- United States

- /

- Oil and Gas

- /

- NYSE:MPC

Marathon Petroleum (MPC): Valuation Check as Maria Khoury Steps In as New CFO

Reviewed by Simply Wall St

Marathon Petroleum (MPC) is back in focus after naming Maria A. Khoury as its next Chief Financial Officer, a leadership move that could subtly reshape how investors think about the stock.

See our latest analysis for Marathon Petroleum.

The CFO announcement lands after a choppy stretch, with a roughly 14% 1 month share price return decline from about $195 to $168.32, even as the 1 year total shareholder return of 29% and 5 year total shareholder return of 365.55% still point to strong long term momentum.

If you want to see how other energy names are positioning for their next leg of growth and capital returns, now is a good time to explore fast growing stocks with high insider ownership

With shares now trading at a steep headline discount to some valuation models and nearly 20% below the average analyst target, the key question is whether this pullback signals a fresh buying opportunity or if markets are already pricing in Marathon Petroleum's next phase of growth.

Most Popular Narrative Narrative: 16.4% Undervalued

With the narrative fair value set around $201.33 against Marathon Petroleum's last close at $168.32, the framework implies meaningful upside if its long term roadmap holds.

Strategic portfolio optimization, including high-return refinery "quick hit" projects and ongoing expansion in midstream logistics/NGL infrastructure (such as the Northwind Midstream acquisition), are enhancing operational flexibility and supporting incremental improvement in net margins and long-term cash flow generation.

Want to see why modest revenue shrinkage can still support a richer valuation? The narrative leans on sharper margins, rising earnings power, and a punchy future multiple. Curious how those moving parts combine into that higher fair value?

Result: Fair Value of $201.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on robust refining margins remaining intact. Faster than expected EV adoption or stricter carbon rules could quickly compress demand and earnings.

Find out about the key risks to this Marathon Petroleum narrative.

Another Angle on Valuation

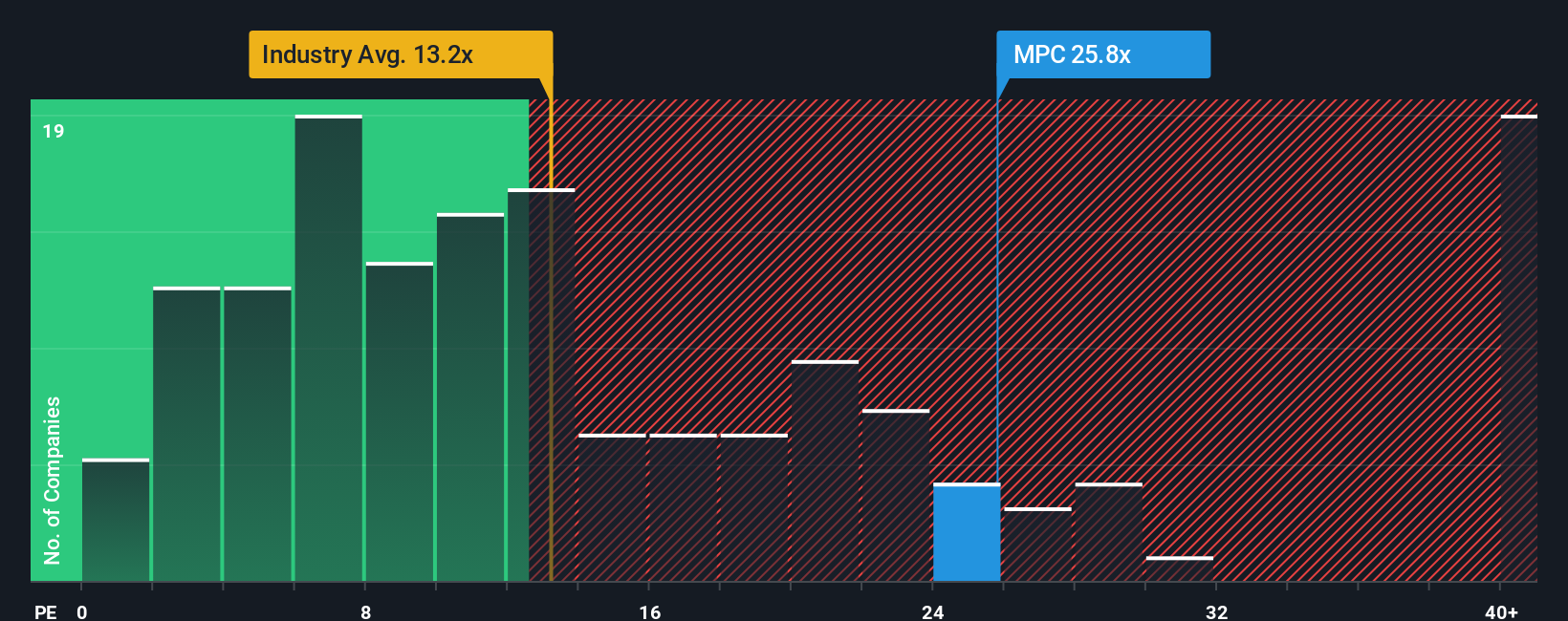

On earnings, the picture is murkier. Marathon trades at about 17.6 times earnings, richer than the US Oil and Gas industry at 12.8 times. It is below peer averages near 28.6 times and its own fair ratio of 20.9 times, leaving investors to weigh upside against multiple compression risk.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Marathon Petroleum Narrative

If this framework does not quite fit your view or you prefer hands on research, you can build a custom narrative in minutes: Do it your way

A great starting point for your Marathon Petroleum research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before the next move in Marathon Petroleum plays out, you may wish to scan fresh opportunities on Simply Wall Street that match your style and strategy.

- Explore potential in smaller companies with these 3625 penny stocks with strong financials that already show stronger financial underpinnings than many speculative names.

- Focus on structural tech shifts by reviewing these 24 AI penny stocks positioned at the intersection of rapid innovation and scalable business models.

- Seek quality at more attractive prices by considering these 913 undervalued stocks based on cash flows where current prices differ from long term cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MPC

Marathon Petroleum

Operates as an integrated downstream energy company in the United States.

Established dividend payer and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion