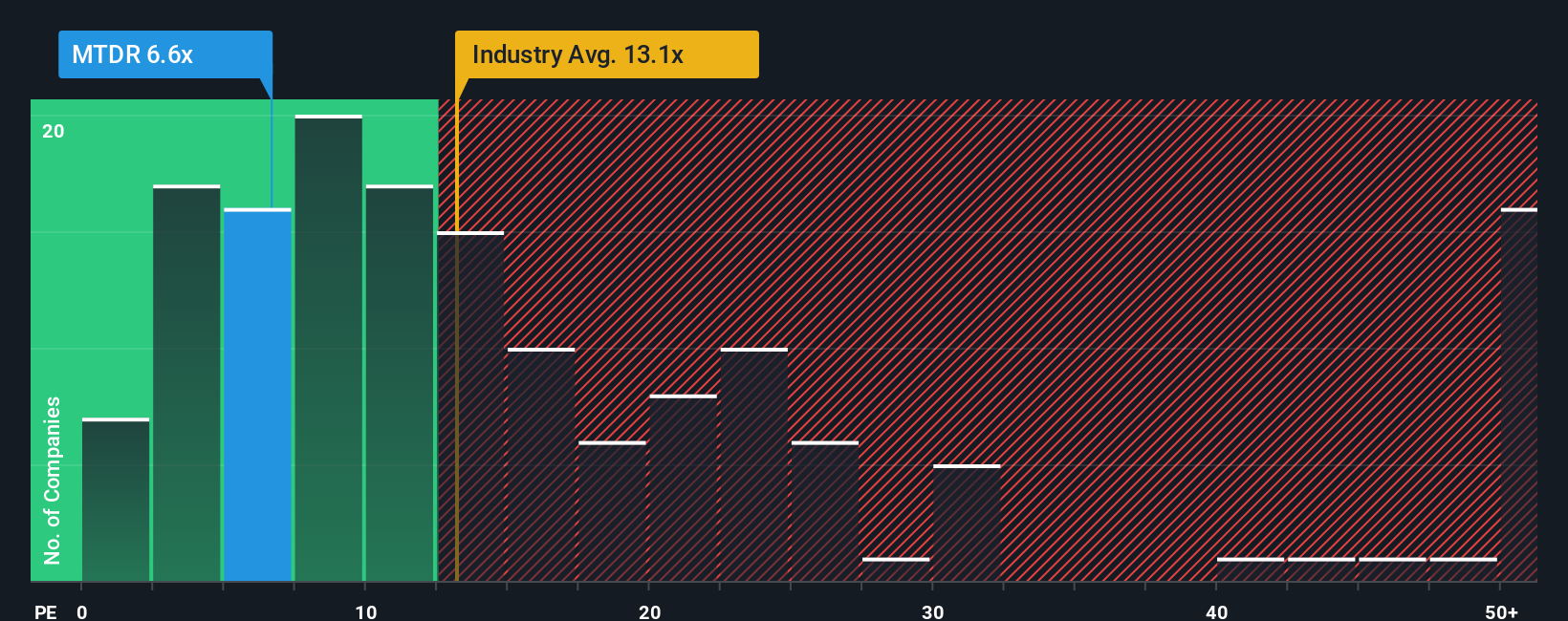

The Price-to-Earnings (PE) ratio is a classic valuation tool and a great starting point when assessing profitable companies like Matador Resources. The PE ratio tells investors how much they are paying for each dollar of current earnings, making it especially useful when comparing similar companies in the same industry.

Expectations for future earnings growth and a company's risk profile both play a big role in what PE ratio is considered "normal." A higher anticipated growth rate or lower risk would usually justify a higher PE multiple. Conversely, slower growth or higher risk means a lower ratio is more acceptable.

Currently, Matador Resources is trading at a PE ratio of 6.3x. For context, the oil and gas industry as a whole averages 12.6x, and Matador's peers have an average of 11.1x. This puts Matador noticeably below both benchmarks.

The Fair Ratio from Simply Wall St offers a different perspective. Unlike simple averages, the Fair Ratio is a proprietary measure that incorporates company-specific factors such as Matador’s growth outlook, industry, profit margins, market cap, and risk profile. This approach provides a more nuanced benchmark than a standard peer or industry comparison.

For Matador, the Fair Ratio is 15.2x, which is well above the current PE. This suggests the stock appears not just inexpensive compared to peers and the industry but is also trading below a level that might be considered fair value, based on its specific fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Matador Resources Narrative

Earlier, we mentioned there’s an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative connects your perspective or "story" about a company’s future, such as your forecasts for revenue, earnings, and profit margins, to an actual fair value. This bridges the gap between what you believe and what the numbers say.

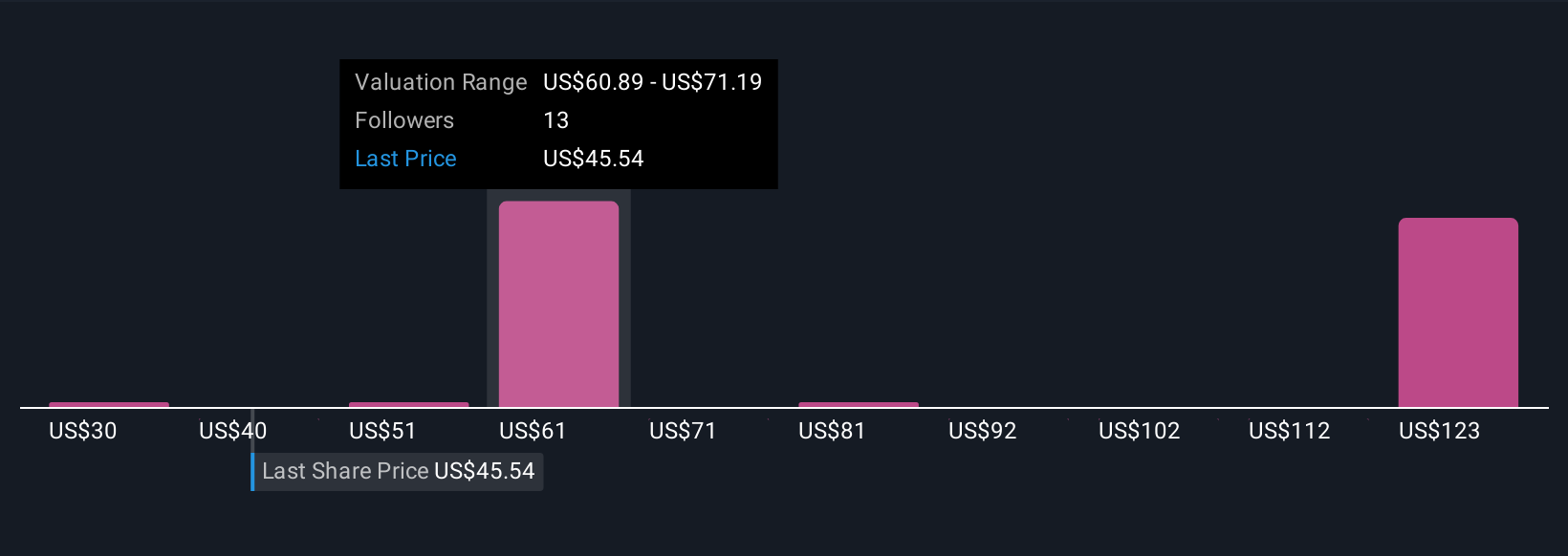

With Narratives on Simply Wall St’s Community page, you can quickly create and share your own investment thesis, compare your assumptions to others, and instantly see the fair value outcome of your view, all in one place. This hands-on approach empowers investors to make more informed buy or sell decisions by directly comparing their personalized fair value estimate to the current market price.

Narratives update automatically as new information comes in, such as news or earnings updates, ensuring your analysis stays relevant. For Matador Resources, different investors have different views. One believes robust midstream expansion and operational efficiencies justify a bullish fair value of $89.00 per share, while another, factoring in regulatory risks and fluctuating commodity prices, sees fair value closer to $48.00. Narratives help you visualize this range and understand the reasoning behind each perspective, so you can invest smarter with confidence.

Do you think there's more to the story for Matador Resources? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTDR

Matador Resources

An independent energy company, engages in the acquisition, exploration, development, and production of oil and natural gas resources in the United States.

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives