- United States

- /

- Oil and Gas

- /

- NYSE:MPLX

Is There Still Opportunity in MPLX After Five Years of 367% Returns?

Reviewed by Bailey Pemberton

Thinking of what to do next with MPLX stock? You’re not alone. MPLX has been a steady presence in energy infrastructure, but many investors are reevaluating after its impressive journey. Let’s break down what’s new, what’s already reflected in the share price, and whether there is still an opportunity for you to profit.

Consider this: MPLX delivered a 21.5% return over the past year and a 367.7% return over five years. That level of growth attracts attention, and the path has not always been smooth. In the last seven days, shares have edged up a modest 1.4%, while the past month has included a slight pullback of -1.4%. Year to date, the stock is up 2.0%, which suggests a tone of cautious optimism even as investors weigh recent developments around sector stability and MLP tax advantages remaining intact.

What is driving these moves? Recent reports of continued strong demand for midstream infrastructure and ongoing supply chain investments have supported long-term confidence, though some uncertainty remains as the broader energy market adapts after an eventful period. Despite this, MPLX scores 5 out of 6 on our value assessment checklist, indicating it meets five undervaluation criteria. That is a notable signal that the market could still be underestimating its potential.

But how exactly do we measure value, and what should you consider? Next, we will walk step by step through the main valuation methods. After that, stay with us as we introduce another approach to help evaluate whether MPLX presents a compelling opportunity or not.

Approach 1: MPLX Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model helps estimate a company’s intrinsic value by projecting its future cash flows and then discounting those figures back to today’s value. In essence, it tells us what all future profits are worth in present terms, giving investors a fact-based way to judge if a stock is priced attractively.

For MPLX, the most recent Free Cash Flow stands at $5.01 billion, which serves as a foundation for future projections. Analysts estimate that by 2029, annual Free Cash Flow will have risen to approximately $5.4 billion. Beyond this, Simply Wall St extrapolates the next decade’s cash flows and expects steady growth fueled by the company’s ongoing investments and market position.

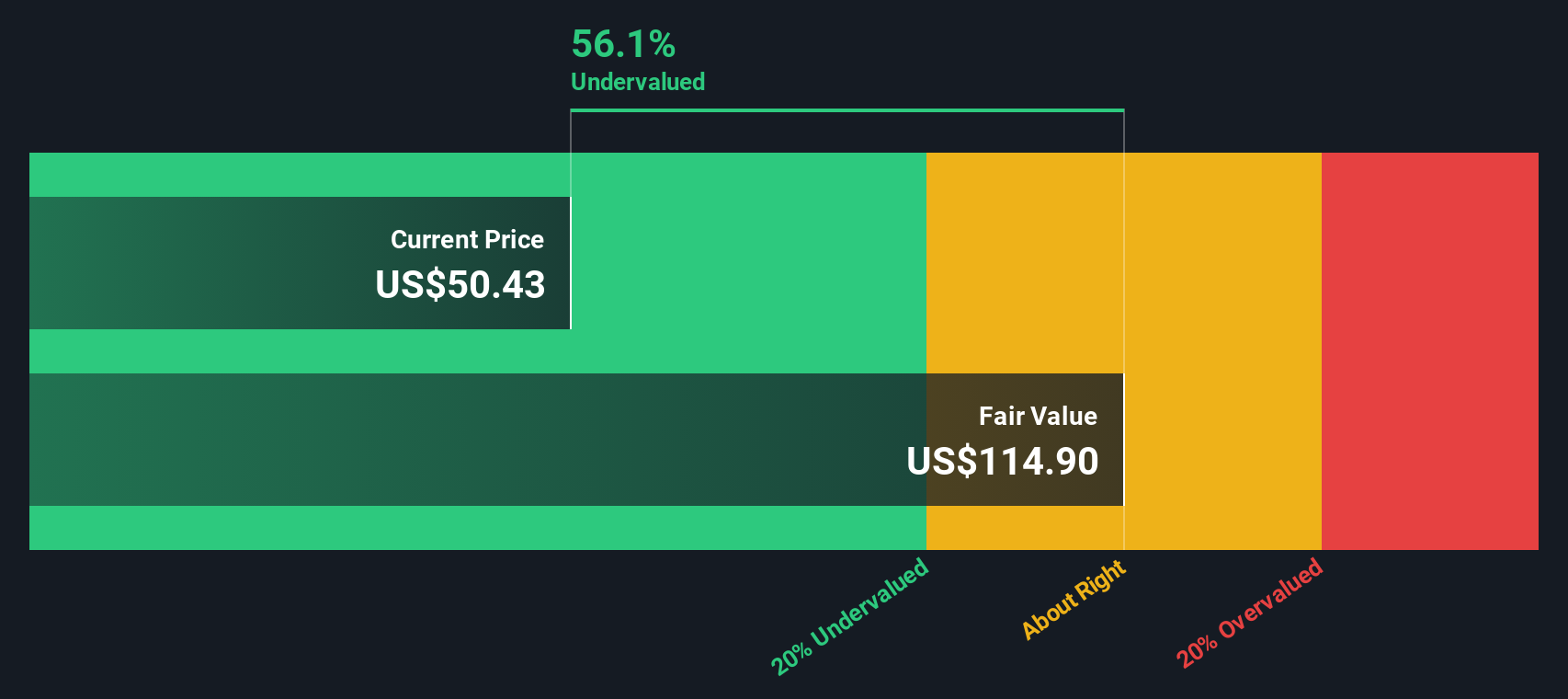

Based on these cash flow projections, MPLX’s intrinsic value is calculated at $116.84 per share. This figure is generated via a two-stage Free Cash Flow to Equity model, which takes into account both detailed analyst estimates for the next five years and longer-term extrapolations.

The result is that compared to MPLX’s current market price, the DCF model implies the stock is trading at a 57.5% discount to its fair value. That suggests significant undervaluation relative to what the company’s future cash potential appears to be.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests MPLX is undervalued by 57.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

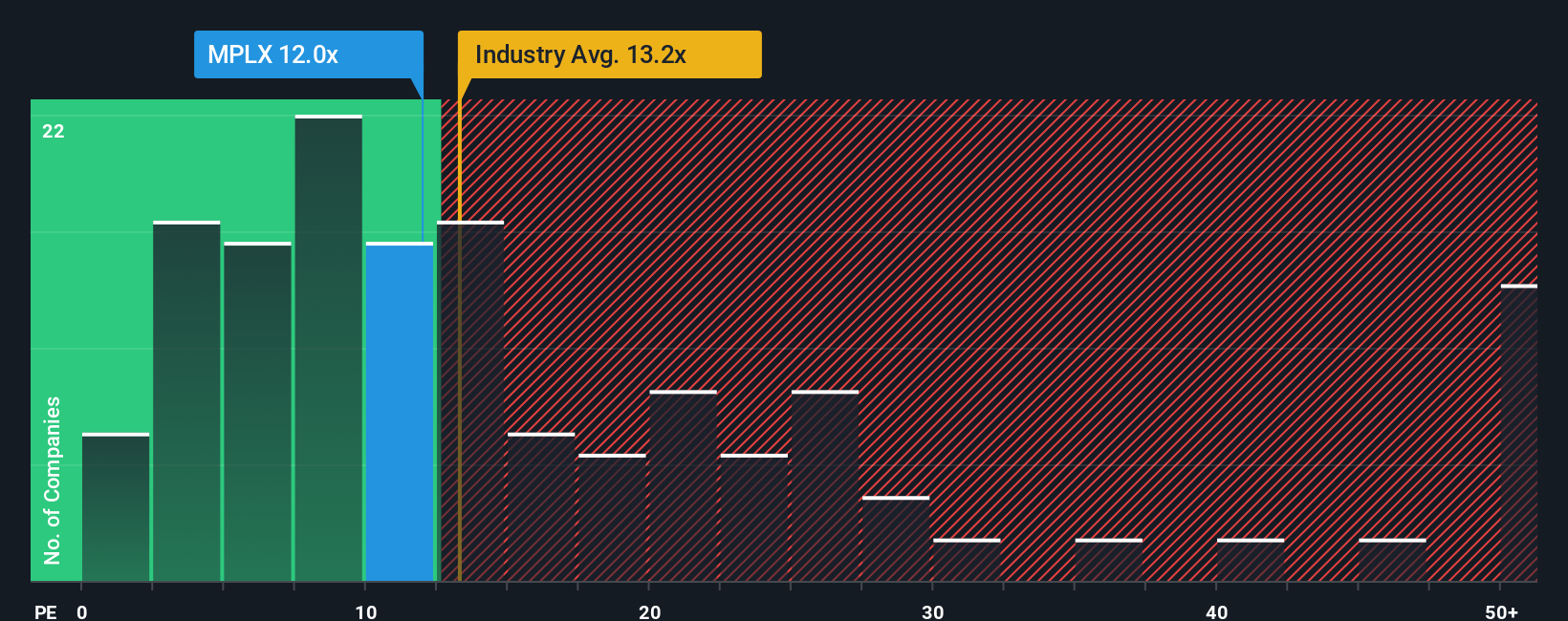

Approach 2: MPLX Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric, especially for profitable companies like MPLX. It gives investors a quick sense of how much they are paying for each dollar of the company’s earnings. Since MPLX consistently generates solid profits, the PE ratio is an appropriate tool to assess its value within the energy sector.

It is important to remember that what counts as a “fair” PE ratio varies case by case. Companies expected to deliver stronger growth or demonstrate lower risk typically justify higher PE multiples. Conversely, firms facing uncertainty or slower growth often trade on lower ratios. This is why looking at peers or broad industry averages is just the starting point and not the final answer.

Currently, MPLX trades at 11.8x earnings, compared to the Oil and Gas industry average of 12.8x and peer average of 15.2x. However, Simply Wall St’s proprietary Fair Ratio for MPLX is 19.1x. The Fair Ratio is calculated using a more robust framework that factors in earnings growth, profit margin, industry dynamics, market capitalization, and company-specific risks. By weighing these elements, it provides a more tailored benchmark for each business, making it more insightful than generic peer or industry comparisons.

In MPLX’s case, its actual PE ratio is well below the Fair Ratio, suggesting that the market is currently undervaluing its earnings power relative to the company’s strengths and outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

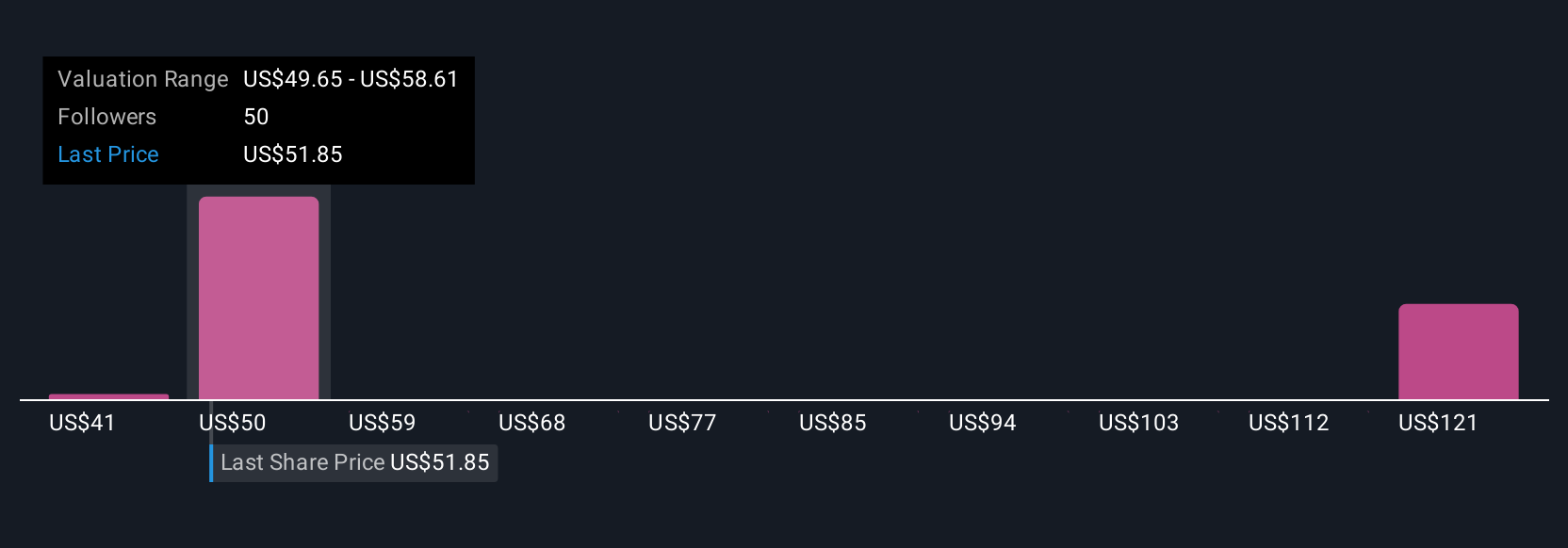

Upgrade Your Decision Making: Choose your MPLX Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story about a company like MPLX, where you outline your reasons behind a fair value estimate and your forecast for its future revenue, earnings, and margins. Narratives are powerful because they connect the company’s unique story. Whether that involves accelerating pipeline expansions or navigating industry risks, Narratives link these elements directly to a set of financial assumptions and an up-to-date fair value. This bridges what you believe with the numbers that drive investment decisions.

On Simply Wall St’s Community page, millions of investors use Narratives to easily build, share, and refine their perspectives on companies like MPLX. Narratives show at a glance whether the current share price looks attractive compared to your own fair value, and they dynamically update when new information or earnings are released. This makes them a practical tool for deciding when to buy or sell. For instance, while one investor’s Narrative might highlight the potential for $64.0 per share thanks to bold expansion strategies, another might be more cautious, estimating just $51.0 due to concerns about overbuilding or contract risks.

Do you think there's more to the story for MPLX? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MPLX

MPLX

Owns and operates midstream energy infrastructure and logistics assets primarily in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives